Nova Scotia-based nanotech company Meta Materials Inc. (MMAT:NASDAQ; MMAX:CSE; 1T01:FRA) has been granted two U.S. patents that it says will improve safety and reduce the cost of lithium-ion batteries needed for the expanding electric vehicle (EV) industry.

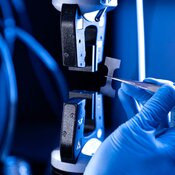

The patents cover Meta’s second-generation NPORE® nanoporous ceramic separator and its third-generation NPORE® ECS (electrode coated separator) for lithium-ion batteries.

Independent investor PennyQueen has long been a fan of disruptive and clean technology companies and continues to be excited about Meta. Out of literally hundreds of patents the company has applied for and received, battery tech is “one of my favorite areas for them.”

“The ceramic battery separators could be just like … half their patents, (they) could be massive,” she told Streetwise Reports.

“The ceramic battery separators could be just like … half their patents, (they) could be massive,” she told Streetwise Reports.

Meta said it now has 251 issued patents and 159 pending patent applications. Its portfolio has 98 patent families, of which 57 include at least one already issued patent.

Separators are porous membranes between the electrodes in the battery. They prevent contact between the anode and cathode while allowing the flow of lithium ions.

The second-generation NPORE® separators do not have a plastic substrate inside but are made of a nanoporous ceramic material. The lack of plastic makes it much more stable. A video on Meta’s site shows a test where batteries with both types of separators are pierced by nails. The one with the plastic separator catches fire and explodes, while the one with the NPORE® separator is fine. The cathode is deposited directly on the separator with the third-generation NPORE® ECS, reducing weight and thickness.

“The thickness and weight of the inactive materials (both separator and current collectors) can be reduced,” said Rob Stone, Meta’s vice president for corporate development and communications. “That's how the battery becomes more efficient (more power, less weight) and cheaper (less materials, simpler assembly).”

Company is a ‘Technology Leader,’ Analyst Says

Developed first in the 1960s, metamaterials came into their own when design and manufacturing capabilities caught up to the technology in the 2000s. Meta is using them to develop nanotechnology products like self-deicing and defogging car and truck headlights and windows, see-through antennas, augmented reality glasses that look like regular glasses, and an eyeglass coating that protects pilots’ eyes from laser strikes.

The company said its total revenue grew 264% year-over-year to $4.1 million in 2021 on the strength of $1.8 million from the acquisition of Nanotech Security, which provides applications for currency authentication.

Fed by the expanding EV industry, the global market for lithium-ion battery separators was estimated at $5.1 billion in 2021 and is projected to reach $9 billion by 2025, Yano Research Institute Ltd. said.

One out of every five vehicles sold worldwide could be an EV in less than two years. Ford and General Motors have set a goal of achieving 40-50% of their sales from EVs in the U.S. by 2030.

Meta Materials is a “technology leader,” ROTH Capital Partners analyst Gerry Sweeney wrote in a May research report, when ROTH initiated coverage on the company with a Buy rating and a target of $2.25.

“We believe MMAT is a leader in metamaterials and we anticipate the company to aggressively fund R&D to develop new opportunities, enhance existing products and improve manufacturing procedures to lower production costs,” Sweeney wrote. “In addition, we believe MMAT will augment these efforts with acquisitions, which have the added benefit of human capital additions.”

Meta Materials has a market cap of $324.77 million and 360.85 million shares outstanding. It trades in a 52-week range of $6.55 and $0.88.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None. His/her company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Meta Materials Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Meta Materials Inc., a company mentioned in this article.