Maurice Jackson: Joining us for a conversation is Michael Rowley, the CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE). Glad to be speaking with you today, as you have a big announcement for shareholders regarding the Black Lake–Drayton gold project. Before we begin, Mr. Rowley, please introduce us to Group Ten Metals and the opportunity the company presents to shareholders.

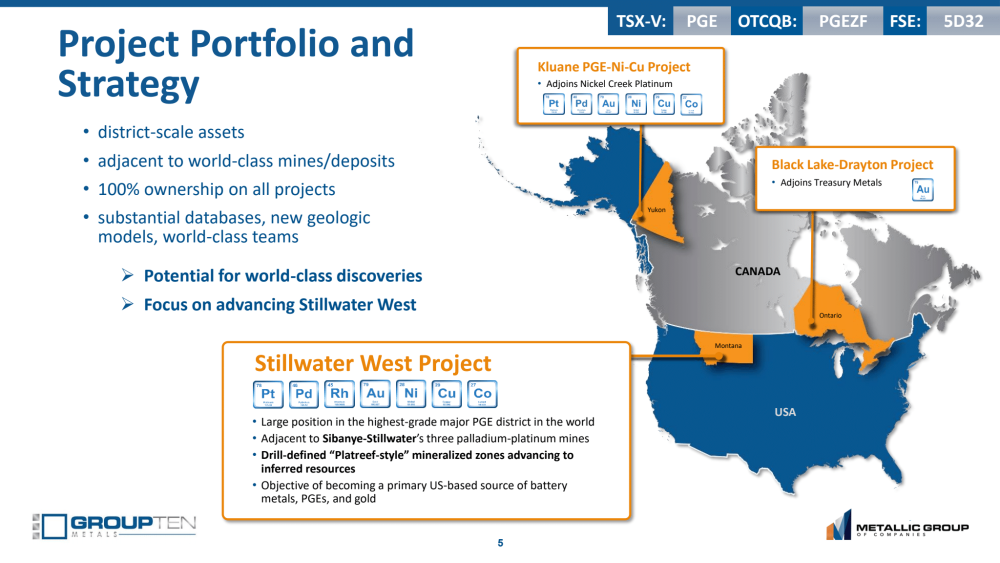

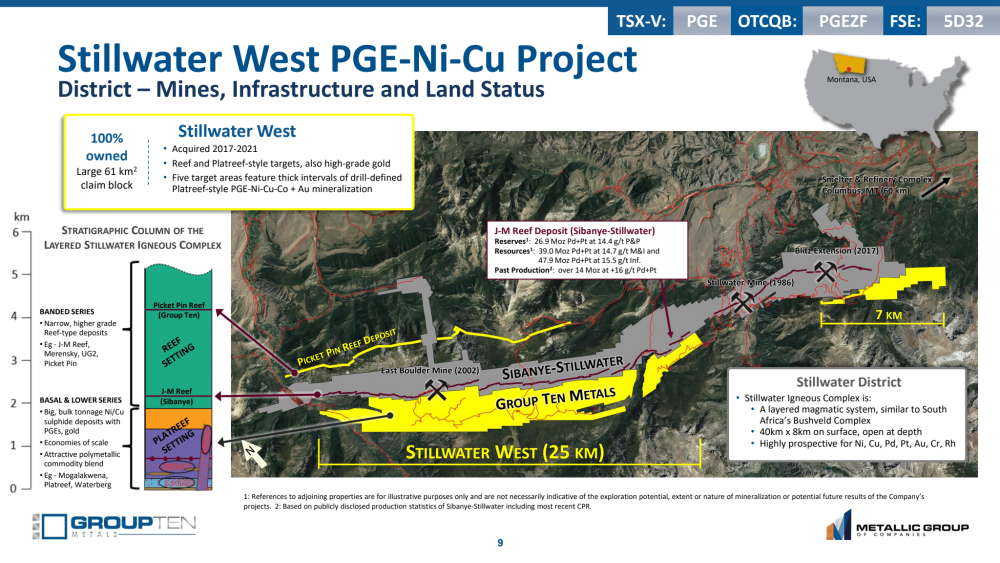

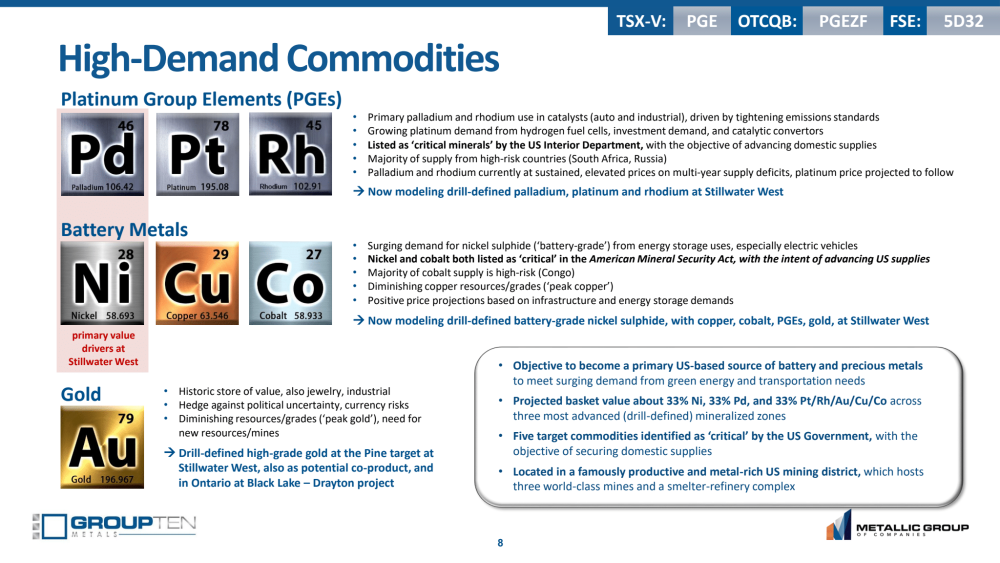

