So, let's get this clear. Fobi AI Inc. (FOBI:TSX) has positioned itself as the third largest creator of digital wallets after Apple and Google in what promises to be a massive growth sector. The company recently successfully closed a fully subscribed upsized non-brokered private placement for aggregate gross proceeds approaching CA$2.5 million, so there is little risk of any funding activity soon.

The company is advancing on many fronts, including having provided the digital ticketing for the ROTH conference several weeks ago, and early this month on the second came the news that it has SIGNED A DATA LICENSE AGREEMENT WITH ASAHI CANADA TO DELIVER ENHANCED DATA ANALYTICS & INSIGHTS and further to that a couple of days later on the fourth came the announcement that FOBI AI PARTNERS WITH A LEADING THEME PARK TICKETING PROVIDER TO DELIVER UP TO 1 MILLION DIGITAL TICKETS.

Through this new paid partnership opportunity, Fobi will create up to 1 million digital tickets, which will be sold across its partner's various online and retail channels. This partnership aims to revolutionize the theme park industry by offering a digital and personalized concierge experience for theme park guests. It is thus clear that the company is "not letting the grass grow under its feet."

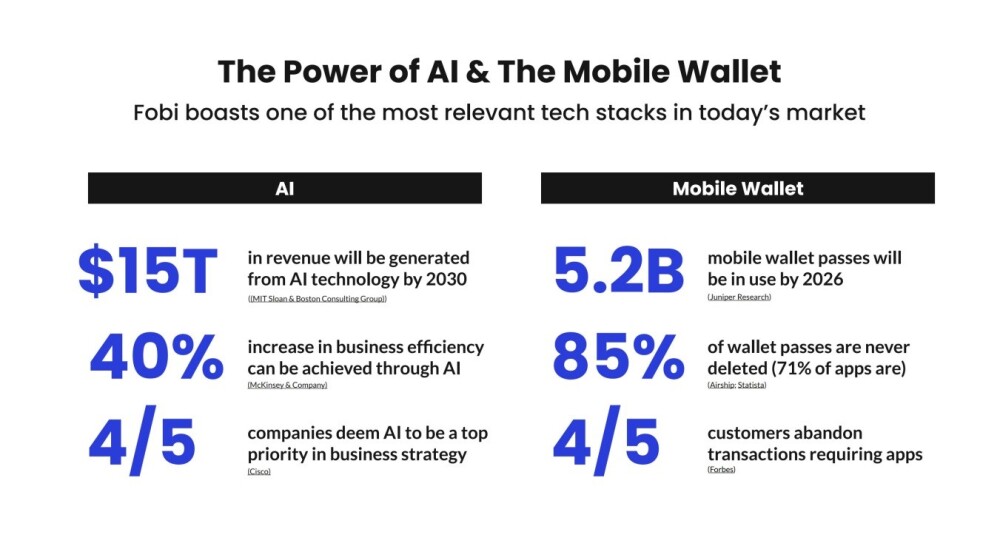

To put it mildly, FOBI is in a growth market, as shown in the following slide from its latest investor deck.

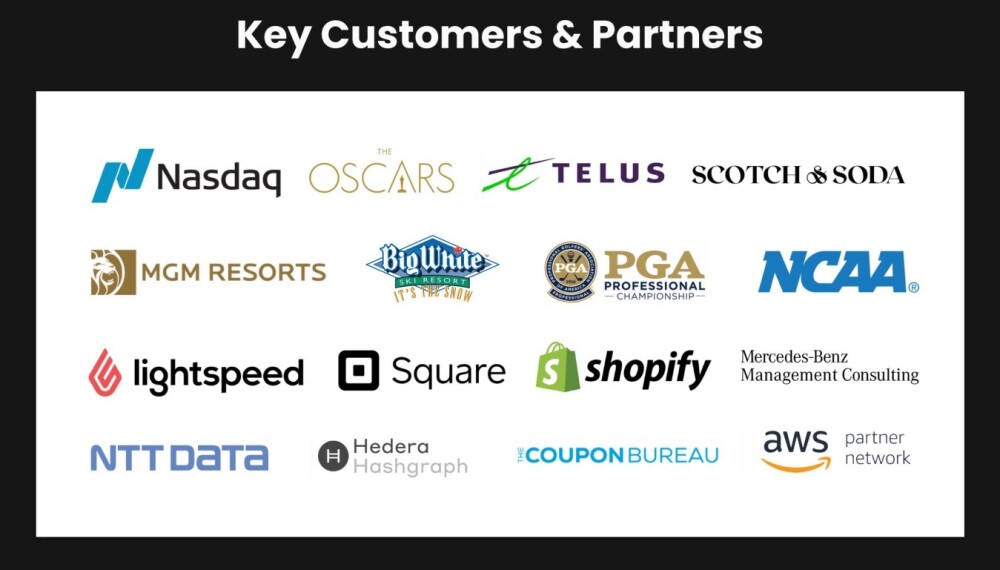

FOBI is already doing business with a lot of important customers and partners.

