Maurice: Joining us for a conversation is Shawn Khunkhun, the CEO of Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCMKTS).

It's a pleasure to speak with you today to discuss the opportunity before us and Dolly Varden, which is focused on new discoveries in a historical mining camp. Sir, before we begin, please provide us with an overview of Dolly Varden Silver Corp. and the unique value proposition the company presents to the market.

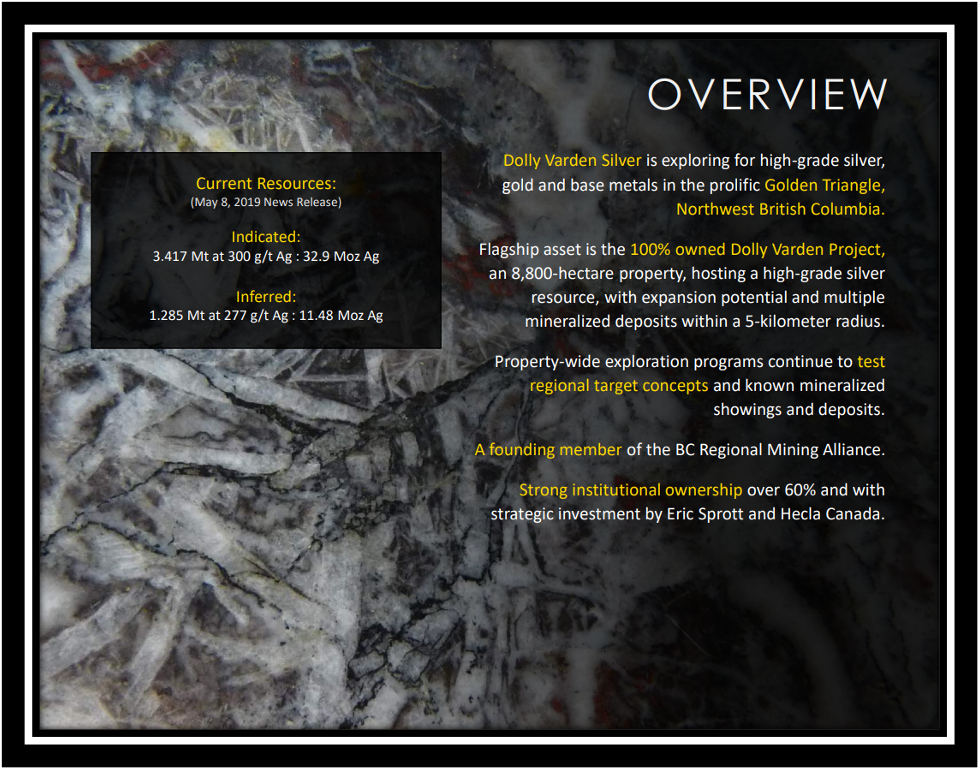

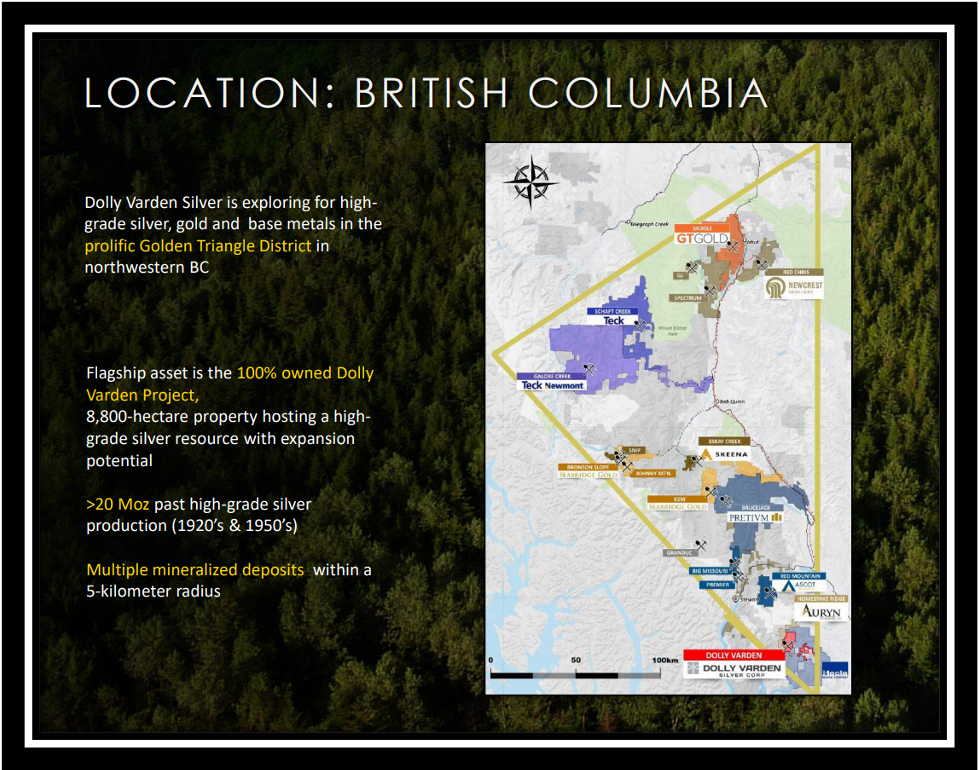

Shawn Khunkhun: Dolly Varden is a very rare opportunity for speculators, as we are amongst a very small group of companies that are considered a pure-play silver company. In a landscape that represents thousands of mining companies, there's only a handful of pure silver projects. What makes Dolly very rare amongst a very small group of companies is the fact that our project is located outside of the camp. It's located outside of Chile, Argentina, Mexico and Peru where the bulk of the world's silver comes from, especially the pure plays. For speculators to have a high-grade opportunity in a safe jurisdiction like Canada makes it unique and quite special opportunity. When I think of Dolly Varden, I think of pure silver, and I think of the Golden Triangle, and we are in a safe jurisdiction.

