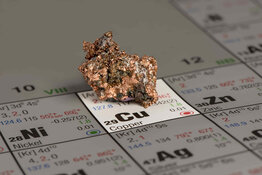

Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB) will now be able to recover significantly more copper from oxide material at its Carmacks project in Canada's Yukon Territory by employing a combination of methods, noted a January 17 news release. This was proven out in the additional metallurgical testing Kemetco Research Inc. completed on Carmacks' copper oxide flotation tailings.

Now, instead of yielding only 39.8% of copper from oxide via initial flotation alone, the Canadian company may recover another 48.2% through a subsequent process of leaching plus chemical precipitation for a total recovery from oxide of 88%.

The base case for copper recovery in the 2023 Carmacks preliminary economic assessment (PEA) was 93.7% for the sulfide material but just 39.8% in oxide, with the total recovery target being 77%. The additional oxide recovery will now likely take total recoveries, sulfide plus oxide, well beyond the company's 77% target.

"The unlocking of additional value through the improved oxide recovery that this testing represents, especially in the early years of mine life, has the potential to add significantly to the net present value (NPV) of the project," Granite Creek's President and Chief Executive Officer Tim Johnson said in the release.

For an idea of how the greater recovery will impact economics, just boosting the life-of-mine average recovery to 77% from 64% would have added another US$180 million (US$180M) to the NPV5%.

Couloir Capital rated Granite Creek Buy and noted that the potential upside in the stock, given its then-share price of CA$0.08, was about 355%.

Further, Johnson said, "These results could allow for re-evaluation of resources that didn't make it into the mine plan due to lower grades or assumed recoveries."

The economics of Carmacks outlined in the PEA already were robust, Couloir Capital wrote in a January 2023 research report.

"The PEA demonstrates attractive project economics with significant opportunities for additional mine life expansion, reinforcing the potential of Carmacks to become a top-tier global copper project," wrote Couloir.

In other news, according to the release, Granite Creek appointed Susan Henderson, who has extensive experience in the mining industry, as corporate secretary. She will oversee and manage corporate governance matters, ensure Granite Creek complies with regulatory requirements, and liaise between the company and its stakeholders.

Potential Top-Tier Global Copper Project

A member of the Metallic Group of Companies, Vancouver, British Columbia (B.C.)-based Granite Creek Copper is an explorer-developer of metals projects in North America, Couloir Capital described.

Its flagship copper-gold-silver project, Carmacks, spans 176 square kilometers in the Yukon's Minto copper district and will be powered primarily by renewable energy.

Granite Creek also owns the Lucky Ship molybdenum project, which it acquired last year, and the Star copper-nickel-platinum group metals project, both in B.C.

Currently, the mining company is advancing Carmacks toward a feasibility study, Couloir Capital wrote. This involves the metallurgical work that has been underway for some time along with baseline environmental studies and exploration drilling.

The World Needs Copper, and Lots of It

With respect to copper, used in electrical equipment and industrial machinery, Haywood Securities purported in a January 2024 report that based on the long time it takes for new copper supply to come online, the market for the metal "will be tightening for the foreseeable future [and] that could eventually lead to a new copper cycle." Haywood noted predictions are for a copper deficit this year, marked by supply shortfall of about 500,000 tons.

CNBC reported in a January 2, 2024, article that copper supply is low, and the world's ongoing transition to renewable energy will continue to drive high demand for the metal.

More than 60 countries, during the 2023 United Nations Climate Change Conference, agreed to a plan to triple global renewable energy capacity by 2030. Citi estimated, in a December 2023 report, that this collective endeavor will boost copper demand over the next six years by another 4,200,000 tons and could push the copper price to US$15,000 per ton in 2025. (Copper is now about US$8,189 per ton.)

Electric vehicles alone require large quantities of copper, and by 2030, that amount is expected to triple from today's total to 3.8 million metric tons, according to Citibank's "Wealth Outlook 2024" report.

"Profitable copper producers may be one of the lower-risk components of the energy transition, with a strong correlation to global growth once it improves," added Citibank.

According to CNBC, analysts and experts predict the copper price will start rising in H2/24 on the back of heavy copper demand and the weakening of the U.S. dollar resulting from anticipated real interest rate cuts by the U.S. Federal Reserve. The price of copper is forecasted to skyrocket more than 75% in the next two years.

The Catalyst: More Progress at Carmacks

According to Couloir Capital, any news on Carmacks with respect to drilling, fieldwork, or other advancements toward a feasibility study could boost Granite Creek Copper's share price.

"We see [the feasibility study] as a potential value accretive catalyst, as it would signal to the market that GCX's intrinsic valuation is due for a step change," Couloir Capital wrote.

Specific near-term catalysts, Granite Creek said, include results of 2023 exploration work at Carmacks, the announcement of 2024 drilling plans, and possibly an updated PEA on the project.

Couloir Capital rated Granite Creek Buy and noted that the potential upside in the stock, given its then-share price of CA$0.08, was about 355%. The company is trading lower now, at about CA$0.04 per share.

Granite Creek continues to successfully carry out the work that is necessary to advance its Carmacks project, Couloir wrote. The determination via additional metallurgical testing that the mining company could recover 48.2% more copper from oxide material at the project represents another achieved milestone in this regard.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Granite Creek Copper Ltd. (GCX:TSX.V; GCXXF:OTCQB)

Ownership and Share Structure

According to Reuters, insiders own 5.74% or 9.23 million (9.23M) shares of Granite Creek Copper. One of the five insiders is Chairman of the Board, President and CEO Timothy Johnson with 2.54% or 4.08M shares. The other four, all directors, are Robert Sennott with 1.87% or 3.01M shares, Michael Rowley with 1.06% or 1.71M shares, John Cumming with 0.26% or 0.42M shares and Loy Chunpongtong with 0% or 0.01M shares.

The company does not have any institutional investors.

Retail investors own the remaining 94.26%.

Granite Creek has 161M shares outstanding and 151.77M free float traded shares. The company's market cap is CA$6.4M, and its 52-week trading range is CA$0.03−0.105 per share.

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Granite Creek Copper Ltd.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- [Granite Creek Copper Ltd.] wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.