Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB) is a gold exploration company whose time has come. The company is advancing a gold-rich extensive district-scale project in Ontario, Canada, and has already made significant discoveries.

The reason that the company's time has come is a combination of the progress that it has made on its property with the ongoing powerful bull market in gold, which is increasingly drawing attention to companies like Dryden. As we will proceed to see when we examine the latest stock chart for Dryden, the stock has been under persistent accumulation for a long time and is right now on the point of breaking out of its large base pattern into a major bull market.

First, I wanted to touch on the precious metals sector. With gold leading the way, the precious metals sector staged a spectacular breakout from a 5-year-long Bowl consolidation pattern just last week. This Bowl pattern is evident on the charts for GDX, the HUI index, and the large stock XAU index. It is shown on the 6-year chart for GDX below.

This broad sector breakout is believed to mark the start of a major growth phase for gold and silver stocks, which means that stocks like Dryden Gold will "have the wind at their back" as they will be given added impetus by a strongly rising sector.

Before looking at the stock chart, we will overview the fundamentals of the company using pages from its latest investor deck, which is new out this month.

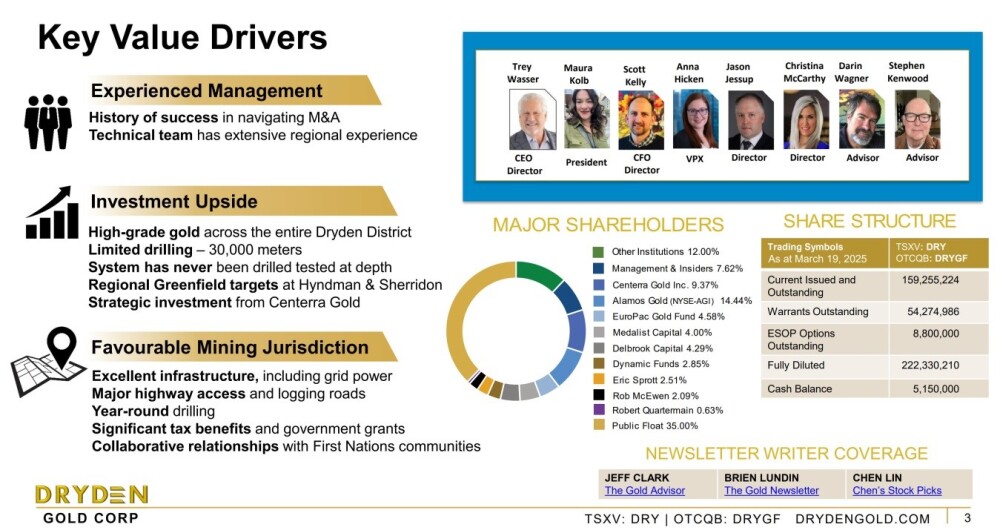

This page from the deck provides a quick overview of the company. Amongst the many key points presented on this page, a very important one to note is that, while the number of shares in issue may be considered high at 159 million, only 35% of these are in the public float due to sizable percentages being owned by management and insiders, funds and institutions and it is also noteworthy that legendary precious-metals-sector investors Eric Sprott and Rob McEwen have significant stakes.

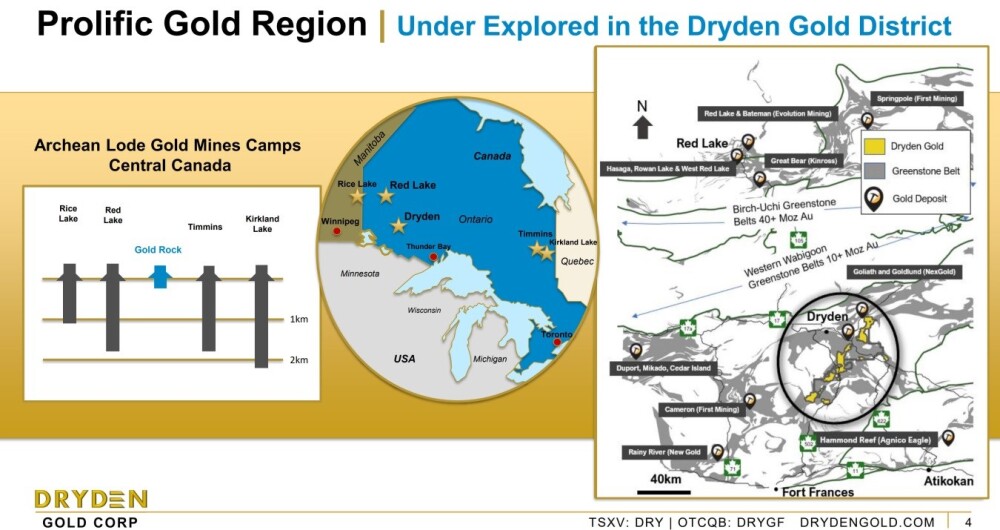

The next page shows the physical location of the Dryden Gold property in Ontario and its proximity to other big projects in the area owned by prominent mining companies, which certainly augurs well for further significant discoveries on the company's extensive property.