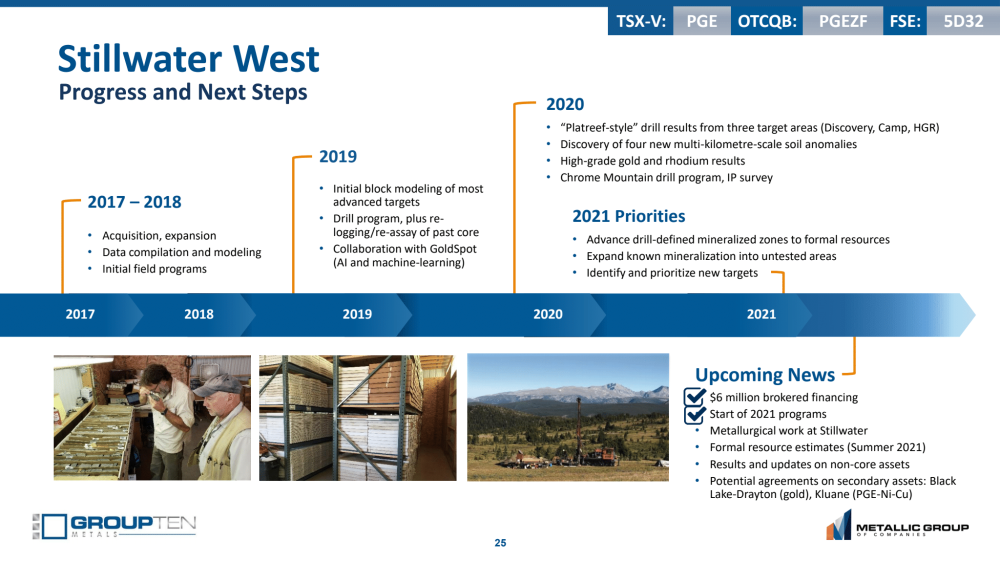

Michael Rowley: Group Ten is focused on advancing our Stillwater West project as a premier source of low-carbon ‘green metals’ in Montana’s Stillwater district, beside Sibanye-Stillwater Ltd. (SBSW:NYSE)’s mine complex. Within the next few weeks, we expect to debut our maiden resource estimates of nickel, copper, palladium, platinum, rhodium, gold, and cobalt, on that project which we expect will compare favorably with our peers and position us for growth based on this years drill campaign.