Maurice: And to truly appreciate the opportunity before us, I believe it's paramount to understand the genesis of Dolly Varden. Mr. Khunkhun, please share with us the impressive mining history that made Dolly Varden one of the most iconic names in mining.

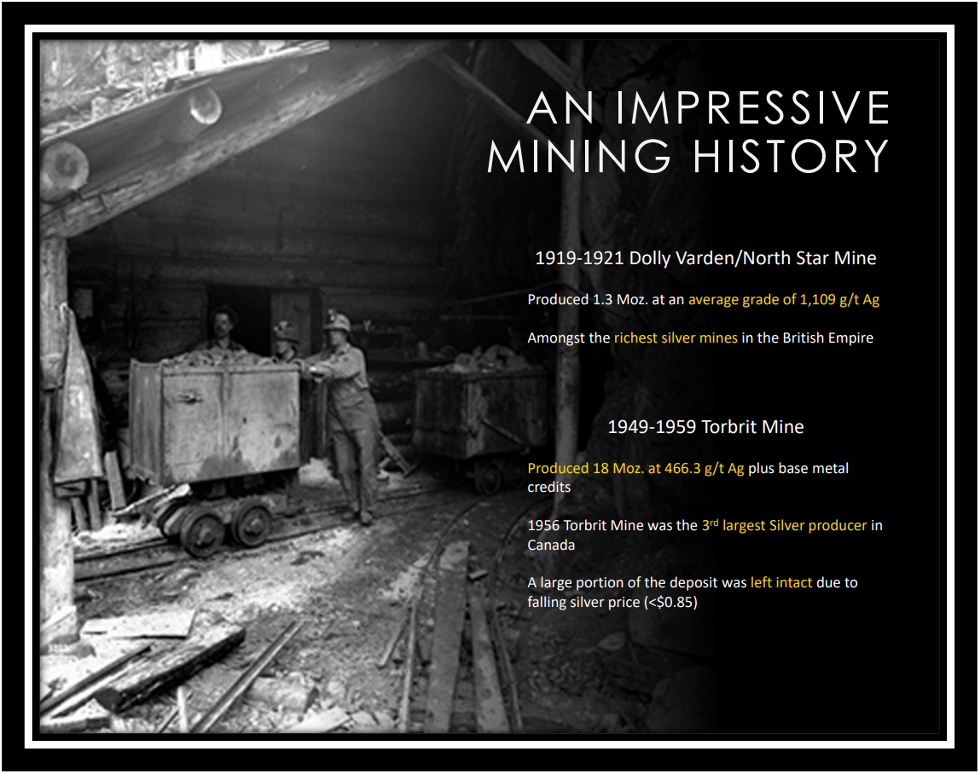

Shawn Khunkhun: Great, great question. It is important to know where it's come from and that's going to tell us where we're headed here. So, silver was discovered on the property back in 1909 and the Dolly Varden Silver Mine began production in 1919. And so, the Dolly Varden silver mine produced for two years. It produced at very, very exceptional grades of 1,100 gram per ton (g/t) silver. And there was a series of other deposits, other mines that were identified in some following years, including the Torbrit Mine. In and around 1949, the Torbrit Mine made its way into production and from 1949 to 1959, the mine produced about 18 million ounces of silver at 466 grams per ton. And there were two other mines at the time that were identified, the North Star and the Wolf.

Historically, there were four mines, two of them giving meaningful production, and that's what have inherited today. Back in 1959, the silver price was $0.85 an ounce, and so mining operations, they just weren't profitable at that price at that time. So much of the deposit was left intact, and so there's been a series of aggressive drill campaigns in recent years that have drilled on a compliant resource.

The name and projects have strong rich history. At that time, under the British Empire, the Dolly Mine was the richest silver mine in the British Empire. Back in the 1950s, it was Canada's third-richest silver mine. So, it's got a long, rich, storied history.

And if you zoom out from the project and you look at the area as a whole, we're talking about Canada's, Northwest British Columbia's Golden Triangle. And if you go north, set in the same type of rocks, we've got a very, very famous, what started as a silver mine, which then evolved into becoming a gold mine, which was Eskay Creek. Maurice, 200 million ounces of silver at around 2,200 grams per ton. And there's a lot of similarities between the two projects.

We are in an area that has about billion ounces of silver in the ground, and so it's a very rich area. It's the type of area you want to be looking for in your big discoveries. So, yeah. Rich, rich, storied history, not only on our property but the area at large.