With some major success stories.

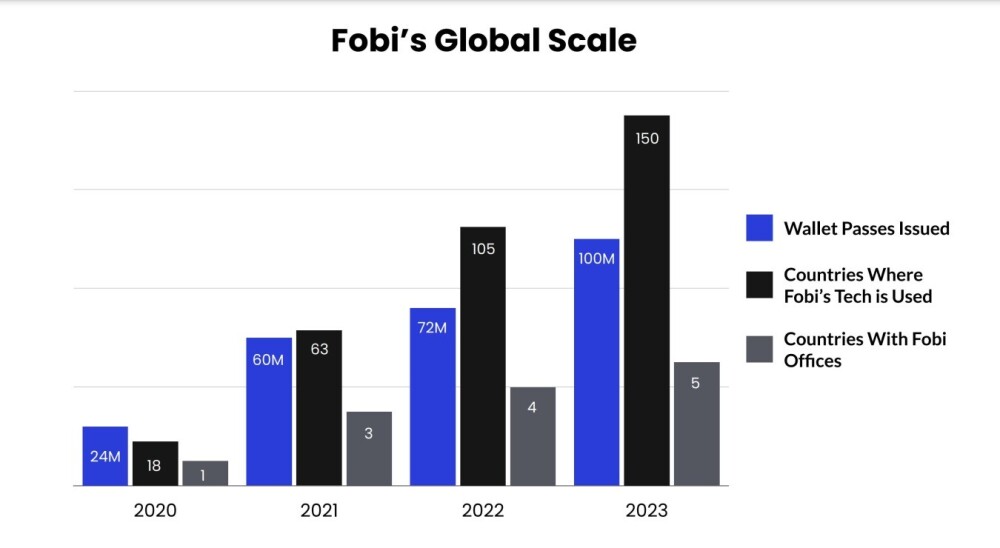

The company has made big inroads into the market over the past several years.

The global market opportunity for the company's products and services is gigantic.

Despite all this, the company's stock is trading at about 7 cents (at the time of writing) after a particularly severe bear market from its highs when it touched CA$3.93 in the Fall of 2021 when it was incredibly 56 times the current price. This suggests that even after factoring in the increased number of shares in issue now compared to back then, the stock is decidedly cheap now — very cheap, in fact.

Looking at the 5-year arithmetic chart, we can see how the fine Bowl or Cup pattern in 2020 gave birth to a vigorous bullmarket that ended with a spike top in the fall of 2021, with an earlier spike top late in 2020 not getting so high. The Fall 2021 spike top was followed by a prolonged and severe bear market, as mentioned above, that has brought the price down to support what is believed to be a cyclical low at its early 2020 lows, very close to zero. The reason that the stock is viewed as so interesting here is that it is still at a very, very low price despite the company's fundamental situation improving significantly, as we noted at the outset.

Despite the stock looking like a "no-brainer" on its 5-year arithmetic chart, it is important that we remain mindful of the fact that it is still locked into a bearmarket downtrend on its 5-year log chart, but having said that, there are several technical factors that point to it breaking out this downtrend soon.

One is that there has been a significant increase in upside volume since December that has driven the Accumulation line higher, which itself bodes well. Another is that downside momentum, as shown by the MACD indicator, has completely dropped out and is close to turning positive. Still another positive factor is that it looks like it may be forming a large Double Bottom with its lows of early 2020 in the vicinity of which there is support, with a smaller Double Bottom forming at the current price that we will now look at in much more detail on the 6-month chart.

On the 6-month chart we see that there is a clear line of support at 7 cents which is a reason that the stock was recommended back in February after which it made a substantial if fleeting gain when it rose briefly to touch 12 cents, since which time it has dropped back to arrive at 7 cents again.

Whilst we cannot entirely rule out that it won't breach this support, which could be a false break lower given the positive outlook for the company, there is thought to be a high probability that it is making a Double Bottom with the January – February lows here, in which case we are at an excellent entry point (again) now.

We, therefore, stay long, and Fobi AI is rated a Strong Buy for all timeframes.

Fobi AI Inc.'s website.

Fobi AI Inc. (FOBI:TSX) closed at CA$0.075, $0.055 on April 10, 2024. The stock currently trades in rather light but acceptable volumes on the US OTC market, where volumes should improve once the expected uptrend takes hold.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Fobi AI Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fobi AI Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.