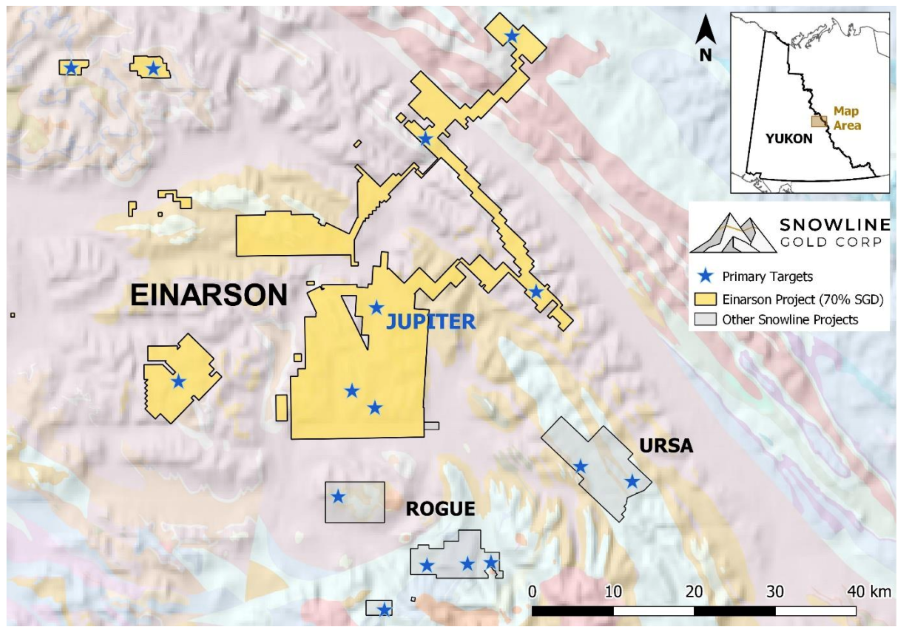

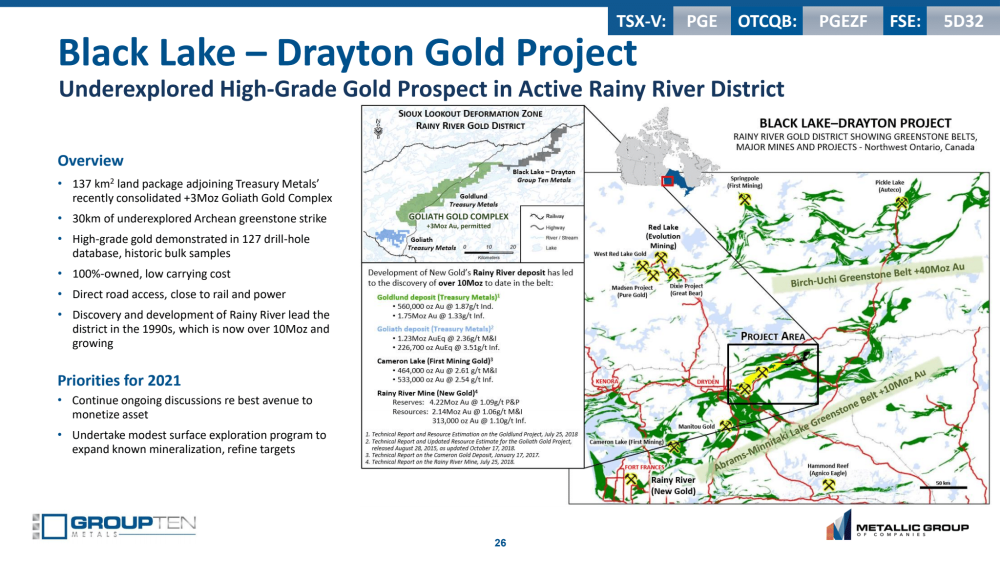

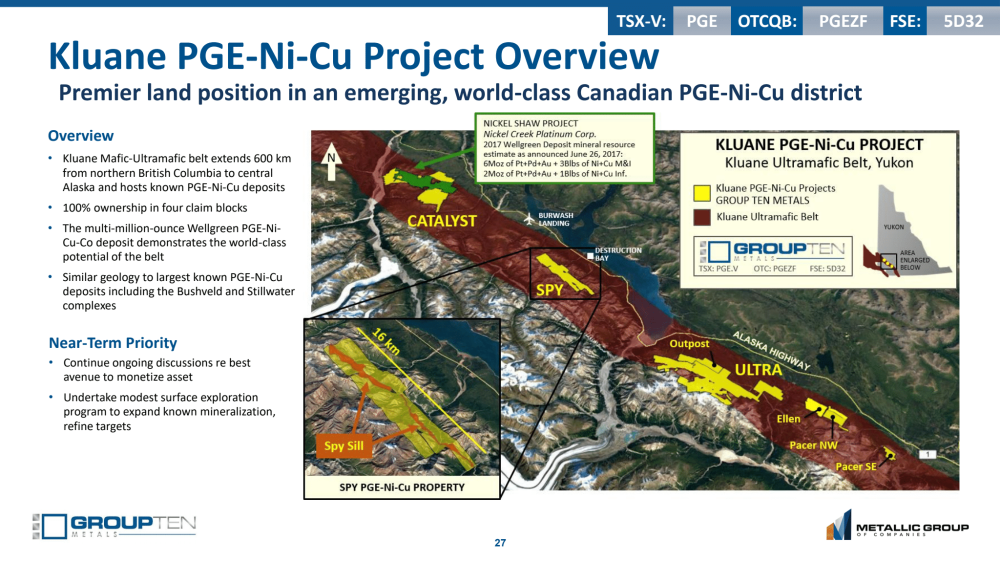

Along with owning half of the iconic Stillwater district in Montana, Group Ten also has two other district-scale land positions, the Black Lake Drayton gold project in Ontario that you mentioned a minute ago, and the Kluane PGE-Ni-Cu-Co project in the Yukon. All three of these are big brownfield land positions in great districts, and they are 100% owned by Group Ten because we were acquiring them strategically during the bear market when great assets were available inexpensively. We are focused more than ever on Stillwater, and with that our non-core assets are effectively up for sale or spin-out in the first in a series in that regard.

Maurice Jackson: Well, let's begin today in Ontario is Group Ten Metals has just announced a letter of intent with Heritage Mining on the sale of the Black Lake–Drayton gold project. Congratulations, sir.

Michael Rowley: Thank you, we are excited about the potential we see there. Heritage Mining is a new listing with an excellent team, and they are well equipped to focus on Black Lake and give it the attention it deserves while granting excellent exposure to that success.

Black Lake is a rare asset that is hard to find in this current, improving market with increasing activity in junior exploration. It checks all the boxes. It is a big land position that shares an emerging district with a 3Moz development-stage high-grade gold project, yet is underexplored. So there is lots of smoke, someone just needs to find the fire.

Treasury Metals Inc. (TML:TSX: TSRMF:OTCQB) has done great work to the west of us consolidating the rest of the district, and Rainy River, farther to the west is now in production with New Gold Inc. (NGD:TSX; NGD:NYSE.MKT). This whole belt was late to the game because of limited access and shallow ground cover, but developments at Rainy River in the 1990s changed that, and now there is over 14Moz in the belt, and growing.

Maurice Jackson: All right, let's get into the exciting stuff, sir. Please share the terms of the agreement with us and in particular, the cash and share compensation that Group 10 Metals will be receiving along with the carried interest in the potential for discovery payments.

Michael Rowley: It's a great deal for both parties. Group Ten will gain a major share position in a newly listed company that's focused on precious metals and focused on developing tier one assets, developing resources. And we get that 10% free carried interest through to feasibility study. So we can be at the table at a later stage to negotiate the sale of that during a possible broader consolidation play in the district.