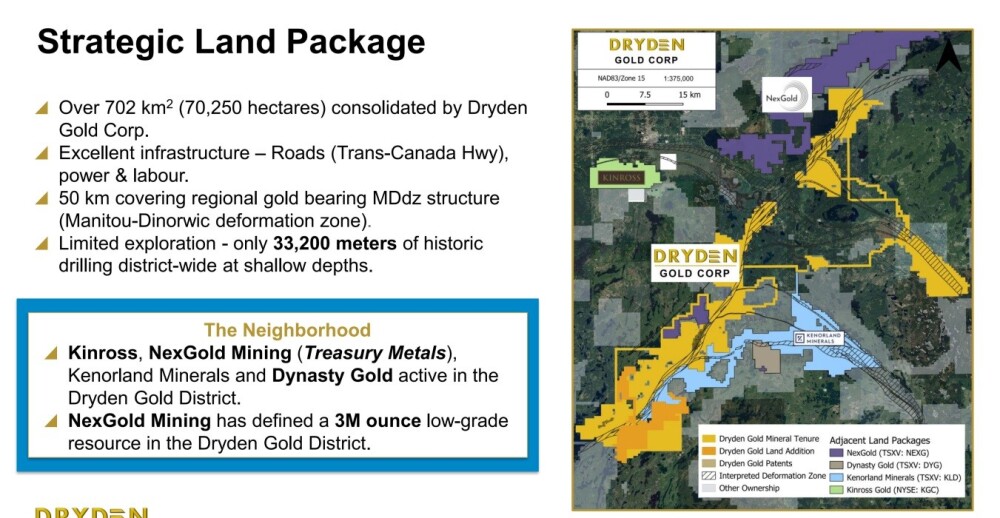

Dryden's land package is massive, and the fact that it is surrounded by other large properties being developed by other major mining companies with Dynasty Gold Corporation (DYG:TSX.V), Kenorland Minerals Ltd. (KLD:TSX.V; KLDCF:OTCMKTS; 3WQO:FSE),Kinross Gold Corp. (K:TSX; KGC:NYSE), and NexGold Mining Corp. (NEXG.V:TSXV; NXGCF:OTCQX; TRC1.F:FRA) nearby is certainly auspicious.

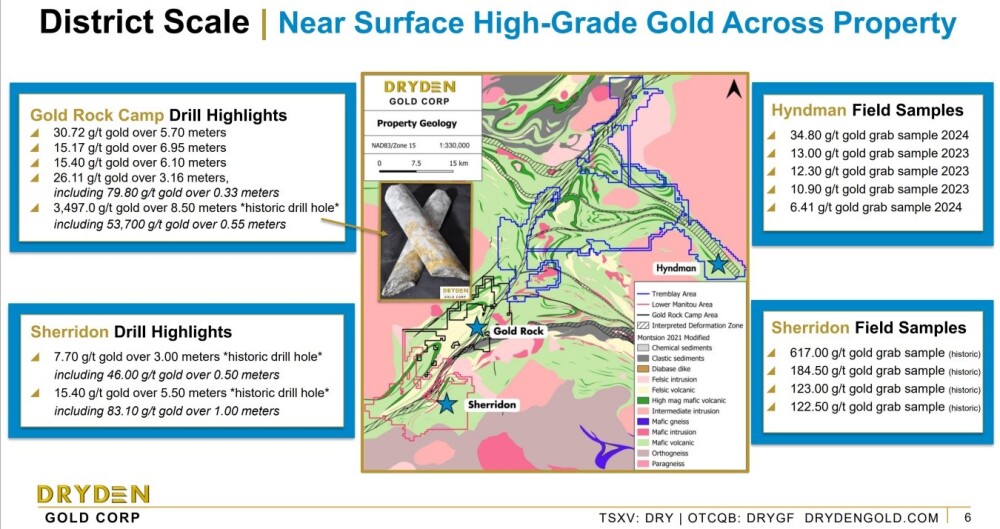

Near-surface high-grade gold has already been found across the property, meaning that the potential is great — district scale, in fact.

