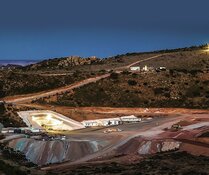

Emerita Resources Corp (EMO:TSX.V; EMOTF:OTCMKTS; LLJA:FSE) has announced additional assay results from the La Romanera deposit on Emerita's Iberian Belt West (IBW) project. The assay results have been received for three additional drill holes that were not included in the prior National Instrument 43-101-compliant mineral resource estimate news releases.

Drill holes LR148, LR150, and LR151 have intercepted sulfide mineralization below the limit of the current mineral resource estimate, extending the mineralization at depth. The intercepts are approximately 550m to 600m below surface and span about 300m horizontally along strike.

Downhole TEM anomalies indicate that the mineralization continues at depth for at least another 100m or more. The upper and lower lens at this depth appear to merge into one larger sulfide lens of up to 30m to 40m thickness. This lens is referred to as the lower lens.

According to David Gower, the CEO of Emerita, "Massive sulfide mineralization continues to extend at depth at La Romanera, and drill intercepts where assays are pending, as well as borehole geophysical surveys, confirm that the sulfide mineralization continues to extend beyond the drilling completed to date. We are excited to see the intercept at the El Cura deposit, as we have limited historical data for this deposit. Mineralization extends to at least 200-meter depth based on early drill results."

The highlights of the assay results are as follows:

- Drill hole LR151 intersected 662.0m of depth, and encountered 42.2m of grading with 0.3% Cu, 1.0% Pb, 2.0% Zn, 2.44 g/t Au, and 70.4 g/t Ag, including 7.3m of grading with 0.3% Cu, 2.0% Pb, 2.2% Zn, 8.11 g/t Au, and 114.2 g/t Ag, and including 13.1m of grading with 0.3% Cu, 1.0% Pb, 4.0% Zn, 1.24 g/t Au, and 55.5 g/t Ag.

- Drill hole LR148 intersected the lower lens at 594.0m of depth, and encountered 32.2m of grading with 0.4% Cu, 0.2% Pb, 1.0% Zn, 0.32 g/t Au, and 11.7 g/t Ag, including 9.0m of grading with 0.5% Cu, 0.4% Pb, 1.9% Zn, 0.32 g/t Au, and 20.1 g/t Ag.

- Drill hole LR150 intersected the lower lens at 575.2m of depth, and encountered 4.3m of grading with 0.4% Cu, 0.4% Pb, 1.0% Zn, 0.26 g/t Au, and 8.3 g/t Ag.

Additionally, the company has commenced the El Cura drilling exploration program. The program consists of 2,800m in 10 drill holes. Two drill holes have been completed, EC002 and EC003. Hole EC003 intercepted 9m of mineralization, of which 5m is massive sulfide mineralization. Assays are pending for these holes and will be reported when received.

According to Varun Arora, the IBW is "set to deliver great news flow and likely surprise investors to the upside . . . many mile markers will be passed in 2023 on the way to demonstrating IBW has what it takes to be a mine."

According to Joaquin Merino, the President of Emerita, "The intercept in EC003 is approximately 203 meters down the hole. There is a drift that extends to about 20 meters below surface. Data suggests the zone could have a lateral extent of about 400 meters. Emerita does not have complete information on the historical work done on the El Cura deposit, so will systematically drill it and monitor the results."

The company will keep six rigs on IBW during the summer, although measures are being taken to reduce workers' exposure to high temperatures. The company expects to return to normal operations for drilling after the summer.

Headed for Another Rally

Barry Dawes of Martin Place Securities believes that gold may be heading back up to the record prices seen in March. This opinion was echoed by Richard Mills of Ahead of the Herd, who also sees a bull market for gold.

According to Mills, "Steady demand from central banks confirms that precious metals, in particular gold, deserve investors’ attention. Earlier this year, the gold price flirted with the record-high US$2,074.60, set on March 8, 2022."

Set for Growth

According to Varun Arora, the IBW is "set to deliver great news flow and likely surprise investors to the upside . . . many mile markers will be passed in 2023 on the way to demonstrating IBW has what it takes to be a mine."

Ownership and Share Structure

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Emerita Resources Corp. (EMO:TSX.V; EMOTF:OTCMKTS;LLJA:FSE)

Michael Lawrence Guy owns 1.90% of the company with 4.32 million shares. David Patrick Gower owns 1.22% with 2.76 million shares. Joaquin Merino-Marquez owns 0.92% with 2.09 million shares. Catherine Stretch owns 0.70% with 1.60 million shares. Marilia Bento owns 0.44% with 1.00 million shares. Gregory Duras owns 0.29% with 0.65 million shares. Damian J.D. Lopez owns 0.20% with 0.46 million shares, and Ian T. Parkinson owns 0.11% with 0.25 million shares.

Merk Investments LLC owns 1.21% with 2.75 million shares, and Sprott Asset Management LP owns 0.11% with 0.26 million shares. There are no strategic investors.

The company just raised CA$11 million in a private placement during Q2 2023.

Emerita reports no potential negatives.

The company does not work with any IR firms. Varun Arora of Clarus Securities provides research coverage and analysis of the company.

There are 234.82 million shares outstanding, 19.19 million options, and 23.95 million warrants. The company has a market cap of CA$74.94 million.

Sign up for our FREE newsletter

Important Disclosures:

- Emerita Resources Corp is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Amanda Duvall wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. T

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.