Maurice: I'm hearing location, location, location. And we're also going to get into something equally as important to the location, and that is management. Now that we understand the historical accomplishments of Dolly Varden, get us up to date on the successes in the recent years that the market speculators are optimistic about, and the upside potential before us.

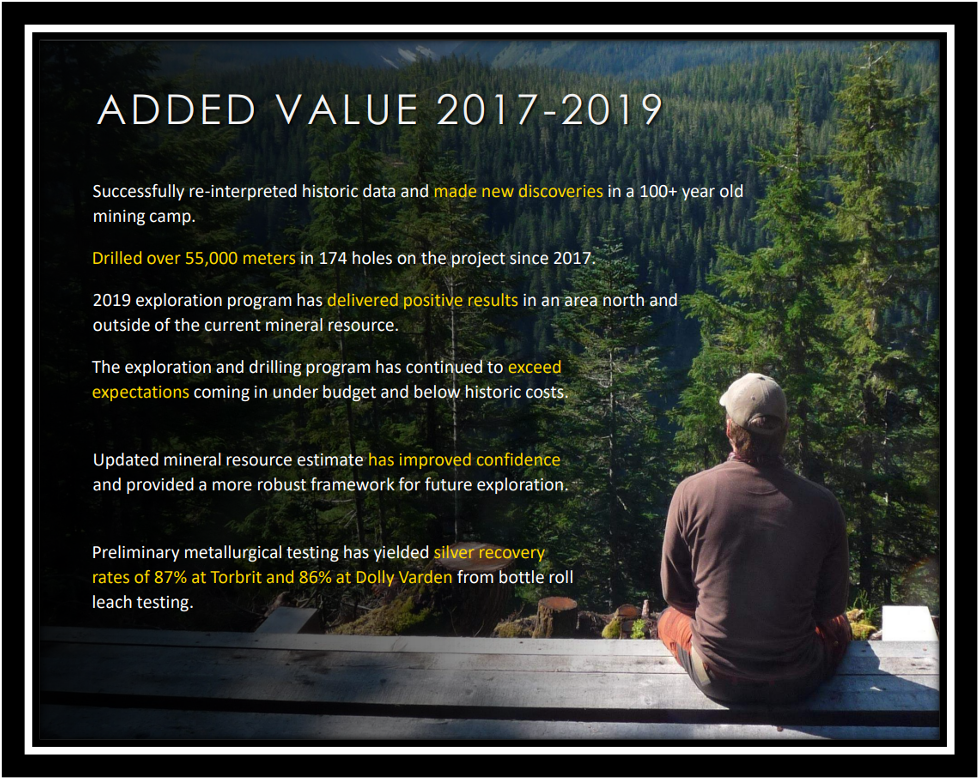

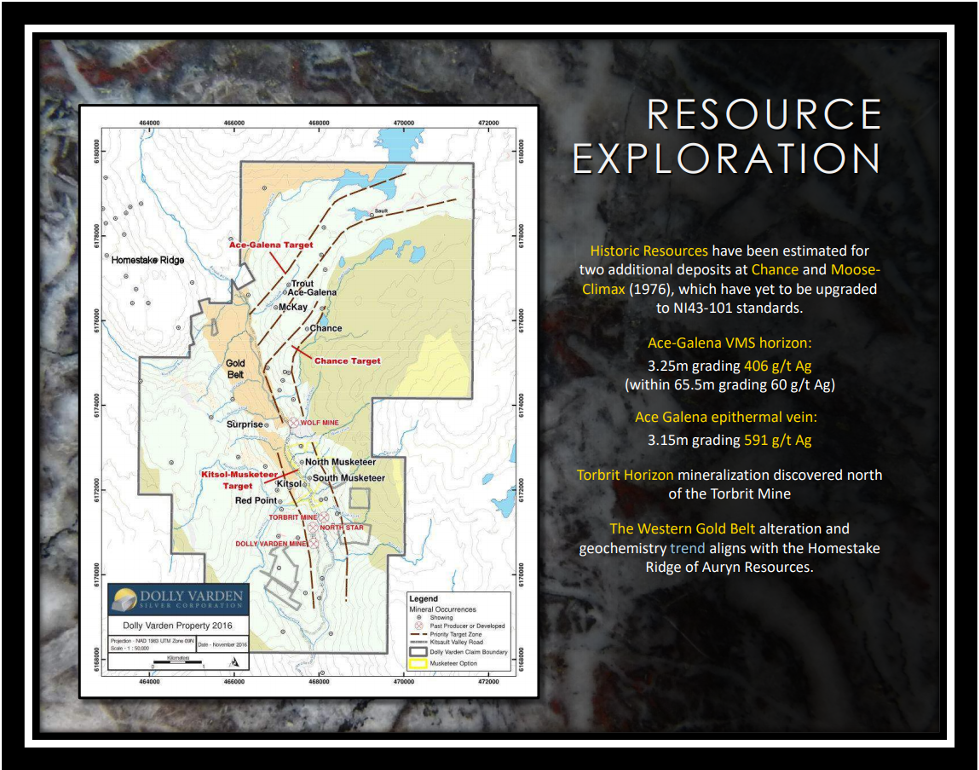

Shawn Khunkhun: Well, what's interesting is, despite a 100-year history of exploration and mining activities on the property, it's not uncommon for the company to put out a new discovery that is just quite tremendous from a thickness perspective and from a grade perspective. Some of the numbers that come to mind in the neighborhood of about 60 meters thickness, which is amenable to both mining methods, and grades of 400 or 500 hundred grams per ton. So, if you look at years 2017–18–19, there were about 55,000 meters of drilling, which produced a new compliant resource estimate. And so, what we've done is we've taken these rich historical mines and we've brought them into a modern resource, and these resource estimates, with the criteria you need to meet in terms of spacing of drill holes—there are strict criteria—and the fact that the bulk of our ounces are in the Indicated category, just shows the confidence we have when we talk about our 44 million-ounce resource estimate at 300 grams per ton.

