Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) now owns all of the San Pietro iron-oxide-copper-gold property — the junior’s flagship development asset — after Sumitomo Metal Mining Chile, a subsidiary of Sumitomo Metal Mining Co. Ltd. (STMNF:OTCPK), sold it to the junior explorer for $3.35 million.

Sumitomo, along with Teck Resources Ltd. (TECK:TSX; TECK:NYSE), had spent about $15 million drilling some 34,000 meters on the property between 2008 and 2013 and even outlined a resource—but it’s not a National Instrument 43-101 compliant resource.

“We're kind of the hole in the donut between a billion tonnes of resources.” — Golden Arrow Vice-President of Exploration Brian McEwen

Confirming a new NI-43-101-compliant resource through further drilling is a high priority for Golden Arrow management.

Hole RA-12-DH-003, drilled previously, hit 28 meters averaging 1.14% copper (Cu), 0.12 gram per tonne gold (0.12 g/t Au), and 335 parts per million cobalt (ppm Co).

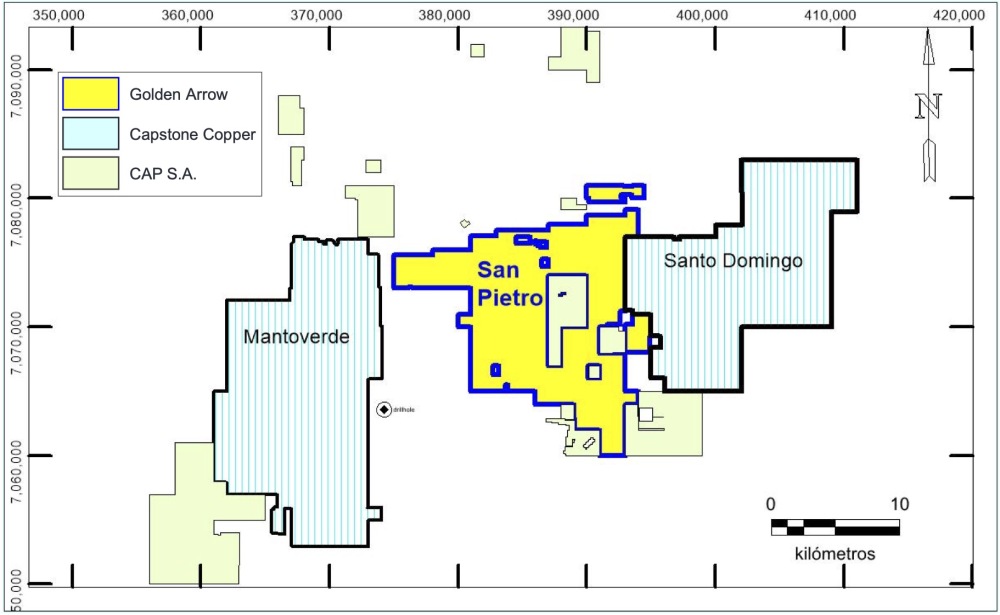

“We're just north of Copiapo in an area that's home to giant mines — Mantoverde, Candelaria, and even the Santo Domingo project. We're kind of the hole in the donut between a billion tonnes of resources. We've got 18,000 hectares right in the center of it,” Golden Arrow Vice-President of Exploration Brian McEwen told Streetwise Reports.

The junior’s management team believes that dramatic increases in prices for all the commodities identified at San Pietro — copper, gold, iron, sulfur, and especially cobalt — should provide the project with robust economics.

A new National Instrument 43-101 compliant resource could happen at San Pietro in short order, possibly at the Rincones target area.

Rincones abuts Santo Domingo and has been the focus of the drilling to date. There are four other target areas that have seen at least some drilling but previous geophysical work outlined targets that Golden Arrow believes need to be looked at through a different lens.

Golden Arrow Has Done This Before

In 2012, Golden Arrow optioned a property that — after a lot of drilling and development — morphed into the Chinchillas silver project.

Six years later, Chinchillas ranked as the seventh-largest undeveloped silver project in the world, and it was spun into Puna, a 75/25 joint venture with SSR Mining Inc. (SSRM:NASDAQ) holding the majority stake as operator.

It was a good fit.

SSR had the producing Pirquitas silver mine and mill in Jujuy province, Argentina, while the nearby Chinchillas silver deposit added significant ounces to the mill feed.

It’s rare to go from zero to production in six years at any mining project — and Chinchillas is still going strong five years later. The Puna operation has current proven and probable reserves of almost 39 million oz silver.

In 2019, SSR bought out Golden Arrow’s interest in Puna for $44.4 million in cash and shares, and Golden Arrow immediately began to look for ways to leverage those assets into another world-class project. Then COVID hit. And the search paused.

Once global pandemic restrictions eased, the junior did its due diligence, placed a $3.35-million bid at Sumitomo’s property auction — and won.

In a small bit of serendipity, between the time COVID hit and SSR acquired San Pietro, shares in SSR went from $19 to about $26, essentially covering the cost of the acquisition.

Proven Projects in the Region

Capstone Copper Mining Corp. (CS:TSX)’s Santo Domingo iron-oxide-copper-gold (IOCG) project, which it acquired when it bought Far West Mining for $725 million in 2013, is east of San Pietro. It is permitted and undergoing an updated feasibility study due in H2/23.

The measured and indicated resource at Santo Domingo is 536,548,000 (536.5 Mt) tonnes grading 0.30% copper (Cu), 0.04 gram per tonne gold (0.04 g/t Au), 25.7% iron (Fe), 229 parts per million cobalt (229 ppm Co), and 2% sulfur.

On the other side of San Pietro, Capstone also owns 70% of the venerable Mantoverde copper mine. The measured and indicated resource there is 593.5 Mt at 0.47% Cu, 0.10 g/t Au.

So why didn’t Capstone buy the San Pietro property? McEwen says that the bankers brokering the San Pietro sale told him that it was offered to Capstone but the company had its hands full with the Mantoverde acquisition.

Cobalt Sweetener at San Pietro

The current price for cobalt, due largely to its role in lithium-ion battery production, is $41,000/tonne or $46/lb — that’s 10 times more valuable than copper.

Golden Arrow management looked at the cobalt numbers assayed in previous drilling, and McEwen says the cobalt grades are comparable with what’s been found at Santo Domingo. However, in some cases, the grade is as high as 700 ppm — more than three times the average grade at the neighboring project.

The Santo Domingo feasibility study outlines the addition of a roaster (to literally roast the ore to release the cobalt) and a specific cobalt recovery circuit. Essentially, the cobalt, despite the added recovery costs, makes the project economics work. As a bonus, the operation would produce sulfuric acid as a byproduct that could be sold for different industrial uses.

“We believe the cobalt is going to make a big difference,” McEwen said.

The Santo Domingo feasibility study also outlines significant iron production, with as much as 30% of the revenue coming from iron sales.

San Pietro and the nearby mines all sit in an iron-oxide-copper-gold belt that runs through the region. Management has already reached out to CAP S.A., a giant Chilean iron miner to discuss San Pietro and the iron grades there.

San Pietro is about 100 km north of the city of Copiapo, and due to a lengthy history of mining in the region, there is plenty of infrastructure, including roads, electricity, and desalinization plants (a lack of water for industry is common in Chile).

Reuters reports that Grosso Group Chairman and Founder Joseph Grosso owns 7.24% of Golden Arrow, while other members of management also own significant positions.

The company has about 107 million shares outstanding and trades in a 52-week range of CA$0.14 and CA$0.21.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Golden Arrow Resources Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.