Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) announced it has started Phase 2 of its infrastructure and open-pit geotechnical drilling at its Wicheeda rare earth element (REE) project in British Columbia.

Just last month, the company announced what one analyst called a "significant upgrade" to its Mineral Resource Estimate (MRE) for the project, increasing the total rare earth oxide (TREO) by 17%, or a 31% tonnage increase, compared to an MRE in 2021.

Two drilling rigs, sonic and core drills, are operating at Wicheeda, focusing on overburden and bedrock characterization and the east highwall of the proposed open pit.

"This work will provide critical inputs for the ongoing PFS study (preliminary feasibility study), and in the case of exploration targets, have the potential to expand resources," Chief Executive Officer Craig Taylor said. "The company's technical teams and principal engineering contractors continue to push forward, keeping us on track for a planned PFS completion by the end of Q2 2024."

Mark Reichman of Noble Capital Markets kept his Outperform rating on the stock with a target price of CA$0.70 per share. It stood at CA$0.195 on Wednesday morning.

The MRE comprised a 6.4 million tonne Measured Mineral Resource, averaging 2.86% TREO; a 27.8 million tonne Indicated Mineral Resource, averaging 1.84% TREO; and an 11.1 million tonne Inferred Mineral Resource, averaging 1.02% TREO.

The results are reported at a cut-off grade of 0.5% TREO within a conceptual open pit shell, the company said.

"In the months ahead, we expect more information regarding the project's process flowsheet to reinforce the project's commercial value," analyst Mark Reichman of Noble Capital Markets wrote in an updated research note after the MRE was released. "We think the current price is an excellent entry point for investors seeking exposure to one of North America's advanced REE projects."

Reichman kept his Outperform rating on the stock with a target price of CA$0.70 per share. It stood at CA$0.195 on Wednesday morning.

Work to Take Four to Six Weeks

The second phase of the exploration is expected to take four to six weeks, the company said, with results to follow. The work is being completed by SRK Consulting (Canada) Inc., one of the consultants for the PFS, and APEX Geoscience Ltd.

SRK's geotechnical engineering investigation will look at waste rock, tailings, the contact water pond, and site infrastructure.

This morning, Technical Analyst Clive Maund sent out a Buy alert on the company.

Also being assessed are tailings alternatives and geochemical characterization of the site to support mine planning and waste management and to develop preliminary water chemistry predictions for the main mine.

"In pit geotechnical core drilling will progress from current drilling on the east highwall, followed by south, north, and west pit walls," Defense Metals said in a release. "Drilling into the south pit wall is expected to collar in REE mineralized dolomite carbonatite."

Geotechnical core drilling of the west pit wall was being co-purposed with the testing of a high-priority ground radiometric geophysical anomaly with the potential to represent an undiscovered carbonatite body, the company said.

The Catalyst: 'A Globally Significant Producer'

Wicheeda has "the potential to be a globally significant producer" of REEs, Reichman noted.

"The project has several competitive advantages, including a mining-friendly location, well-developed infrastructure, and a strong technical team," Reichman wrote on September 13. "Wicheeda is well positioned to take a leading role in the North American and Global REE supply chain."

Right now, China accounts for about 60% of REE current mine production and more than 85% of the refined output of REEs.