So, the way I look at where we are, and where we're headed is we've—we're anchored with this cornerstone 44 million-ounce resource estimate, but the real story here is the potential to potentially double or triple that resource, and for this to be truly one of the great silver mines, not only in the Golden Triangle, but in the world.

Maurice: Let's get some boots on the ground. Sir, take us to the Golden Triangle of British Columbia (BC) and introduce us to your flagship Dolly Varden silver project.

Shawn Khunkhun: We are located in the Golden Triangle. If we zoom in to the project, and we're sandwiched in between Fury Gold Mines (FURY:TSE) and Hecla Mining Co. (HL:NYSE). And what's interesting about that is Hecla, which has been producing precious metals for over 100 years and are expert underground miners. Not only does Hecla own a very, very large block of ground to the east of our property, but they also have a plus 10% share position in Dolly Varden. They've invested over $2.5 million into Dolly Varden this year. Dolly Varden is sandwiched, with our 44 million-ounce silver resource, in between Fury Gold Mines' Homestake Ridge deposit, which is a 1 million ounces of gold, 18 million ounces of silver. And then Hecla's got a very, very impressive discovery on what's known as the Illance Trend.

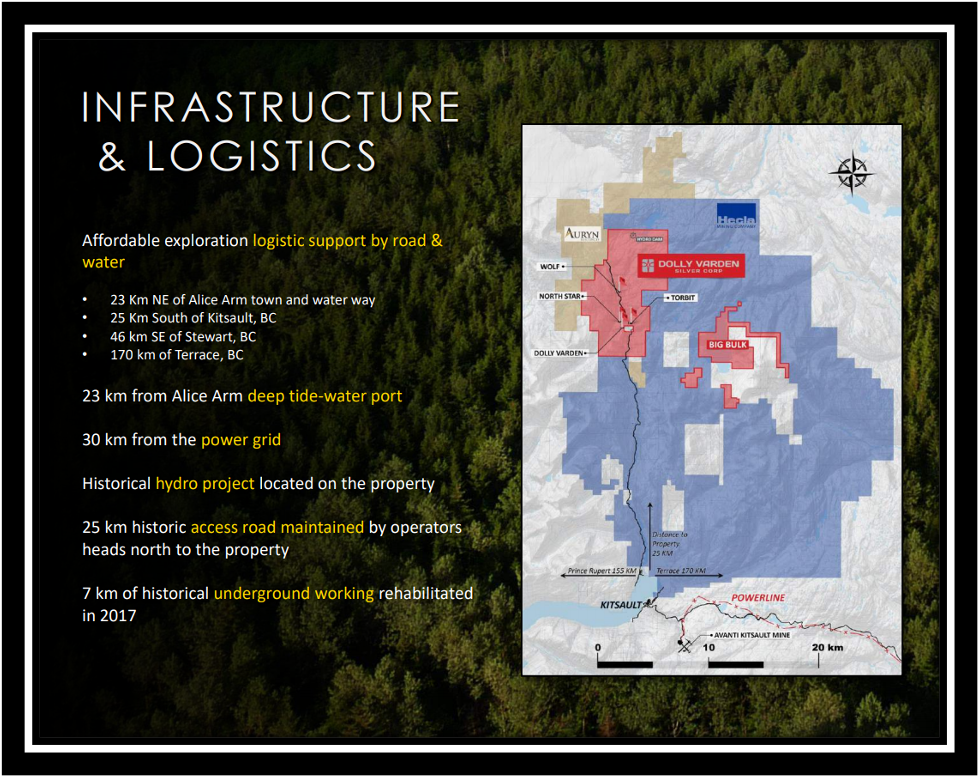

In terms of infrastructure, there's a road that takes us from the Dolly Varden property down to Alice Arm, which is an ocean port where we bring in our heavy equipment and barge up drill rigs. Included in the infrastructure we also have power lines that take us to towns like Terrace. We are fortunate to have great infrastructure with a tremendous endowment. It's truly a region that's emerging, and it's unique because of the shared successes in the Triangle of late.

Just this week, Ascot Resources Ltd. (AOT:TSX.V), which is just to the north of us, announced they have their project financing to take the Premier Mine back into production. So, some exciting things are happening that are validating investors' interest in the area. We've got some of the largest mining companies in the world, including Newcrest Mining Ltd. (NCM:ASX) and Newmont Corp. (NEM:NYSE), which have made big, big investments into the Golden Triangle.

As you stated earlier, it's location, it's infrastructure, it's the regional opportunity that we have zooming into the specific part of the Golden Triangle.