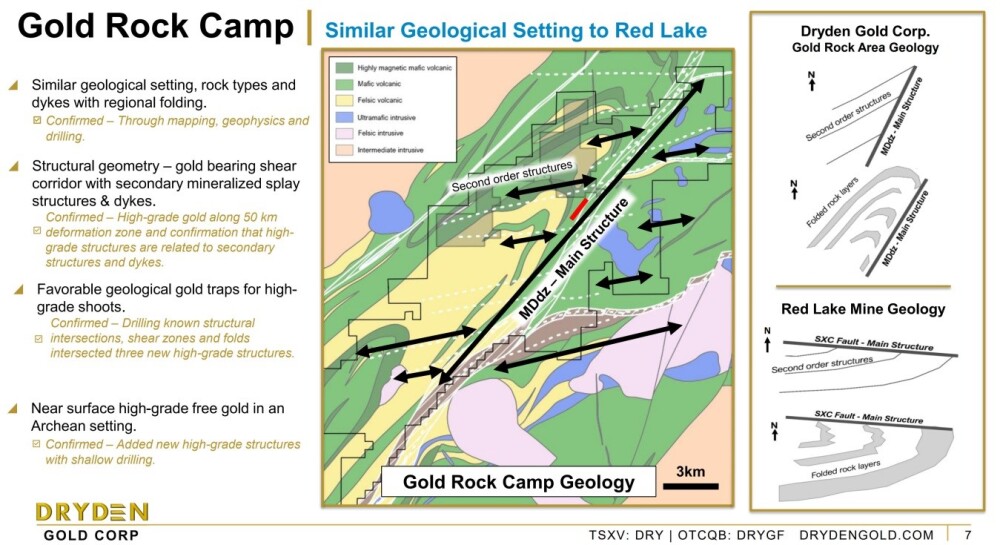

The Gold Rock Camp has similar geology to Red Lake — and most people in the industry know about that.

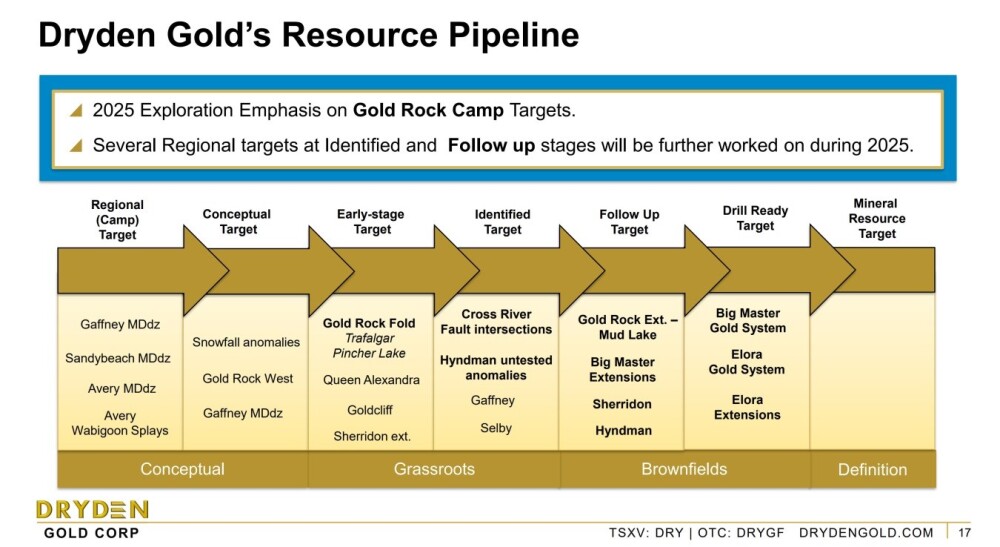

The following chart shows the progress of exploration, and as we can see, several big targets are now drill-ready.

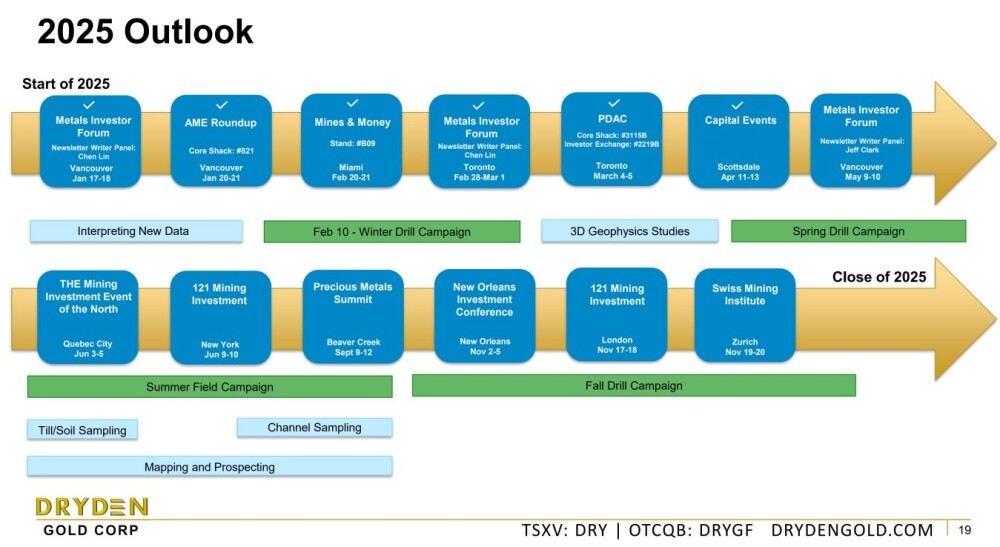

This page shows the 2025 outlook with a Spring drill campaign underway and a Fall drill campaign in prospect.

