Enthusiastic gold investors everywhere are wondering…has gold finally bottomed?

The short answer is… I think so.

That's because, from a number of perspectives, that seems the most likely scenario. Right now, most of the evidence points in that direction.

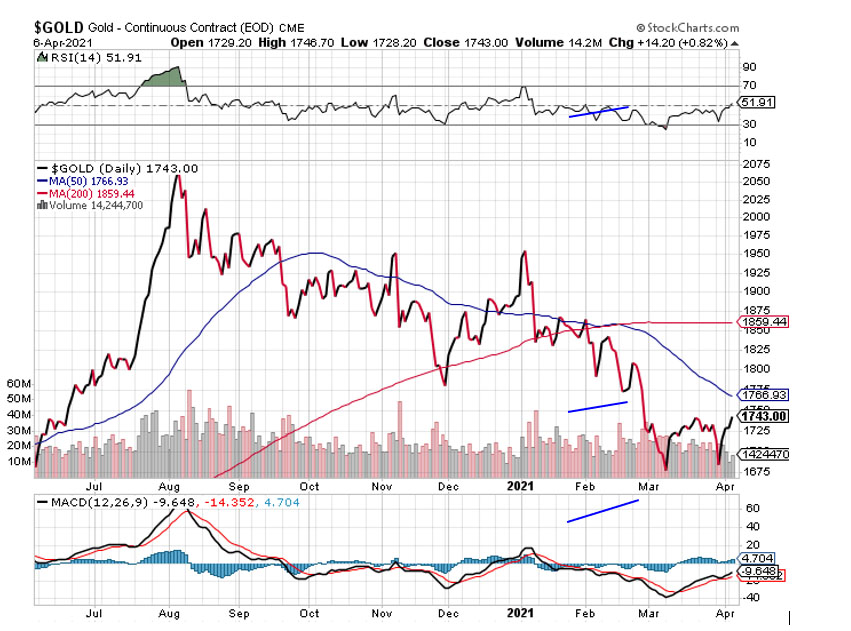

A dramatic rip higher from March to August last year caused gold to soar by 40% in just five months. It also allowed gold to establish a new nominal all-time record high at $2,070.

Since then, gold's been retracing, giving up about half of those gains. Two major drivers led to this: sentiment and the dollar. At this point, however, it seems both factors may have run their course, setting up gold and gold stocks for a new rally.

Let's examine the current outlook to formulate what's most likely ahead.

Negative Gold Sentiment Exhausted

Markets ebb and flow, and gold is certainly no exception. The dramatic rise last spring and summer was likely driven by fear as the impact of the COVID-19 pandemic was being assessed.

One of gold's biggest attractions is obviously as a safe haven, a role it's played for thousands of years. And last year was an excellent example. But as the world grew accustomed to its new reality, that meant other drivers took center stage.

It was also natural for gold to start ebbing. Naturally, large numbers of investors became enamored with gold and gold stocks as they chased them higher. That meant lots of buying near the early August peak. But that buying soon became exhausted.

Savvier investors then started to take profits while the late buyers eventually capitulated after buying high. Their lack of understanding, and lack of conviction, made them victims. It looks like that final capitulation happened in late March, as the sentiment pendulum swung to an extreme.

But fundamental drivers worked in conjunction with sentiment to help mark a turning point.

I have detailed before the effect of rising long term bond yields. Consider that the U.S. 10-year Treasury yield bottomed at 0.51%, just two days before gold peaked. Since then, the 10-year yield has soared, peaking on March 31 at 1.75%. That's a 240% spike in yields. Massive global fiscal and monetary stimulus on a record scale caused investors to start pricing in much higher expected inflation.

This hurt gold prices in two ways. Higher yields compete with gold, which pays no yield. It also meant a higher U.S. dollar index, as foreigners likely converted to dollars to buy those long-term bonds. Of course, a stronger dollar is a natural headwind for gold, which is priced in dollars.

But as we can see in both previous charts, this upleg appears to have run its course. Prices have retreated, and momentum indicators suggest a recent peak.

And the action in gold prices is starting to look bullish for the first time in months.