And again, what makes it so unique is the nature of our deposit. It's highly uncommon to have such a pure high-grade silver play. Most of our peers are reporting silver equivalents, and if you look into their numbers, it's a lead deposit, it's a zinc deposit, and half of the equivalent is coming from base metals. And what we have that makes us truly unique is we don't report equivalents. We report the pure silver numbers; there is very little byproduct and just exceptional in its thickness and its grade.

Maurice: I'm giggling here because I have seen the nomenclatures of those said companies. They tend to have silver in them, but they are not a pure silver play or a silver play at all.

Now, what's interesting as well, and our [readers] should note this, is that you heard about the infrastructure. Now consider the capital expenditures that will not have to be allocated because everything is in place.

All right, sir. Exploration is a research and development exercise. I'm interested in hearing how Dolly Varden arrived at its thesis, which has given the company confidence that the upside in making additional discoveries, and increasing shareholder value, is just around the corner. Please walk us through the genetic model and then the exploration model.

Shawn Khunkhun: Dolly Varden is blessed by having some of the smartest scientists involved with the project, and so this is a group of exploration geologists and engineers that understand the tricky nuances of the Golden Triangle.

The Golden Triangle is a very, very well-endowed part of the world, producing and hosting some of the highest-grade deposits in the world. But with all the faulting and folding, it can make for a very, very tricky place to build up tonnage. And based on our team and the fact that they've had experience on almost every major mining in the area, they bring the experience we need to delineate our project in the most efficient manner.

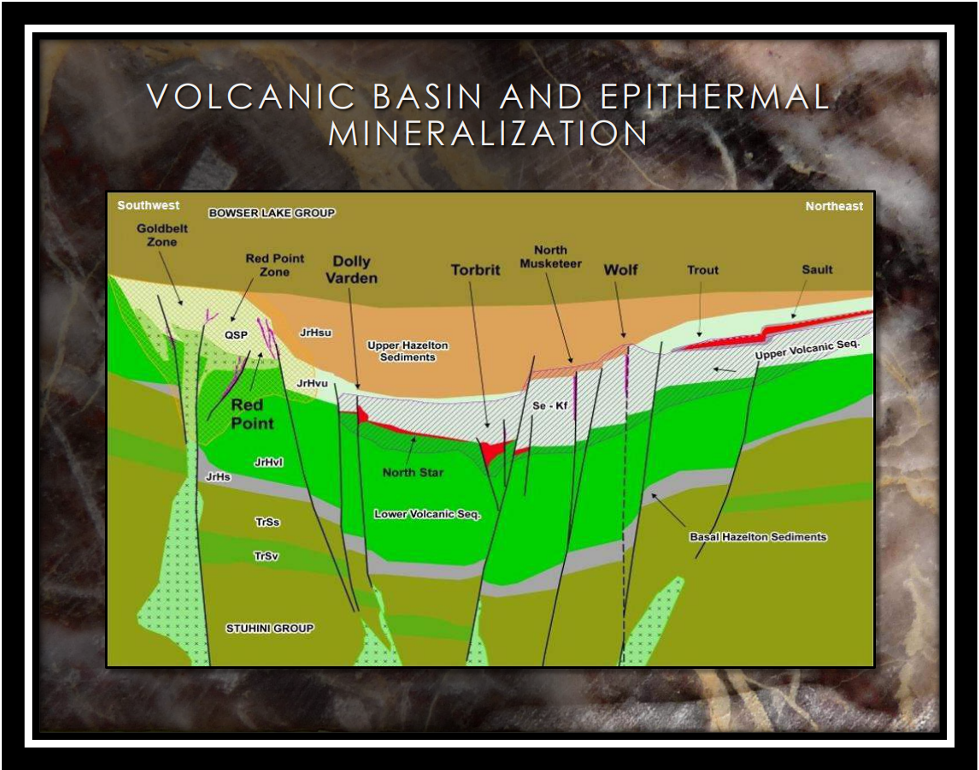

We have two types of mineralization occurring on the property. We have a volcanogenic massive sulfide-style mineralization, which is where you've got this very, very high grade, wide intercepts, and deposits, like the Torbrit Mine. And then what makes it special is we've got this epithermal overprint that's occurring.

To keep it very high level, I'll just say that structure and the structural studies, like LIDAR, have been very useful in identifying structure, especially on a property that has a lot of tree cover, and also understanding the sodium, the potassium, relationships and understanding how that impacts the alteration we're seeing in the field.

And we have identified a term that I've coined the Silver Highway, where we've got a trend that starts at the old Dolly Varden Mine and runs right up to the Chance discovery, that stretches for about five kilometers. And we've got about two dozen showings, past-producing mines, new discoveries that we're following up on this Silver Highway.

Maurice: You've drilled about 174 holes and about 55,000 meters. What can you share with us about the assay results from your exploration efforts?

Shawn Khunkhun: Looking specifically at the 2020 campaign, where we drilled 40 holes and we've reported 11 assays from those 40 holes, the big highlight, or the success, so far, of this drill campaign has been some methodical 25- and 50-meter step-outs at the Torbrit mine.

So, when we started the drill program, the idea was to see if Torbrit was going to extend, and not only extend in terms of along strike and the opportunities along strike that had depth, but also looking at high-grade mineralization within the block model and extending the high grade and adding ounces by extending high-grade pockets, focusing on the kilo grades.

