Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) is hoping to expand the resource at its 100%-owned Iskut property in British Columbia's Golden Triangle.

Planning is "well advanced" for an "extensive" drill program at the Bronson Slope copper-gold deposit this spring with 12 to 15 drill holes removing more than 12,000 meters of core, the company noted Monday.

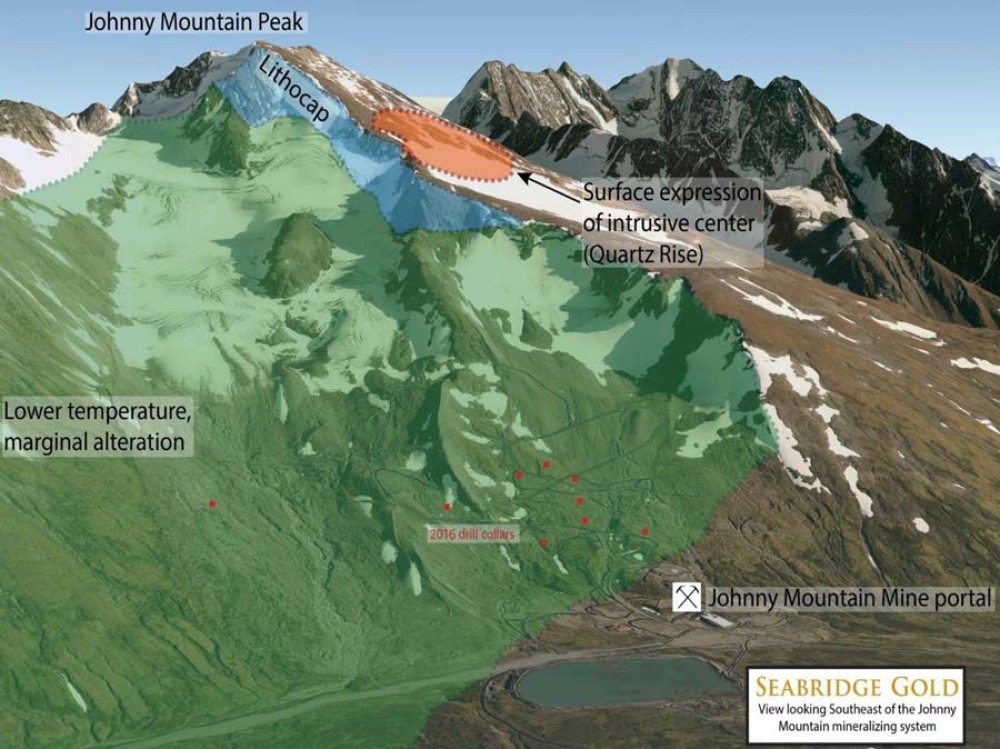

Geophysical surveys and surface geology confirm a district-scale structural feature that connects the Quartz Rise, Bronson Slope, and Snip North targets. Results from drilling last year identified copper and gold grades outside of the 187 million tonnes (Mt) Bronson Slope resource, the company said.

"Resource expansion potential may extend as far as 1.2 kilometers southeast along strike, connecting to historical drilling that encountered numerous high-grade intersections," the company wrote in a news release.

In an updated research note after Iskut's 2022 results were released in January, analyst Mike Kozak of Cantor Fitzgerald noted that Iskut is located near Seabridge's flagship KSM project, which is also in the Golden Triangle.

"We . . . continue to view this exploration property as a highly prospective ‘free option.’ We reiterate our Buy rating and (CA$43.50) price target," Kozak of Cantor Fitzgerald wrote.

"We . . . continue to view this exploration property as a highly prospective ‘free option.’ We reiterate our Buy rating and (CA$43.50) price target," Kozak wrote.

"The 2022 field season at Iskut included 10,162 (meters) of drilling within 10 holes," Kozak wrote. "The newly discovered breccia pipe below the Bronson Slope skarn deposit will help Seabridge target the source of mineralization at the project, thought to be a large Au-Cu porphyry system at depth."

The quartz-magnetite pipe, which holds gold and copper mineralization from multiple hydrothermal eruptive events, has been identified as the source of the Bronson deposit.

