Key Points for Nova

- 9.9moz gold resource in Alaska

- The enterprise value of a ridiculous A$0.00/oz.

- Much more coming

- Listing on NASDAQ to improve market valuation

- Exploration indicating considerable potential

- Low-grade ore but high operating margins

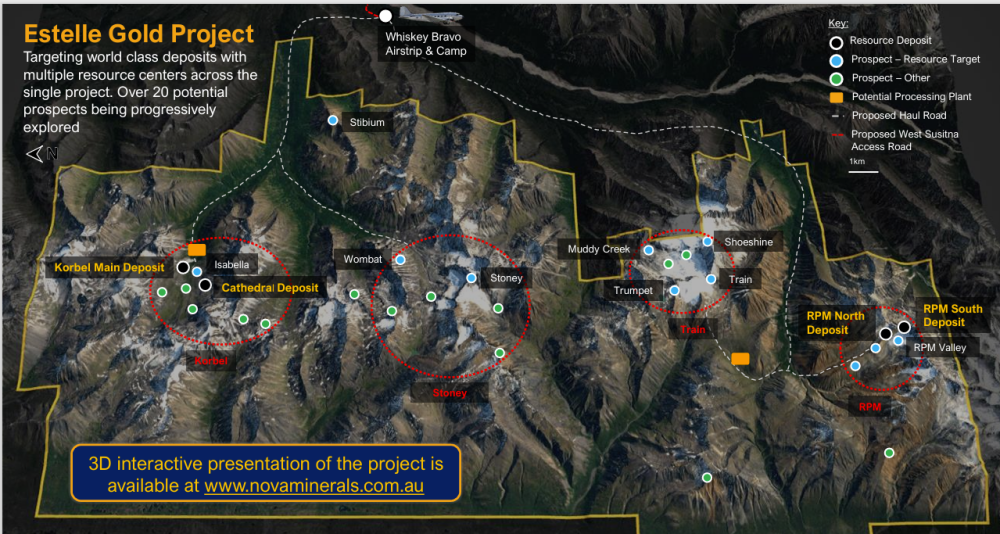

- Korbel is the main deposit

- RPM high-grade growing resource

- Excellent prospects at Train, Trumper, Shoeshine, Muddy Creek

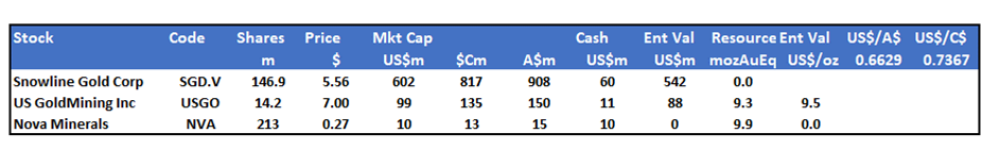

- Very cheap against its peers.

The market has a love/hate relationship with Nova Minerals Ltd. (NVAAF:OTCMKTS). Everyone knows its potential for additional resources, and everyone knows the grades are relatively low.

The stock surges when it's in favor and drops away when interest wanes. The sentiment can come and go, but it needs to be recognised that 10 million ounces is 10 million ounces in a bull market. The rock types at Estelle are essentially granites, and the mineralized veins are geologically and optically quite different, so they would be ideal materials for ore sorting.

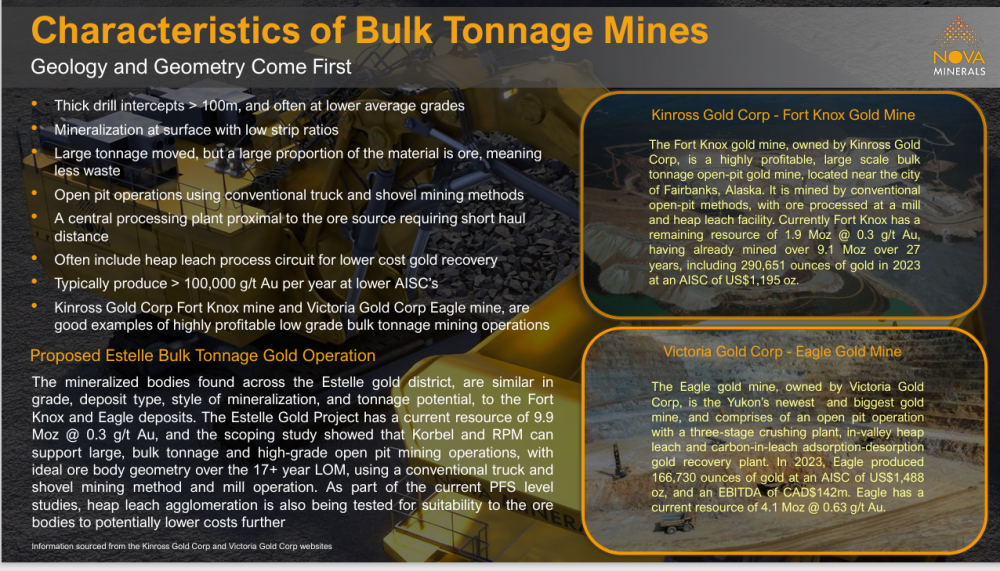

Low-grade gold mines typical all the Tintina Belt, and low-cost near surface open cut mining and treatment is the norm. At US$2400/oz this is >US$77/g, and most bulk mining and processing can be done for well under US$10/t, so US$35/gEq is a good margin.