And so, in terms of both goals that we set out at Torbrit, we accomplished both of them. In an Oct. 7 press release, we headlined over 300 grams, over 12 meters, on brand new step-outs (click here). And then, within the mine, we were hitting 300 grams over 30 meters, and within that, some very, very high-grade intercepts.

So, this project just keeps delivering. We keep adding and we keep stepping out and the bulk of the holes that we're yet to report, the remaining 29 holes, half of those are focused on exploration targets, and then the other half is going back and with strategic step-outs, again, around the Torbrit mine.

Maurice: And what type of activity is actively being conducted on your projects at the moment?

Shawn Khunkhun: We just finished cutting the last of the core and logging the last of the core and getting that out to the assay labs. Right now we are going to take all the drill data that comes in and we will drop that into and marry it with all the historical work that was done in previous years, and then come up with targets and the plans for the 2021 campaign. And I should say some of those plans are going to include more than just exploration.

Maurice: Now, before we leave the project side, fill us in on the latest round of financing, which was conducted successfully back in November, and then the company's acquisition of strategic surface rights.

Shawn Khunkhun: This has been a very busy year on the financing front (click here). The company raised about $27 million in total in 2020, which is quite exceptional considering that in February, when I took over the company as the new CEO, the market cap in total equated to $20 million. So, it's been a very busy time. We've staircased the financing prices, so we started the year with a $0.30 financing, then a $0.45, a $0.71, and the last financing we conducted was a dollar a share, where we raised $7 million.

In terms of the new land deal that we announced (click here) just within the last week, what we've done there, is for years the company was leasing all the land that housed the Dolly Varden camp, the Dolly Varden buildings, all the core storage, including waterfront access to where the barge would deliver the equipment that's used on site. We want to control our destiny. And one what to accomplish that is to focus on development and future development opportunities and mining operations coming back to the Dolly Varden project.

We purchased all of the lands that house all of our buildings, along with the surface rights, and strategically, we also have access to the port. I think this is strategic not only for Dolly Varden, but for the area at large. So, I'm happy to say that we now control our destiny, in terms of future development.

Maurice: All right. Let's leave the project side and discuss some important topics germane to the projects. Do any of the projects have any earn-in options?

Shawn Khunkhun: No. We have a 100% interest.

Maurice: What is your relationship with the First Nations?

Shawn Khunkhun: We are part of an organization called the BC Regional Mining Alliance. This is a collaboration between the government, the First Nations, and GT Gold Corp. (GTT:TSX.V), Ascot, Skeena Resources Ltd. (SKE:TSX.V), and Dolly Varden. And so, beyond having a partnership where the First Nations, the company, and government go out to talk to investors and let investors know that BC is open for business, the Golden Triangle has got a long history of mining, we want development with all three partners.

The government's there. People like Peter Robb are there, explaining the permitting process, explaining how the government was key in bringing infrastructure in. And then the First Nations partners are pro-business. We at Dolly Varden, specifically—a third of our workforce is from the Nass Valley. They are the Nisga'a people.

And this is not lip service. These are our brothers and our sisters. These are our friends. I live here in British Columbia, so this is an extension of my community. The people that work on our site do exactly what you and I do. They coach basketball or soccer. They have positive impacts on the local communities. And longer term, what's pushing and motivating the team at Dolly Varden is we want to bring good, strong jobs to the area, and we believe that this is going to be a win-win from the communities to the companies, shareholders, and the province. So, I'm excited about the opportunity of all the wealth we can bring to the area.

Maurice: That is so encouraging to hear because this relationship is paramount to success. If you don't have it, nothing moves forward. And all too often, I think we sometimes just look at numbers, and you have to look at the human aspect of it, and I'm glad that you take it so seriously and have forged that relationship, and looks like it's going to be one going for a long time coming.