We received $320,000 in cash payments in the first two years of the deal as well. And we receive bonus payments of $1 for every ounce of gold that is formerly brought on the books in any category at any time and even in multiple stages. That has a $10 million cap on that, the district already hosts more than 10 million ounces. So that figure is certainly possible given the area.

Maurice Jackson: So that we better appreciate the terms, would you please provide us with a quick bio on Heritage Mining and what they bring to the table?

Michael Rowley: Heritage Mining is a very experienced team with an excellent track record of raising cash and advancing projects, especially in Ontario and Quebec. Heritage is familiar with this geology. They're keen to hit the ground, which is very pleasing to us because the point of this deal is that we want someone else to raise the $5 million and advance this asset the way we think it can be advanced. So they certainly appear to be capable of that. They have an excellent record of proving ounces, developing mines, operating companies, and marketing, raising capital.

Maurice Jackson: Where will this transaction put Group Ten Metals in terms of ownership, percentage on the share structure for Heritage Mining?

Michael Rowley: Well, we'll have to see what their first placement looks like once they're trading and that's a couple of months out from now. But we expect to be about 10% of the company initially, and then maintain between the 5% and 10% level from there. A key point on that note also is that we have that bonus structure having a carried interest. Therefore, we are not relying solely on our share position for value. We've got several avenues here to be exposed to that success that we expect them to have.

Maurice Jackson: And when does Group Ten Metals expect the transaction will close?

Michael Rowley: We look good to close around the 60-day mark around mid-October.

Maurice Jackson: Leaving Ontario and onto the Yukon where Group Ten Metals has another non-core asset within his property bank that is equally has been receiving a lot of interest from prospective buyers. And I'm speaking of the Kluane PGE, nickel, copper project in the Yukon. Sir, any updates for us?

Michael Rowley: The Kluane is another explored project. We have over 250 square kilometers in the under-explored Kluane Belt, which is a fantastic belt of deposits. Another ultramafic system like Stillwater reaching from BC through into Alaska. The most advanced one. There is Nickel Creek Platinum Corp. (NCPCF:OTC), formerly Wellgreen. And the news there is that they've been increasingly active in the past year. And that's good to see. They've been drilling, they've been doing geophysics and they've been doing it up on the northwest end of the system towards us, which is music to our ears. We'll be seeing them at Beaver Creek and we're looking forward to further activity from them.

You're correct that we're getting more interested in those projects and that they like Black Lake are effectively for sale. We just have low carrying costs. Then we're taking our time looking for the right deals.

Maurice Jackson: Leaving the Yukon less visit Montana, which hosts your flagship Stillwater West project. But before we get into the latest news on the Stillwater West, would you please remind us about the unique value proposition before us on your flagship project?

Michael Rowley: The Stillwater West is fantastic. In 2017, the opportunity was presented to us to own half of the iconic Stillwater District, which sounds too good to be true in a way. But thanks to several factors that came together at the right time. Most of all, a local vendor who had spotted a bankruptcy that left these claims available, and he was quick, he bought the data from the past operators and he tied up the claims.

