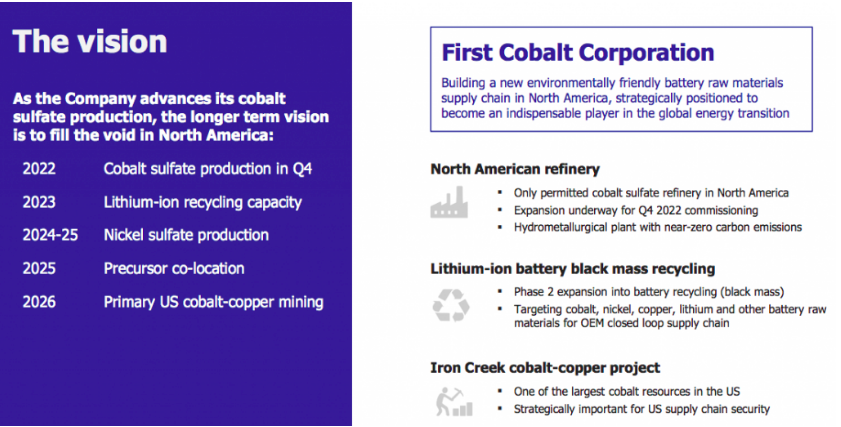

First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) is a North American battery materials company with leading ESG credentials, ideally positioned to play an important role in Ontario’s emergence as a significant EV & Li-ion battery manufacturing hub.

First Cobalt expects to be in production at its 100%-owned battery materials park (BMP) [initially producing premium-grade cobalt sulfate] within 15 months. Despite very substantial companywide de-risking, today’s share price is the same as it was in December.

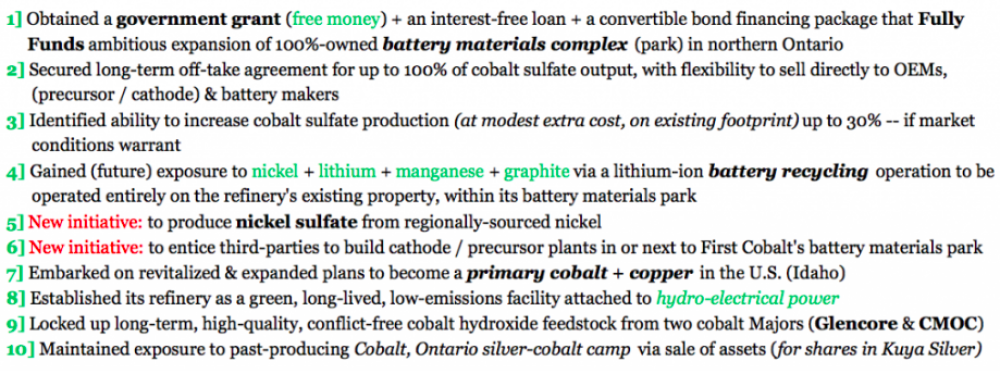

Admittedly, the number of shares has increased by about a third since then, but the Company now has millions more in cash. More importantly, FCC is fully-funded for its Phase 1 cobalt refinery expansion.

First Cobalt’s valuation does not reflect substantial de-risking since December

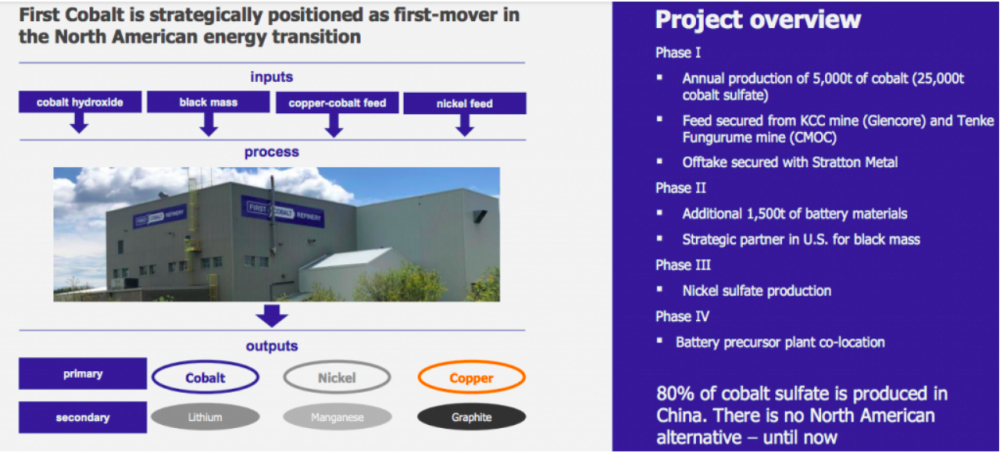

Phase 1 is expected to be completed in 4q 2022, at which time the refinery will start ramping up to 25,000 tonnes per year cobalt sulfate (“CoSO4”), making it the 2nd largest producer outside of China. Note: Management believes it can increase production by up to +30% with minimal additional cap-ex.

