Canadian intermediate gold producer Pretium Resources Inc. (PVG:TSX; PVG:NYSE) yesterday announced operating and financial results for its second quarter 2021 ended June 30, 2021.

Pretium Resources' President and CEO Jacques Perron stated, "The second quarter of 2021 started under some challenging circumstances, but thanks to the hard work of our team we made consistent improvements through the quarter and we remain on track to achieve our annual guidance. . .We accomplished another profitable quarter with $152.3 million in revenue, generated $50.7 million in free cash flow, and we have reached a key turning point where our cash position now exceeds our debt."

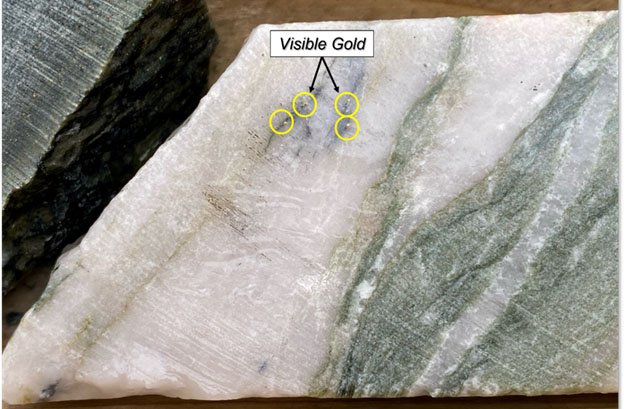

"Our resource expansion drill programs continue to successfully intercept high-grade mineralization immediately adjacent to existing underground infrastructure. Follow-up drilling is currently underway targeting the potential expansion of the Valley of the Kings deposit. Drilling results are expected to be released throughout the remainder of the year and will contribute to the updated Mineral Resource estimate we plan to release in the first half of next year," Perron added.

The company indicated that it produced a total of 83.083 Koz Au in Q2/21, compared to 90.419 Koz Au in Q2/20. The firm noted that the decrease in production volume was due mostly to the residual effects of the COVID-19 pandemic continuing into Q1/21. In addition to its gold production results, the company advised that it also produced 110.645 Koz Ag at Brucejack in Q2/21, compared to 123.926 Koz Ag in Q2/20.

Pretium advised that during Q2/21 it sold 84,618 oz of gold that generated $152.3 million in revenues. The company noted that revenues in the latest quarter decreased by 8.6% from the $166.6 million in revenues recorded during Q2/20. The firm pointed out that this was mostly due to the reduction in the number of ounces sold, though it was offset somewhat by a 3.8% increase in the average realized price of gold to $1,804/oz, up from $1,738/oz in Q2/20.

The company reported net earnings of $30.7 million, or $0.16 per share in Q2/21, compared to $36.1 million, or $0.19 per share in Q2/20.

The firm listed that all-in sustaining costs (AISC) in Q2/21 came in at $1,099 per ounce of gold sold, which was within the range of its annual guidance. The company mentioned; however, that the AISC incurred was much higher than the AISC of $911 per ounce of gold sold as it experienced in Q2/20. Pretium explained that "the impact of the strengthening Canadian dollar on total production costs during Q2/21 increased total cash costs and AISC by approximately $85 per ounce of gold sold in the period compared to Q2/20."

The company pointed out it is on track to produce 325,000-365,000 oz Au to meet its FY/21 guidance. The firm listed that it estimates that AISC will be between $1,060 and $1,190 per ounce of gold sold. Pretium added that "free cash flow is expected to be within the existing guidance range of $120 to $170 million."

Pretium said that during Q2/21 a total of 330,480 tonnes of ore (3,632 tpd) were processed at its Brucejack Mine, which represented a 1% increase over the 327,262 tonnes (3,596 tpd) processed in Q2/20. The company listed that, in Q2/20, gold recovery improved to 97.4%, versus 96.7% in Q2/20.

Pretium advised that it continued its diamond drilling activity in Q2/21 at Brucejack where nine drills are currently being utilized for infill and resource expansion drilling. The firm said it carried out a total of 50,680 m of diamond drilling in Q2/21.

Pretium Resources is an intermediate gold producer based in Vancouver, B.C., Canada, that is conducting operations at the high-grade gold underground Brucejack Mine located in northwestern British Columbia.

Pretium Resources started the day with a market cap of around US$1.6 billion with approximately 187.8 million shares outstanding and a short interest of about 4.4%. PVG shares opened 5.5% higher today at $8.915 (+$0.465, +5.50%) over yesterday's $8.45 closing price. The stock has traded today between $8.87 to $10.3387 per share and closed at $9.85 (+$1.40, +16.57%).

Read what other experts are saying about:

[NLINSERT]

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Pretium Resources Inc. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pretium Resources Inc., which is a company mentioned in this article.