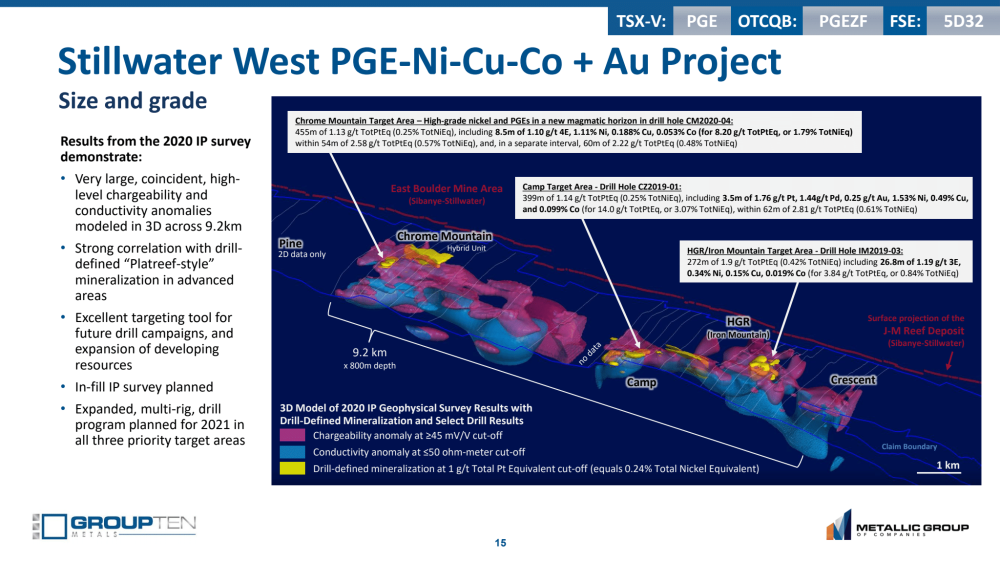

We've since tripled land position. We now own half the district we've built a terrific database, predictive geologic model. The point is that we are well on our way to proving ourselves as a primary source of green metals, battery-grade nickel, copper, cobalt, with platinum group elements, palladium, platinum, rhodium, and also gold.

In a U.S. district beside three mines and a smelter complex. These are big disseminated, sulfide deposits. They convert easily and cleanly to nickel sulfate. And we are weeks away from our first resources on the project, which is a very exciting moment for any junior exploration company. This will be a solid debut, it'll position us nicely among our peers. And we see terrific room to grow from there. If you've seen our news release back in April, where we related the 3D models from our IP survey, the emerging images of our Resource models, and the potential we have for expansion.

Maurice Jackson: The Stillwater West is currently undergoing its largest exploration program to date, which is a 10,000-meter drill program there recently added a second drill rig. Sir, take us on-site and get us up to speed on the program.

Michael Rowley: We have two rigs turning, which is music to our ears. We're hitting sulfide very nicely in both, massive sulfide in places, net texture, and disseminated in others. The predictive model that we've been working up the past few years is working beautifully. And that's a key point. We're now hitting with a high degree of predictability, which is what geologists want to see. The district is well mineralized. Our neighbor has 87 million ounces in current resources, reserves, and 14 million ounces in past production of the highest-grade palladium-platinum in the world.

That's a single magmatic pulse laid down across 40 kilometers. These things are staggering in scale, and it's also a nickel-copper-sulfide deposit that is worth noting. We are just below them in that stratigraphy. And we're seeing similar continuity of these horizons. We are hitting new ones all the time, they seem to run for great lengths and it's easy to add ounces and pounds.

The program that you mentioned that's underway now should do very nicely for expanding the inaugural resources as fast as we can in 2022. So we'll debut numbers here in summer 2021, and then look to expand them as fast as possible in 2022.

Maurice Jackson: All right, you have two truth machines drilling away. Do you already have some core in the lab and any timeframe on when we may receive some assays?

Michael Rowley: The first one and a half holes are in the labs, include some nice-looking core. The labs are saying six weeks though: Give me into October to get those into a news release.

Maurice Jackson: Now we won't hold you to that, but we will hold the labs to that. All right, switching gears, let's look at some numbers. Sir, please provide the capital structure for Group Ten Metals.