Over the past 10 months, the number of milestones achieved by CEO Trent Mell, his Board, advisors, and management team, has been remarkable.

Despite significant challenges from COVID-19, two mega-trends remained surprisingly robust. The electrification of transportation and the ever-growing efforts to decarbonize the planet. Both paradigm shifts are copper & cobalt-intensive.

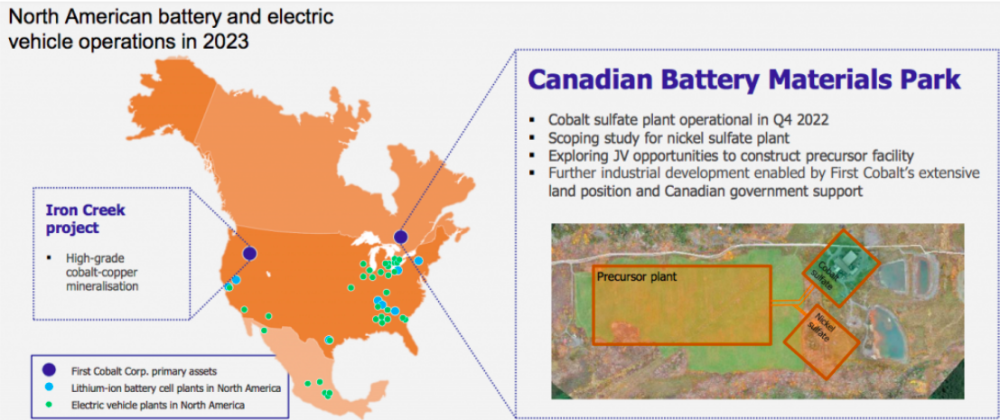

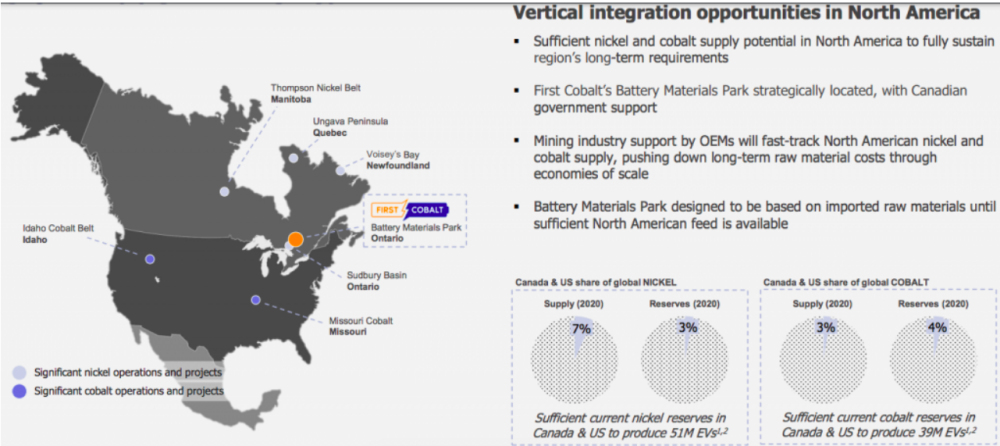

The primary use of cobalt going forward is in Li-ion batteries, mostly for electrified transportation. However, as important as the growth in the number & size of Li-ion batteries will be, is where the batteries are needed. N. America will be a huge market for decades to come.

This is great news for FCC as ESG considerations are becoming incredibly important. Having impeccable ESG — environmental, social, and government— credentials is not only critically important for global EV brands, it’s a key element in ethical investing mandates.

Mining, processing, and transport of raw materials & finished goods becoming greener

There are several crucial ESG steps to get right. Extraction must be done while minimizing the use of chemicals and fresh water, and keeping emissions low.

One of the more difficult aspects of the mining lifecycle — from mineral extraction to end-of-life product recycling — is the transport of raw materials, semi and finished goods over large distances.

Mining, processing, and manufacturing need to happen as close together as possible to avoid excess emissions. That’s what makes BMPs so compelling. Not only are they environmentally-friendlier, they offer logistical benefits that can lower operating costs & enhance security of supply.

Management believes it can cut its op-ex by 10% to 15% if one or more third-party precursor / cathode plant(s) sets up shop next to its BMP.

The Company will have a green refinery, in large part by operating under hydroelectric power. Its cobalt hydroxide feedstock will also come from companies tapping hydroelectric power.