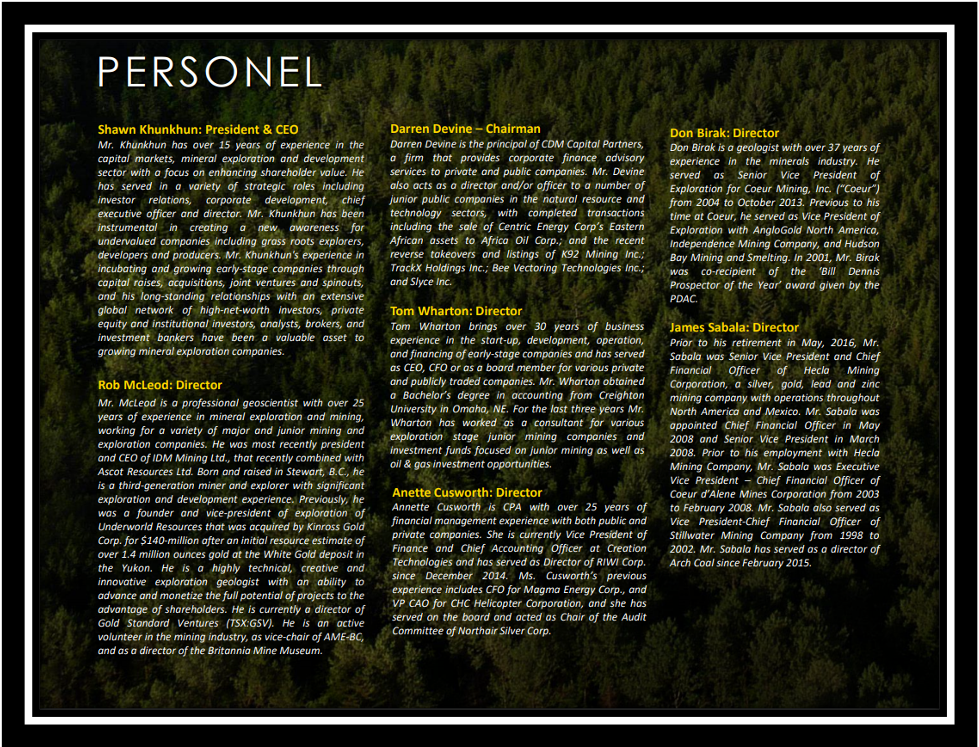

Shawn Khunkhun: I've got to say, just to add, I can't take all of the credit. We've got a very strong director on the board that came along when I came on with Dolly in February. My friend and my colleague Rob McLeod came on, and Rob is a third-generation miner from Stewart, and I've learned a lot in terms of running a junior mining company from Rob. I've just got to pay credit to him.

When we first got into the throes of this year and we were faced with some challenges that none of us has seen before, including a global pandemic, we sat down with our First Nations partners and we said, "Look, we need to come up with a plan here to ensure that we're safe, that your communities are safe." And we worked with an organization, the Nisga'a Employment Skills and Training Organization, to develop protocols around that. And I don't think I could have done that without people on my board like Rob, and other parts of our management team.

Maurice: Oh, that's great to hear. Great to hear. All right, sir. Are you fully permitted?

Shawn Khunkhun: So, we're at the exploration stage right now, so we're not mining, so we're not permitted for mining today. But we are fully permitted for all the exploration activities we're carrying out.

Maurice: Is the ultimate goal for Dolly Varden to build a mine or arbitrage?

Shawn Khunkhun: That's a good question. I think the way I'd like to answer that is I've built a mine before, I've taken a company from inception into production, raising half a billion dollars along the way. I know how to go through that exercise and I think the way I'd like to answer that is that every step, every day, every week, we have to ask ourselves what's best for the shareholders. If we find ourselves in a situation where another company wants to come in and they want to build and they want to develop and it's a lucrative deal for our shareholders, we will do that deal. Until then, we will continue to grow inventory, de-risk the project, and move toward a mining decision.

Maurice: We've discussed the good. Let's address the bad. What can go wrong and what are your action plans to mitigate that wrong?

Shawn Khunkhun: Another good question. I'll give you an example. So, this year, the weather was horrendous. It went wrong, and our team did a phenomenal job of looking for the pockets of weather to be able to get out into the field.

One of the things that I'm going to look at is, when all the companies report their year-end results in April and we look at a drill-cost-per-meter in the area, I think Dolly Varden numbers are going to stand up strong, and it's because we've got individuals involved with the company that are incentivized and aligned with shareholders. They're not just contractors. So, when a lot of our peers were taking a weather day, our team was looking for the opportunity to get into the field.

So, things in business—things in mining—go wrong, and it's having a team in place that is aligned with shareholders to make the best out of all scenarios and situations.

Maurice: Switching gears, let's discuss the people responsible for increasing shareholder value. Mr. Khunkhun, please introduce us to your board of directors.

Shawn Khunkhun: I've got a very strong board and management team. This is a board that has got individuals who've held some of the most senior positions at companies like Hecla, like Coeur Mining Inc. (CDE:NYSE), some of the most famous silver companies in the world. We've got exploration geologists that worked for Anglo, along with a strong legal and accounting staff. Our team has many skill sets incubating a small market cap company to facilitate promotion, finance, execute and then to sell or to merge the company with a larger entity.

And this group has a pedigree of bringing a lot of value to shareholders in the pas,t and a lot of success in M&A (merger and acquisition) transactions. Our board is a very involved, diverse group. We've got some great chemistry, which is important. And the other thing, we also have a lot of fun.

Maurice: That's important.

Shawn Khunkhun: It is very important. On the management side, when COVID hit, what we started doing daily was working out together virtually. So, every day at 1:15, we get together via one of the virtual platforms and we do some exercises together for 45 minutes and it's team-building. But it's a group that you want to come to work, you want to laugh, you want to work hard, you want to have success. And I think if you do that, it doesn't feel like work.

Maurice: Who is Shawn Khunkhun and what makes him qualified for the task at hand?

Shawn Khunkhun: Shawn Khunkhun is a husband, is a father, a soccer coach. In terms of being qualified for the task at hand, I've spent the last 17 years in the junior mining business, helping companies grow, helping companies bring awareness, and getting the financial dollars to unlock the value of the opportunities. And I've got a team of explorationists, mining engineers and brilliant scientists that are motivated and incentivized to help me bring the best value to our shareholders.

