Clinical-stage mRNA therapeutics company Translate Bio Inc. (TBIO:NASDAQ) today announced that it entered into a definitive agreement with Sanofi SA (SNY:NYSE), whereby Sanofi will acquire all outstanding shares of Translate Bio for $38 per share in cash.

The report indicated that each of the firms' respective Boards of Directors has already unanimously approved the transaction, which on a fully diluted basis is valued at around $3.2 billion. The companies advised that the $38 per common share purchase price represents a 56% premium to Translate Bio's 60-day, volume-weighted average share price.

Sanofi's CEO Paul Hudson commented, "Translate Bio adds an mRNA technology platform and strong capabilities to our research, further advancing our ability to explore the promise of this technology to develop both best-in-class vaccines and therapeutics. A fully owned platform allows us to develop additional opportunities in the fast-evolving mRNA space. We will also be able to accelerate our existing partnered programs already under development. Our goal is to unlock the potential of mRNA in other strategic areas such as immunology, oncology and rare diseases in addition to vaccines."

Translate Bio's CEO Ronald Renaud added, "Sanofi and Translate Bio have a shared commitment to innovation in the mRNA space. With Sanofi's long-standing expertise in developing and commercializing vaccines and other innovative medicines on a global scale, Translate Bio's mRNA technology is now even better positioned to reach more people, faster. We believe that this acquisition will strengthen the team's ability to achieve the full potential of the mRNA technology."

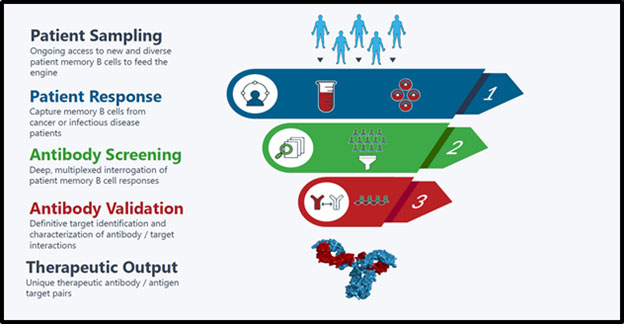

The report stated that the acquisition of Translate Bio serves to further accelerate Sanofi's efforts to develop transformative medicines utilizing mRNA technology. The two companies have already been working closely together for several years since 2018 when Sanofi and Translate Bio first entered into a collaboration granting Sanofi Pasteur an exclusive license to develop mRNA vaccines for up to five infectious disease pathogens. The agreement was later expanded to include the collaborative development of a novel mRNA vaccine for COVID-19 in March 2020.

The companies confirmed that presently, "There are two ongoing mRNA vaccine clinical trials under the collaboration, the COVID-19 vaccine Phase 1/2 study with results expected in Q3/21 and the mRNA seasonal influenza vaccine Phase 1 trial with results due in Q4/21."

The companies advised that the transaction is expected to close in Q3/21 subject to Translate Bio's shareholder approval, customary closing conditions and regulatory waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Translate Bio is headquartered in Lexington, Mass., and is a clinical-stage mRNA therapeutics company that is focused on developing potentially transformative medicines to treat diseases caused by protein or gene dysfunction. In addition, the firm is investigating methods to prevent the spread of infectious diseases by generating protective immunity via mRNA technology.

Translate Bio stated that it is largely focused on employing its technology to treat pulmonary diseases and currently is conducting a Phase 1/2 clinical trial of inhaled treatment for cystic fibrosis. Translate Bio also believes its technology may be of use in addressing a broad range of diseases, including those that affect the liver. The firm feels that the platform may also be useful when applied to various classes of treatments such as therapeutic antibodies or vaccines in areas such as infectious disease and oncology.

Sanofi is a $129.3-billion market cap global biopharmaceutical company based in Paris, France. The firm is involved in research, development, manufacture and marketing of therapeutic solutions and vaccines to alleviate pain and suffering. The company employs more than 100,000 people in about 100 countries. Sanofi's vaccines segment is dedicated to vaccines and includes the commercial operations of its vaccines division Sanofi Pasteur.

Translate Bio started off the day with a market capitalization of around $2.2 billion with approximately 75.23 million shares outstanding and a short interest of about 6.6%. TBIO shares opened more than 29% higher today at $37.65 (+$8.48, +29.09%) over yesterday's $29.15 closing price and reached a new 52-week high price this morning of $37.66. The stock has traded today between $37.59 to $37.73 per share and is currently trading at $37.67 (+$8.52, +29.23%).

[NLINSERT]

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.