A part of FCC’s cradle-to-grave supply cycle solution with room for improvement is the distance between the BMP in Ontario and feedstock sources in the DRC. Management hopes to source feedstock from its own cobalt / copper project in Idaho by 2026 to 2027.

Time to highlight an enhanced, diversified, clean, green high-tech battery materials and recycling focus

Regarding the ‘G’ in ESG, CEO Mell & team have demonstrated provincial & federal gov’t support in the form of a CA$5M grant and a CA$5M, 10-year zero-interest rate loan.

OEMs are demanding a sustainable full-cycle approach to ESG. Not just clean, green supply chains, not only security of supply of conflict-free materials, but also robust end-of-life recycling of critical metals.

FCC plans to hit the ground running with black mass & battery scrap recycling in 2023, which will diversify operations by capturing cash flows from recovered cobalt, copper, lithium, nickel, graphite & manganese.

Several companies with valuations greater than CA$1 billion, are trying to make it big in recycling. It will require huge quantities of black mass / battery scrap for them to succeed. By contrast, FCC will not need much feedstock to potentially generate CA$10M to CA$20M in EBITDA/yr. by 2025. Note: My estimate only, not guidance from management.

In addition to recycling, nickel sulfate production is planned for 2024 to 2025, with feedstock sourced locally. All of these operating segments will be housed on the existing refinery property.

BMPs will be very valuable assets for decades to come

BMPs don’t pop up overnight. They need to be designed & permitted. They require environmental, economic, metallurgical & engineering studies, local community / First Nations support, multiple rounds of funding, followed by construction & commissioning.

There will be dozens of battery material plants built in the U.S. and Canada, but while FCCs should be thriving in 2025 to 2026, others on North American drawing boards will take considerably longer.

First Cobalt’s pro forma Enterprise Value (market cap + debt – cash) of ~CA$180M is, arguably, too low. Analysts estimate run-rate annual EBITDA in 2023 could reach ~CA$45 to 50M. This implies a valuation multiple of 4x [EV/2023e EBITDA].

By comparison, cobalt major Umicore Group (UMI:BRU) trades at 10x

2023e EBITDA, lithium giants SQM (SQM:NYSE) and Albemarle Corp. (ALB:NYSE) at 18x & 24x 2023e EBITDA, uranium major Cameco Corp. (CCO:TSX; CCJ:NYSE) at ~15x, and gold royalty companies like Franco-Nevada at 15x.

These companies are valued at 3 to 6 times FCC’s prospective 4x 2023e multiple.

That’s a huge difference in valuation, especially as FCC’s diversified [cobalt, nickel & recycling] cash flows should grow faster than peers.

As the Company approaches production, its forward valuation multiple should expand.

Once up & running, First Cobalt’s BMP could be worth more than CA$500M

If FCC could achieve a 10x multiple of 2024e EBITDA (estimated @ CA$55M, incl. C$5M from recycling), discounting that CA$550M valuation back 2.5 years at 10%/yr. implies a valuation of ~CA$0.70/shr. (based on 534.3M shares @ CA$0.255 & CA$70M of net debt).

Note: Not a price target, for illustrative purposes only.

Relative value comparisons fail to capture large swaths of the EV / battery & green energy sectors. There are dozens of multi-billion dollar companies that are pre-revenue and will remain EBITDA negative well into the second half of the 2020s.

First Cobalt expects to be EBITDA+ in 1h 2023, years ahead of many high-flying, EV-related companies.

This should make the Company a prime takeover target. But to be clear, management has no interest in selling its scarce & valuable BMP anywhere near the current share price.

A listing on the NYSE American or NASDAQ markets should help draw attention to this compelling story. Several battery materials companies with full U.S. listings enjoy strong trading liquidity & premium valuations.

For example, Canadian & (fully) U.S.-listed Lithium Americas Corp. (LAC:TSX; LAC:NYSE) and Standard Lithium Ltd. (SLI:TSX.V; SLI:NYSE American) are doing great relative to peers, as are uranium juniors Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.American) and Uranium Energy Corp. (UEC:NYSE AMERICAN).

It will take months to get a major U.S. listing, but doing so could be a strong investment catalyst.

First Cobalt Corp. checks a lot of boxes: Clean, green, EV, energy storage, battery materials — CHECK.

ESG credentials — CHECK.

Nickel sulfate production — CHECK.

Recycling — CHECK.

Facilitating decarbonization efforts — CHECK.

First Cobalt is exactly the kind of company institutions & funds with ESG criteria should gravitate to when searching for Li-ion battery materials stocks.

Streetwise Disclosures:

1) Peter Epstein's disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp., Lithium Americas Corp., and Uranium Energy Corp., companies mentioned in this article.

Peter Epstein's Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of First Cobalt Corp. and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.