What a difference a year makes. Last year, Fabled Silver Gold Corp. (FCO:TSX; FBSGF:OTCQB; 7NQ:FSE) was telling the world about its bonanza-grade silver deposit in the Chihuahua state of Mexico, and its two veins, the Santa Maria and the Santa Maria Dos.

What a difference a year makes. Last year, Fabled Silver Gold Corp. (FCO:TSX; FBSGF:OTCQB; 7NQ:FSE) was telling the world about its bonanza-grade silver deposit in the Chihuahua state of Mexico, and its two veins, the Santa Maria and the Santa Maria Dos.

After an intensive drilling program at the site in the prolific Parral silver camp, the company got more of those great silver returns but then also found something unexpected — high-grade gold.

Now, the company believes there are other veins and still more to be discovered. A Phase 2 8,000-meter drilling program across the site is set to begin in June to zero in on the resources.

"There's going to be a lot of good news coming out to shareholders … if we are correct in what we've learned," Fabled Silver Gold President and Chief Executive Officer Peter Hawley told Streetwise Reports.

Hawley said now is a great entry point with the company. The share price has gone down from a high of CA$0.13 in February (the company spun off Fabled Copper Corp. [FABL:CSE] in December 2021) to CA$0.08 on Monday, May 9.

"Has our share price taken a beating? Absolutely," Hawley said. "Is the asset worth more than the market cap of the company? Unequivocally."

In December, shortly before Fabled Silver Gold and Fabled Copper split, analyst Clive Maund said that at first Fabled's (the combined company's) chart looked "rather awful," but that it could "soon see an abrupt reversal to the upside" and rated it an immediate speculative buy.

Fabled Copper is also set to drill this year at its Muskwa copper project in British Columbia.

'We Wouldn't Have Stopped' Drilling

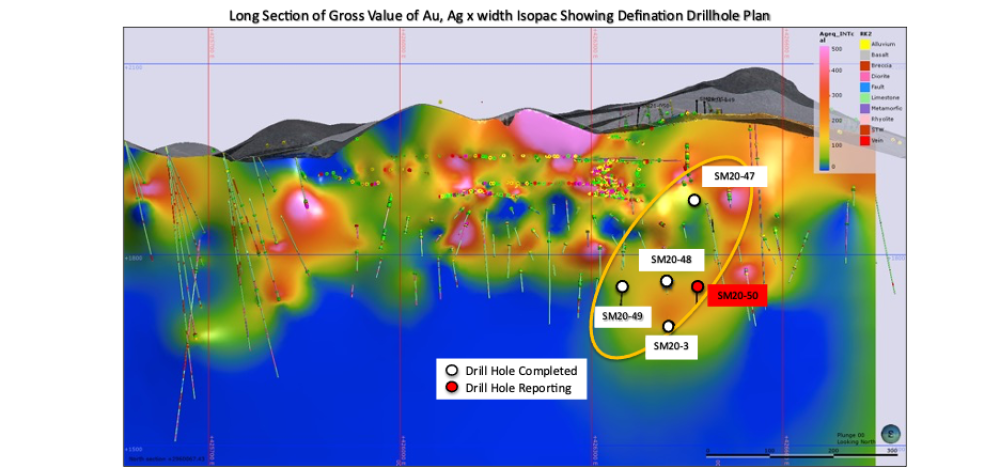

After releasing promising silver results on the last three holes drilled last year, the company in February released results from a fourth hole, SM20-50, in which it hit high-grade gold, returning 86.10 g/t Au within 4,821.98 g/t Ag eq in 21.90 meters grading 5.29 g/t Au contained within 349.21 g/t Ag eq. It was the last hole drilled in the company's Phase 1 drilling program at Santa Maria.

"I wish I knew (the results) before we stopped, because we wouldn't have stopped," Hawley said earlier this year.

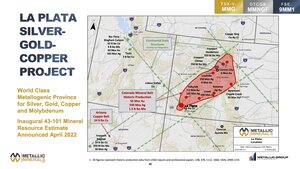

An underground mine that represents a potential source of near-term production, Santa Maria is in an advanced exploration stage. A preliminary economic assessment (PEA) completed and updated in 2018 outlined about 3.13 Moz of silver equivalent over an estimated 4.2-year life of the mine.

The main target of drilling last year was the Santa Maria footwall hydrothermal breccia structure. The entire 21.90 meters reported 5.29 g/t Au within 349.21 g/t Ag eq and remains open at depth and on strike. The company said Hole SM20-50 was successful in following the plunge of the Santa Maria structure from Hole SM20-47 and vectoring in on results from holes SM20-48 and SM20-49.

The company took time to "stop chasing the bit" after collecting and analyzing more than 6,900 samples from 2021's work at the site but quickly got back to work. So far this year, Fabled Silver Gold said it has completed 258 new surface samples, done 11,388 square meters of detailed geological mapping, and created 237 structural interpretation stations.

Twenty-one veins have been discovered on the surface to date, the company said. Fourteen show elevated gold and silver values. At least five mineral/structural trends have been identified as potential targets for exploration. Mineralization is also being found in additional dikes within the property. If test results are positive, these areas will be wrapped into the exploration program.

A Good Time to Be an Explorer

It's a good time to be an explorer, as well. S&P Global Market Intelligence last month released a report called "World Exploration Trends." It found that conditions were improving after the mining industry was struck hard by the pandemic. Financings by junior and intermediate mining companies increased to $21.55 billion in 2021, up from $12.13 billion in 2020. That increase led to results from 68,880 drill holes in 2021, up nearly 70% from the 41,026 reported the year before.

"These factors culminated in our Pipeline Activity Index, or PAI, reaching a recent high of 149 in March 2021, just below the highest recorded PAI of 152 in March 2012," the report said. "The PAI averaged 137 in 2021, compared with just 98 in 2020."

Hawley said Fabled's geologists are starting to be able to reliably predict where the structures/mineralization will be before the drills even break the dirt at Santa Maria.

"They're predictable to the point where when we're drilling at the end, we pick a target and say, 'OK, we're going to hit it at 165 meters,' and we might hit it at 165.2 meters," Hawley said. "That's how predictable this creature is."

The company has about 208 million shares outstanding and a market cap of $16.68 million. It trades in a 52-week range of $0.20 and $0.06.

Read what other experts are saying about:

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Fabled Silver Gold Corp. and Fabled Copper Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Fabled Silver Gold Corp. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fabled Silver Gold Corp. and Fabled Copper Corp., companies mentioned in this article.