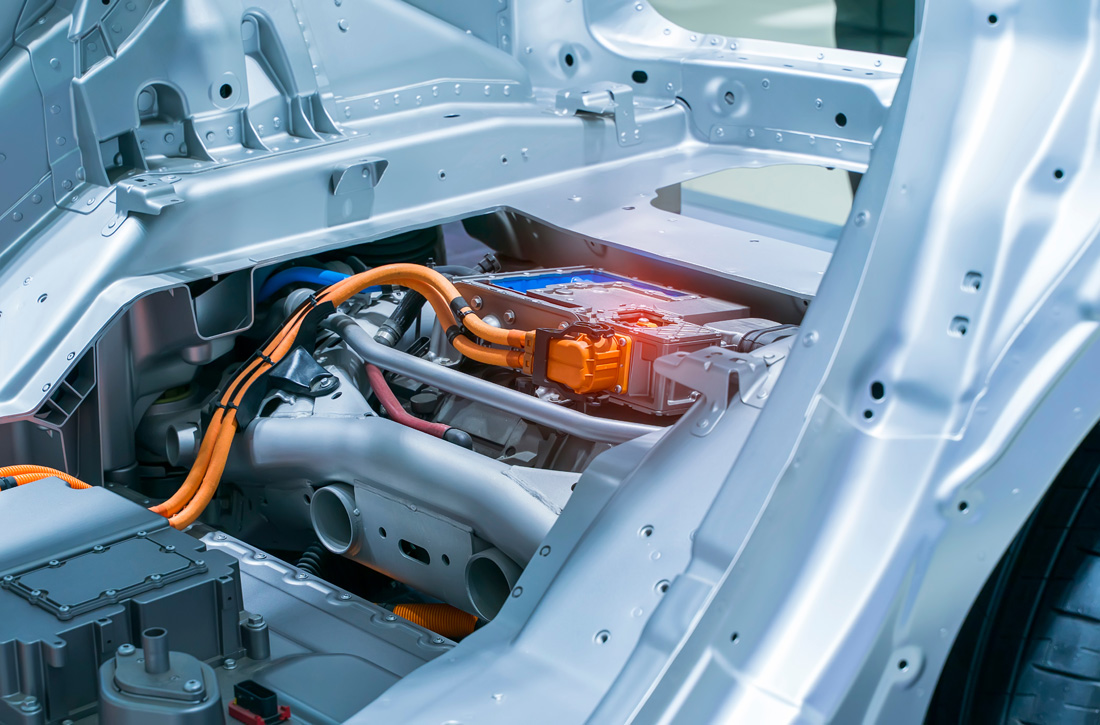

The elements are in high demand as the economy attempts to go green. They are used for purifying water, MRIs, fertilizers, weapons, scientific research, wind turbines, computers, and permanent magnet motors for electric vehicles (EVs).

A recent decision by China to restrict the export of two metals critical to superconductor production, gallium and germanium, has officials in the West worried. While these metals are not being sought by Defense at Wicheeda, company officials said it's possible China may eventually target the REEs the company wants to provide for wind turbines and EVs.

Demand to 'Expand Rapidly'

The global market for the elements is expected to grow from US$2.6 billion in 2020 to US$5.5 billion in 2028, according to a report by Fortune Business Insights.

"The rising demand for consumer durables such as tablets, laptops, and smartphones (are some) of the factors driving the consumption of rare earth elements," the report said. "The demand for these elements in developing economies is estimated to expand rapidly."

Once it reaches commercial production, Wicheeda is expected to produce more than 25,000 tonnes of rare earth oxide annually, Reichman wrote.

"It all begins with developing a world-class deposit that contains high-quality ore," Reichman wrote. "We think Defense Metals is well positioned to benefit from growing demand for rare earths for use in electric vehicle batteries, metal alloys, and advanced technology applications."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE)

Technical Analyst Clive Maund wrote last summer that although the stock's "price hasn't moved — yet," he expected that to change.

This morning, Maund sent out a Buy alert on the company, saying, "After a long and grueling decline for much of this year, it is viewed as way oversold and is down at a cyclical low at strong long-term support with downside momentum easing and the recent volume pattern bullish and Accumulation line positive relative to price."

Ownership and Share Structure

About 5% of the company's stock is owned by insiders, including Director Andrew S. Burgess with 1.63% or 4.18 million shares, and CEO Taylor with 0.98% or 2.5 million shares, according to Reuters.

About 11% of the company is owned by institutional entities, including RCF Opportunities Fund II LP, with 10%, the company said. The rest, 84%, is retail.

Defense Metals has a market cap of CA$49.88 million with 255.78 million shares outstanding and 212.98 million free floating. It trades in a 52-week range of CA$0.39 and CA$0.185.

Sign up for our FREE newsletter

Important Disclosures:

- Defense Metals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

Disclosures for Noble Capital Markets, Defense Metals Corp., September 13, 2023

All statements or opinions contained herein that include the words "we", "us", or "our" are solely the responsibility of Noble Capital Markets, Inc. ("Noble") and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. ("Noble"). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst's judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report. The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures The following disclosures relate to relationships between Noble and the company (the "Company") covered by the Noble Research Division and referred to in this research report. The Company in this report is a participant in the Company Sponsored Research Program ("CSRP"); Noble receives compensation from the Company for such participation. No part of the CSRP compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed by the analyst in this research report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) within the next 3 months. Noble is not a market maker in the Company.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis. Named WSJ 'Best on the Street' Analyst and Forbes/StarMine's "Best Brokerage Analyst." FINRA licenses 7, 24, 63, 87.

CONTINUING COVERAGE Unless otherwise noted through the dropping of coverage or change in analyst, the analyst who wrote this research report will provide continuing coverage on this company through the publishing of research available through Noble Capital Market's distribution lists, website, third party distribution partners, and through Noble’s affiliated website, channelchek.com.

WARNING This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by . This report may not be reproduced, distributed or published for any purpose unless authorized by .

RESEARCH ANALYST CERTIFICATION Independence Of View All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or research report.