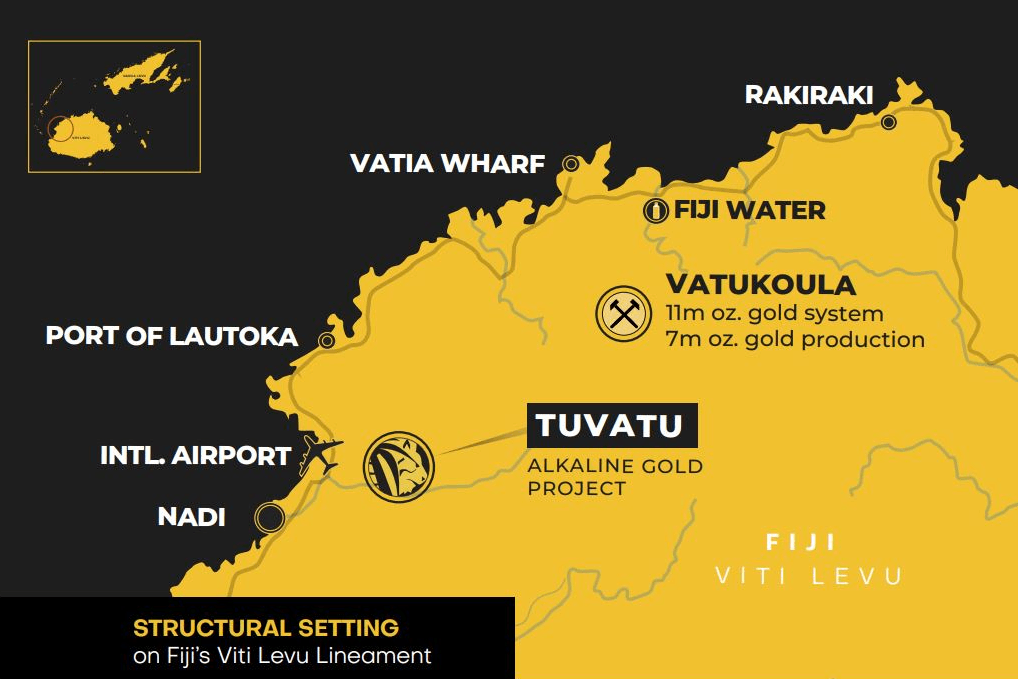

Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX) recently began mining high-grade gold mineralized material at its Tuvatu deposit in Fiji, noted Mike Niehuser in a May 22, Roth research note.

Roth reported that the first lode was found unexpectedly near the portal of main decline. The second found high-than-expected grades.

Niehuser said, "Experience exceeding expectations is consistent with our view that the Tuvatu deposit has the potential to surpass the long-lived Vatukoula mine in Fiji." He also noted that construction is already ongoing, with a December 23 due date for processing material.

"Early experience in mine development suggests bespoke underground mining approach," Niehuser continued. "In our opinion, this suggests that a one-size-fits-all approach to efficiently produce low-cost results may miss gold mineralization that may be mined through a more nuanced method."

The report stated Roth was highly encouraged by the ability of Lion One to accomplish the site work successfully, even in the challenging conditions of the Fijian winter wet season. It is worth noting that all the essential bulk materials have been successfully transported and delivered to Fiji. This achievement eliminates the potential risks of delays in receiving crucial items that are vital to the project's progress and also helps in mitigating any potential price inflation. The development of various infrastructure components, such as roads, tailings, and storage facilities, is progressing according to the predetermined schedule.

The company also plans to continue mining through the Tuvatu deposit to deepen the high-grade 500-Zone.

Niehuser said, "It appears to us that the mine plan will access several lodes to mine, both increasing stockpiles and continuously feeding operations. It is now planning to expand the stockpile pad. As throughput increases, this approach appears to de-risk operations and accommodate a modular increase in processing capacity from 300 tpd to 500 tpd or more."

Previous Assay Results

The report also touched on assays announced from grade-control drill holes from a bay off the main Tuvatu decline on the URW1 lode in April. During this announcement, Lion One had completed 34 diamond drill holes, encompassing 3,538 meters at an average of ~104 meters (104m).

Niehuser noted that this report further defined Tuvatu as a mineable resource.

Highlights of these assays included:

- TGC-0034 – 88.07 grams per tonne (g/t) gold over 5.7m (including 1,396 g/t gold over 0.3m)

- TUG-056 – 27.52 g/t gold over 5.55m

- TGC-0003 – 20.93 g/t gold over 7.2m

- TGC-0014 – 16.12 g/t gold over 9.3m

- TGC-0002 – 16.48 g/t gold over 9.6m

- TGC-0032 – 14.6 g/t gold over 6.6m

- TGC-0018 – 14.97 g/t gold over 5.4m

- TGC-0013 – 10.85 g/t gold over 6.9m

Then on May 18, the company announced it had taken samples from the face of the URW1 lode.

Highlights of these are as follows:

- 51.2 g/t gold over 0.56 m

- 117.48 g/t gold over 0.19 m

- 37.99 g/t gold over 0.19 m

- 58.68 g/t gold (grab sample)

In light of these, Niehuser commented, "In our opinion, the extent of the upside at Tuvatu is just now being realized."

At the end of the report, Niehuser went on to say, "In our opinion, as Tuvatu in the Navilawa Caldera has been identified as an alkaline gold system, it has the potential to grow into a multi-million oz gold resource. In addition, given the proximity, and numerous positive characteristics, LIO’s position in the Navilawa Caldera could match or better Fiji’s Vatukoula gold mine, with an 11 million oz deposit and an 85-year operating history. Beyond Tuvatu, given exploration results on the existing mining concession and within the Navilawa Caldera, we believe that there is the potential for an additional three to four Tuvatu-like prospects. From this perspective, our model’s limiting cash flow to 10 years may appear conservative."

Structure and Predictions

In his report, Mike Niehuser reiterated his Buy rating on Lion One and his target price of CA$2.50 per share.

Niehuser's research also shared current market data on the company.

- Price: 52-week range between CA$0.59 and CA$1.66

- Price Target: CA$2.50

- Market Cap: CA$142.31 million

Niehuser noted Lion One currently has 206.25 million shares outstanding, CA$36.8 million in cash, and CA$25.3 million in debt.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Lion One Metals Ltd. is a billboard sponsor(s) of Streetwise Reports and has paid SWR a sponsorship fee between US$3,000 and US$5,000.

- Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

Disclosures for Roth Capital Partners LLC, Lion One Metals Ltd., May 22, 2023

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Disclosures: Shares of Lion One Metals Limited may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH. Copyright 2023. Member: FINRA/SIPC.