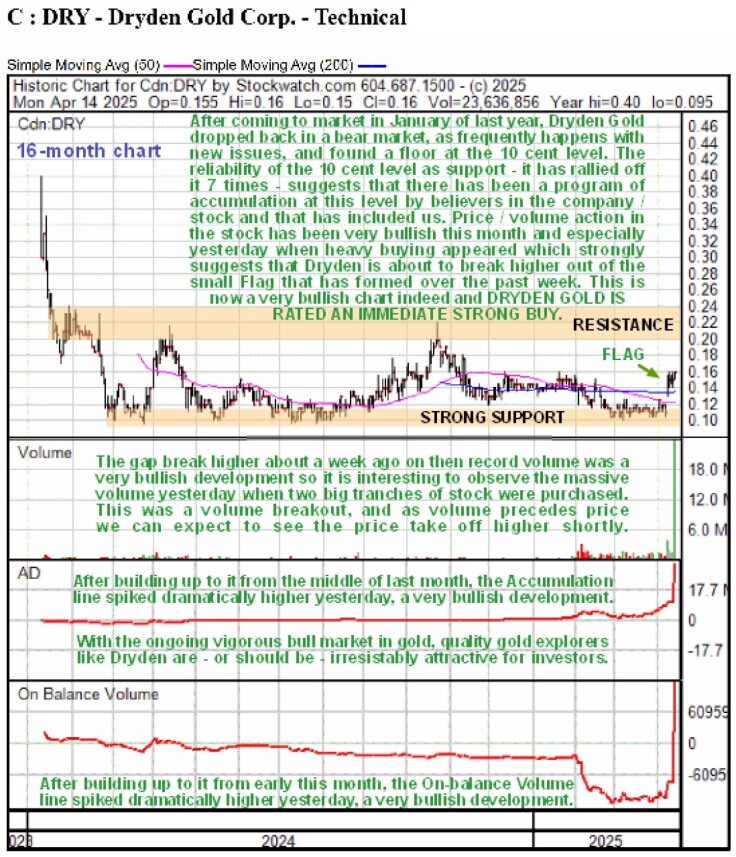

Now we will examine the stock chart for Dryden Gold. Only one is necessary because it started trading on this market in January of last year so we are looking at a 16-month chart which shows all of the action in the stock.

The first point to make is that, aware of the potential of this company and the prospect of a major ongoing gold bull market, Dryden Gold has already been recommended on a couple of occasions, once last May at CA$0.10 and again in September at CA$0.13. The second point to make is that, with Dryden Gold starting to break out into its expected bull market right now, the commitment and patience of investors accumulating the stock within its large base pattern is about to be rewarded BIG TIME.

After coming to market in January of last year, the price dropped steeply until it found a floor of support at the CA$0.10 level. Thereafter, it has tracked sideways in a large trading range bounded by CA$0.10 or a little under on the downside and CA$0.22 at most on the upside. The reliability of the 10 cent level as support, which the price has rallied off no less than seven times, suggests that there has been a program of accumulation at this level by believers in the company and its stock.

Given the relentless upward march of the gold price, it was only a matter of time before more savvy investors put two and two together and, understanding the potential of Dryden, accumulated more and more of the stock ahead of its breakout into a new bull market. Last month and this month this accumulation has become much more overt and aggressive with the gap higher on record volume, at the time, about a week ago, signaling that it was "game on" and that the long awaited bull market was about to start.

Thus, it is most interesting to observe how the price edged higher yesterday on massive record volume, with two huge blocks of stock being bought. Since "volume precedes price" this means that "the writing is on the wall" and Dryden looks destined to take off higher imminently in a powerful bull market that is expected to be long and sustained, especially as the company makes more discoveries on its large District Scale property.

We therefore stay long and Dryden Gold is rated an Immediate Very Strong Buy. The first target for an advance is the resistance at CA$0.22 – CA$0.24, with a higher target once this is cleared at CA$0.40 and higher targets are possible.

Dryden Gold Corp.'s website.

Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB) closed for trading at CA$0.16, US$0.1188 on April 14, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dryden Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dryden Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.