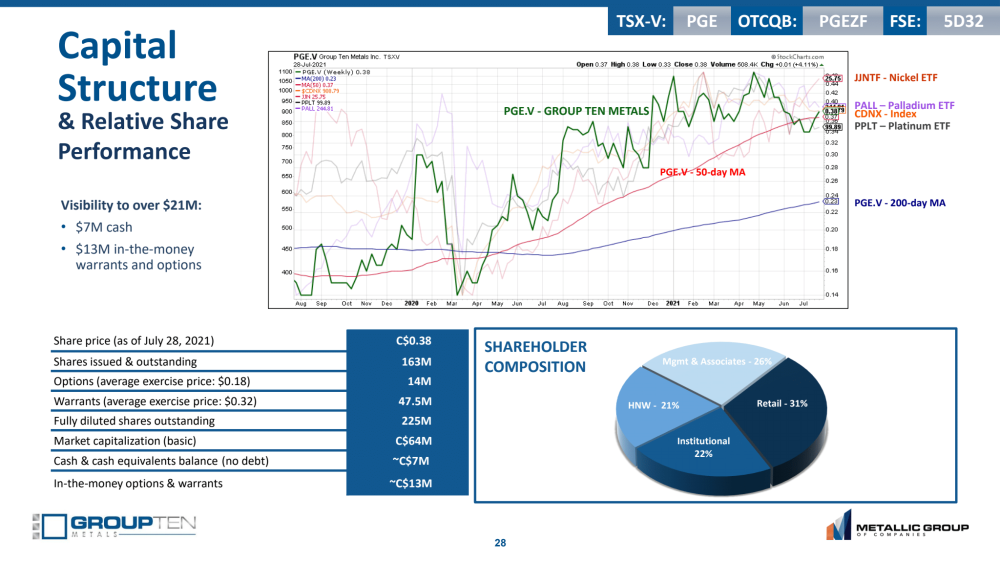

Michael Rowley: Group Ten Metals has 163 million shares outstanding at today's price. That puts us around a $50 million market cap. We feel that is significantly below where we could be based on our peers. I think a good peer might be Canada Nickel Company (CNIKF:OTCMKTS), for example. Noting of course that they don't have the platinum group element component that we have. However, they are four or five times our market cap with a similar, large, lower-grade nickel project. And we think that makes it a compelling comparison.

We have $6 million cash in the bank, and we have $13 million in the money options and warrants. Those are priced between .21 and .30 cents. No placements are planned for the foreseeable future and [we're] fully funded, fully permitted for this year's program. And even into next year at this point.

Maurice Jackson: Speaking of those warrants. Expect for me to go ahead and exercise mine. Speaking of the shares, Group Ten Metals recently upgraded its DTC eligibility. What does that mean for shareholders?

Michael Rowley: I had to look into it myself to be reminded. DTC is an electronic clearing service. This simplifies the process of trading and enhances liquidity for American traders, which we have a really good U.S. shareholder base. So this is meaningful in terms of fast and efficient settling of those trades.

Maurice Jackson: Before we close, Mr. Rowley, what would you like to say to shareholders?

Michael Rowley: This is an exciting time for Group Ten Metals! If you're familiar with the Lassonde Curve value creation in junior miners were at that just prediscovery phase where you get that rapid increase in value. And it's quite a privilege to be here. It's exciting to be systematically exploring the Stillwater Complex, which is famously metal-rich, and yet also under-explored. And it's remarkable, but the 215 drill holes to date across 32 kilometers of claims, 61 square kilometers. That's not a lot.

And we're testing things all the time that have never been drilled, and we're finding nice-looking sulfides there. So to be the ones systematically adding value and looking like, in terms of the market, that we're on the left end of the Lassonde Curve, but knowing that we're much farther along in terms of having comfort about some size and grade here...Pretty exciting.

Maurice Jackson: Last question. What did I forget to ask?

Michael Rowley: Well, it's probably a good point to touch on the broader commodity markets, and you know metal markets are going sideways at the moment. But the fundamentals are in place perhaps more than ever for a really good steady increase. We're looking for all the metals in our suite of commodity baskets to resume their upward momentum likely this fall.

We've got the FED meeting behind us today. Things look positive: The fundamentals are there, and we're looking forward to increased value for all our commodities, especially, in nickel. We're hearing increasingly of the coming shortfall in nickel sulfide, in particular clean nickel that's good for batteries or rather makes nickel sulfate in the most environmentally friendly manner.

We're excited to be part of that and we're looking forward to that renewed momentum. This is a good buying opportunity to buy shares in Group Ten Metals.

Maurice Jackson: Sir, for readers that want to get more information on Group Ten Metals, please share the website address.

Michael Rowley: www.grouptenmetals.com

Maurice Jackson: Mr. Rowley, it’s been a pleasure speaking with you today, wishing you and Group Ten Metals the absolute best, sir.

And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRA’s. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide: Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]

Disclosures:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Group Ten Metals Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Group Ten Metals Inc. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals Inc. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals Inc. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Group Ten Metals Inc., a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.