Gold's Technical Outlook is Positive

Technical action in the gold price is beginning to look bullish. We may have a double bottom, wherein the recent low established a bullish higher low. And both the RSI and MACD momentum indicators are rising, confirming the rising trend.

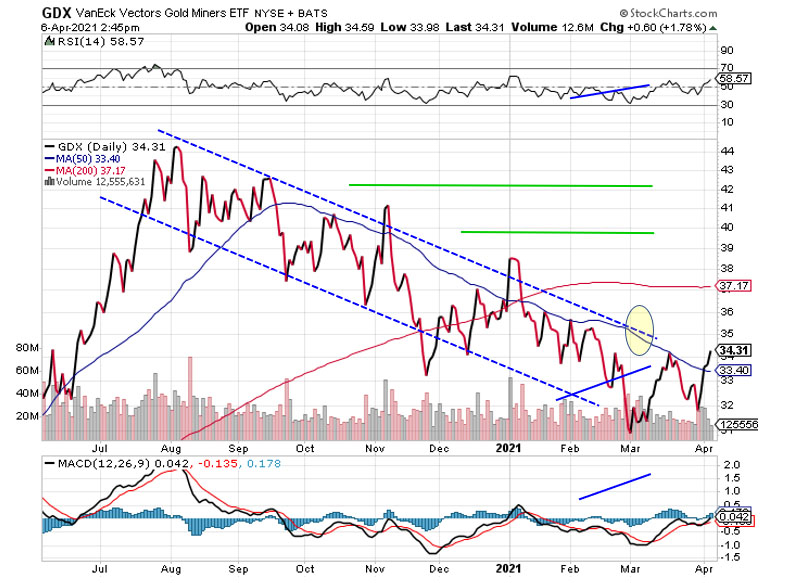

The action in gold stock prices is similar. Using the VanEck Vectors Gold Miners ETF (NYSE:GDX) as a proxy, we see several bullish signals. GDX has recently closed above its 50-day moving average and broke out above its falling trend channel. It too has established a higher low with rising buying volume. And both the RSI and MACD here are confirming upward momentum.

My upside price targets for GDX are $38.50 and $41.

And lastly the Gold Miners Bullish Percent Index (BPGDM) is also providing a bullish signal. This indicator is most bullish when it dips below 30 then reverses higher. And in the last week that's exactly the signal it provided.

So, given a likely reversal in sentiment, combined with positive price action in gold, gold miners, and their momentum indicators, odds are very good that we've seen the bottom for gold and we're starting a new upleg in this sector.

Oh, and one more thing. Gold stocks are cheap. The average stock in GDX trades at a P/E of just 20 and at less than 10 times cash flow. By comparison, the S& 500 index currently trades at a P/E of 28 and over 16 times cash flow.

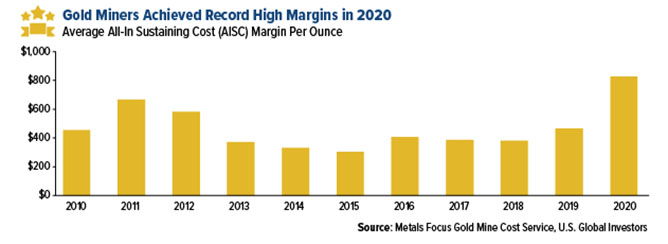

And according to U.S. Global Investors, gold producers had their most profitable year ever in 2020. The average profit per ounce mined was $828, which is well above the previous high in 2011 at $666. Part of this record profit level has been due to cost discipline.

Put it all together, and the indicators—sentiment, technical and fundamental—all point to higher gold and gold stocks over the near and medium term.

In the Gold Resource Investor newsletter, I provide my outlook on which stocks offer the best prospects as this bull market progresses. I recently added a low-risk, deep value gold royalty company to the portfolio, which I believe has exceptional potential to outperform its peers in the next 12 months.

Of course, it's impossible to know for certain that gold has bottomed. But given the outlook for this sector as I've just laid out, it makes sense to layer into gold positions over the next several weeks.

In all likeliness, those who do will be amply rewarded.

After all, it's a gold bull market!

--Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

[NLINSERT]Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.