It's all about the margin.

Fort Knox and Victoria gold Dublin Gulch are low-grade sub 1g/t mines in the Tintina Belt, and they operate very profitably. Nova Minerals doesn't really deserve a market cap that gives you 10moz for nothing!

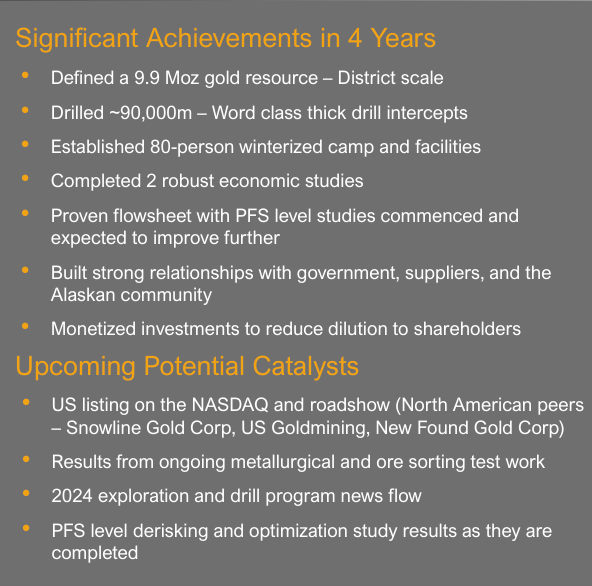

The company's strategy has been to find and develop resources and move through to PFS. It has done the PFS twice to reflect improved resource positions.

It now has a cornucopia of targets that would make any WA-based explorer ecstatic and its biggest problem is probably priorities. Each of the major projects, Korbel, RPM, and Train/Trumpet, are excellent prospects with current total resources of 10 moz with a lot more coming.

A NASDAQ listing would certainly help particularly when compared to peers.

Any geologist would be delighted to work on the Estelle project, which has over 20 potential prospects.

The projects will have large low-grade bulk tonnage operations comparable to other Tintina Belt mines.

And here are a couple of peers.

Note that US Gold Mining Inc. (USGO:NASDAQ) literally abuts the Estelle tenements with 9.3moz AuEq resource in a mixture of porphyry copper and IRGS deposits.

Enterprise value of US$88m or US$9.50/oz resource.

Snowline Gold Corp. (SGD:CSE; SNWGF:OTCQB) is a market favorite without a resource yet and a market cap of US$542m.

Go figure.

This was listed just a year ago at a value of ~US$20/oz. Next door to NVA and the same sorts of grades at its Whistler Project.

Victoria Gold Corp. (VGCX:TSX; VITFF:OTCMKTS) is a new Yukon producer with a 4-year history producing ~165kozpa at 0.7g/t.

Patience is required here.

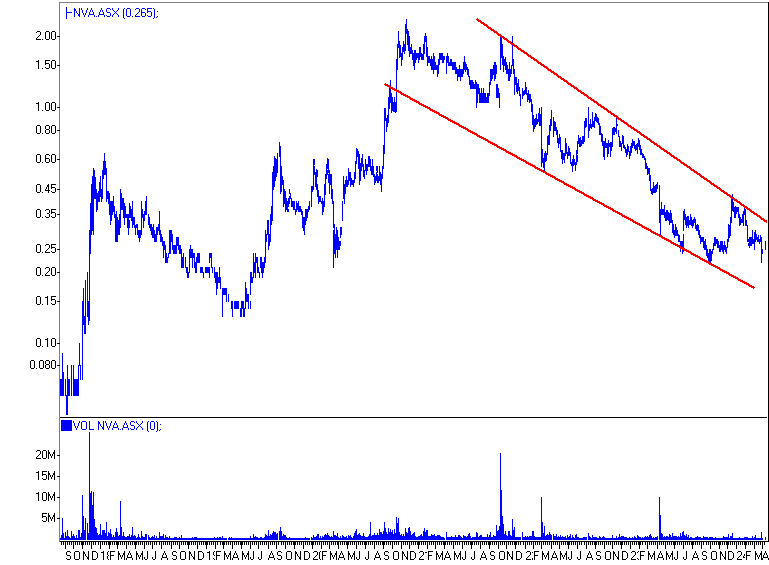

This is a downward-sloping wedge that will soon be resolved to the upside and will again move towards AU$2.

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Snowline Gold Corp. and US Gold Mining Inc.

- Barry Dawes: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.