One hole, SBS-22-05, returned 289 meters of 0.70 grams per tonne gold (g/t Au) and 0.28% copper (Cu). SBS-22-01 returned 446 meters of 0.28 g/t Au and 0.14 Cu.

The Catalyst: A Newly Discovered Pipe

Results from any new drilling outside the limits of the existing resource will be incorporated into the resource estimate, the company said.

"The pipe sits within a district-scale structural trend that localizes all of Iskut's porphyry-style targets," said Seabridge Chairman and Chief Executive Officer Rudi Fronk. "The well-mineralized Bronson pipe is persuasive evidence of a large copper-gold porphyry source below last year's drilling. The structural trend hosting this pipe has two more similar porphyry targets meriting aggressive drill testing."

"The company continues to advance a number of activities to demonstrate a substantial start of the flagship KSM project, including infrastructure and offsetting habitat programs," B. Riley Securities analyst Lucas N. Pipes wrote.

In addition, a magnetotelluric survey and deeper drilling will be completed this year at Snip North, where 32 shallow diamond core holes drilled by previous operators encountered pervasive sericite-pyrite alteration and copper-gold (Cu-Au) geochemical anomalies in sedimentary rocks.

At Bronson, drilling will continue below the Bronson Slope resource following the steeply plunging quartz-magnetite breccia pipe.

Ongoing work has refined drill targets for the intrusive source of an extensive lithocap discovered at Quartz Rise, Seabridge said.

Seabridge drilled 10 holes for 10,162 meters at Iskut in 2022. The Bronson Slope has a measured and indicated gold-copper resource of 187 million tons at 0.36 g/t Au and 0.12% Cu, Seabridge said.

Exploration Continues at Other Projects

Seabridge also continues to explore KSM and its 3 Aces project in the Yukon Territory.

"The company continues to advance a number of activities to demonstrate a substantial start of the flagship KSM project, including infrastructure and offsetting habitat programs," B. Riley Securities analyst Lucas N. Pipes wrote in a note on Nov. 21. "As a reminder, Seabridge published its 2022 PFS (preliminary feasibility study) for the KSM project (last summer), which highlighted several major changes to the mine plan, most notably, shifting to an entirely open pit operation."

The copper-rich expansion will add "considerable value" to the company, Red Cloud Securities analyst David Talbot wrote.

Pipes reiterated his Buy rating on the stock and upped his target price from US$57 to US$60.

Seabridge’s PFS for an initial mine at KMS predicted a 33-year life that would also produce 1 Moz Au, 178 Moz Cu, and 3 Moz Ag annually. The company also released a preliminary economic assessment (PEA) for a separate, underground block cave mine with a small open pit. That mine is expected to produce 14.3 billion pounds Cu, 14.3 Moz Au, 68.2 Moz silver, and 13.8 million pounds of molybdenum over 39 years.

The copper-rich expansion will add "considerable value" to the company, Red Cloud Securities analyst David Talbot wrote.

Because of time constraints, only four holes were sunk in 2022 at 3 Aces. But the company has high hopes for that project, as well.

"While KSM is a world-class deposit, we believe it would likely need investment from a senior miner/strategic to help Seabridge overcome the capital spend and associated financial risk," Talbot wrote. "Additional resources and potential production from copper-rich underground deposits help provide optionality to any potential partner."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT)

"Our expectation is that over time, we will be able to deliver a high-grade gold resource with grades significantly higher than our existing gold resources at our other projects" at 3 Aces, Fronk said.

Ownership and Share Structure

About 36% of the company is held by institutional investors, according to Reuters, including Pan Atlantic Bank and Trust with 7.69% or 6.25 million shares, National Bank of Canada with 5.68% or 4.62 million shares, and FCMI Financial Corp. with 5.11% or 4.16 million shares.

Management, board members, and company insiders own more than 30%, the company said. Fronk owns 1.49% or 1.21 million shares, according to Reuters. The rest is retail.

It has a market cap of CA$1.4 billion and has about 81.3 million shares outstanding, with 67.9 million free-floating. It trades in a 52-week range of CA$28 and CA$13.83.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.