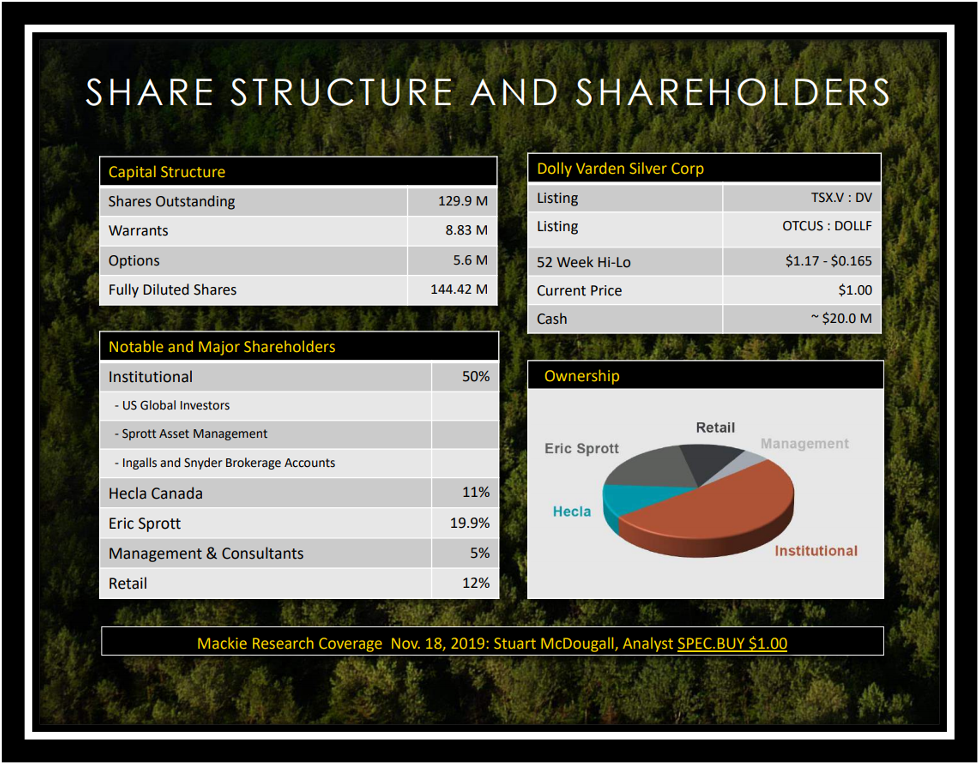

Maurice: Let's get into some numbers. Please provide us with the capital structure for Dolly Varden.

Shawn Khunkhun: We have 130 million shares issued and outstanding. Eighty-five percent of the company is held by astute precious metals investors that are aligned, long-term with the company.

A further breakdown is as follows: Eric Sprott at roughly 19% interest, Hecla at around 10%, and then institutions that own another 50%. So, very, very small float. And we've got about a $100 million market cap today. The company has $25 million in cash and we're well positioned, and in a position where we don't need to finance for at least this season and potentially the following.

Maurice: How much debt do you have?

Shawn Khunkhun: There is no debt.

Maurice: And what is your burn rate?

Shawn Khunkhun: It fluctuates as an exploration company. It varies. We spent about $6 million this year, all in all. About $5.2 million of that was in the field.

Maurice: Are there any redundant assets on the books that we should know about?

Shawn Khunkhun: No.

Maurice: Are there any change of control fees? If yes, what is the compensation?

Shawn Khunkhun: In terms of management change of control?

Maurice: Yes, sir.

Shawn Khunkhun: There's only one change of control, and for a $100 million company, I think the total change of control cost is under $500,000.

Maurice: Is management charging a consultant fee for any services?

Shawn Khunkhun: No.

Maurice: In closing, multi-layered question: What is the next unanswered question for Dolly Varden? When can we expect a response? And what determines success?

Shawn Khunkhun: The catalysts going forward are drill results and those drill results are going to tell us a lot about going forward at the Torbrit Mine, whether the company will decide to go underground and do some underground drilling. And success for us is growing ounces organically through exploration with a low discovery cost, and success for us is adding ounces to inventory—also through acquisition, as long as it's lucrative to our shareholders and the company.

Maurice: Sir, what keeps you up at night that we don't know about? Besides COVID. I think that's everyone's standard answer.

Shawn Khunkhun: It just depends on what's on deck. What kept me up through the summer was any time we were in the field, I just want to make sure everybody was safe, and so it's a sigh of relief. We had no major incidents to report this year. So, that's one thing that keeps me up at night, is the safety of our staff.

And apart from that, because we're in a strong financial position, that's not keeping me up at night. We've got a healthy balance sheet. There's no debt to service. So, just the health and well-being of the people around me.

Maurice: Last question, sir. What did I forget to ask?

Shawn Khunkhun: Potentially, maybe, what differentiates Dolly Varden. And I think maybe we covered this in the first question. But I just want to emphasize how unique this company is from the perspective of being a pure silver company situated where it is. And I just want to re-highlight that point.

Maurice: Mr. Khunkhun, it's been a pleasure speaking with you today. Wishing you and Dolly Varden the absolute best, sir.

Shawn Khunkhun: Thank you so much, Maurice, for the opportunity.

Maurice: Before you make your next precious metals purchase make sure you contact me. I'm a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments, where we have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium and rhodium directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at (855) 505-1900 or email maurice@milesfranklin.com.

Finally, please subscribe to Proven and Probable, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Dolly Varden Silver Corp. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.