Santa Ana was once the largest colonial silver mine in Colombia. Today Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DB) reports that Santa Ana has plenty left to give after a recent 1-kilometer step-out hole on the company’s wholly owned flagship project hit both the thickest and highest-grade intercepts to date.

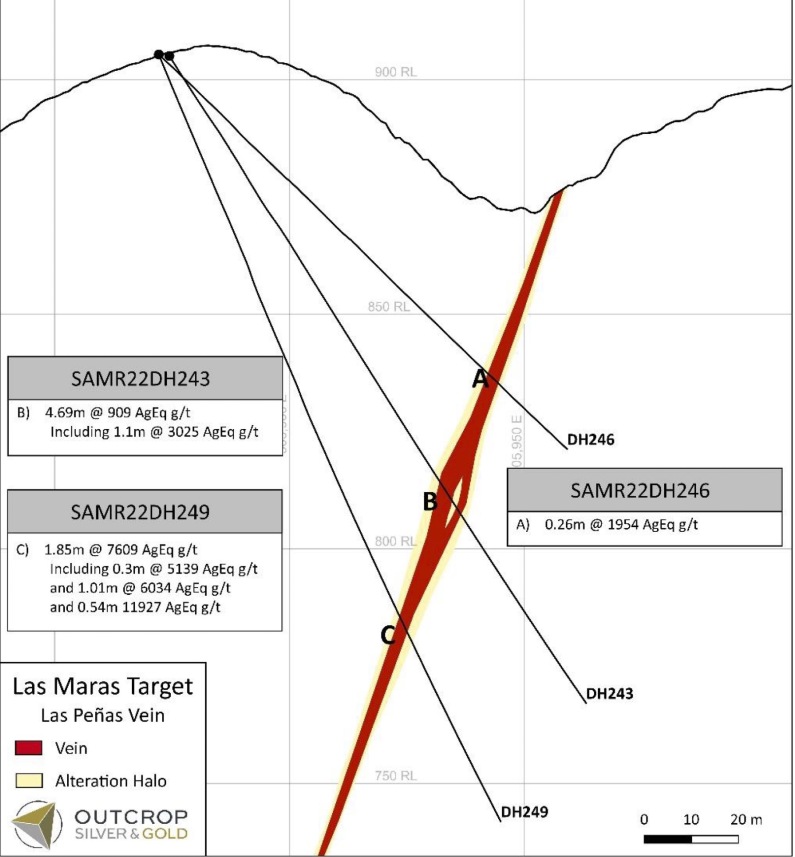

Hole SAMR22DH249 on the Las Maras target, one of several target areas at the Santa Ana Project, hit 1.85 meters grading 1.82 grams per tonne gold (1.82 g/t Au), 7,412 g/t silver (Ag), 1.62% lead (Pb), and 0.93% zinc (Zn) — that’s 7,609 g/t silver equivalent (Ag eq) or 104.13 g/t Au eq (using prices of $1,850/oz Au, $25/oz Ag, $0.97/lb Pb, and $1.09/lb Zn).

The 1.85-meter intercept contained a meaty 0.54-meter section grading 11,927 g/t Ag eq, which exceeds the previous highest-grade intercept at Santa Ana of 10,800 g/t Ag eq over 1 meter.

Toronto-based Research Capital Analyst Stuart McDougall published a note on today's OCG results.

He wrote: "Outcrop Silver has confirmed another high-grade discovery at its Santa Barbara silver- gold project in Colombia. Moreover, two of the three latest holes from the target represent the widest and high-grading intercepts reported from the program to date."

Research Capital kept its "speculative buy" rating on Outcrop with a CA$0.75 per share target price. The target is based on an estimated resource of 50 million oz Ag eq., valued at $3/oz.

The latest hit at Santa Ana happened at 132.6 meters downhole and ran until 134.4 meters.

“Our continued drilling success, and especially the recently released extremely high grades, puts in clearer focus that Santa Ana is likely to become a significant mine,” Outcrop President, CEO and Director Joe Hebert told Streetwise Reports.

Las Maras is a new shoot among 11 high-grade shoots that cumulatively provide over 2.8 kilometers of potential resource area explored so far at Santa Ana.

It was discovered in a step-out hole 1 kilometer along strike from the San Antonio shoot, which is another part of the Royal Santa Ana vein system.

So far, mapping and sampling and some 33,000 meters of drilling have outlined about 12 kilometers of continuous silver veins at Santa Ana.

The Las Maras target has been outlined 150 meters along surface and is open to the north and south.

The good news didn’t end with only one high-grade hit.

Hole SAMR22DH243 at Las Maras hit 4.69 meters grading 0.80 g/t Au, 840 g/t Ag, 0.20% Pb, 0.19% Zn — that’s 909 g/t Ag eq or 12.43 g/t Au eq.

A press release on June 2 reported that another hole drilled at Las Maras hit 3 meters grading 1.18 g/t gold, 672 g/t silver, 0.46% Pb, 0.20% Zn, 774 g/t Ag eq, or 10.59 g/t Au eq. The intercept contained an even higher-grade section of 1 meter at 1,113 g/t Ag eq.

Based on assays from six holes to date at Las Maras, the average intercept is 2.2 meters with a weighted average grade of 1,909 g/t Ag eq.

The drill results are the latest in a 15,000-meter drill program that is designed to establish a maiden resource estimate, likely late this year or early next year.

Cash for Exploration

The junior explorer raised $6.9 million in a public offering in early March by selling 25,555,555 units at CA$0.27 apiece. Each unit consists of one common share, plus a common share purchase warrant that can be exercised at CA$0.37 for 24 months after the deal closed.

Mining financier Eric Sprott opened his checkbook and bought 7.4 million units for just less than CA$2 million. He now owns or controls 27,042,800 common shares of Outcrop and 22,221,400 common share purchase warrants — that’s almost 17% of the junior explorer or 27.1% if Sprott exercises all of his warrants.

The Santa Ana Project is on a 360-sq.-kilometer land package in Tolima Department, Colombia, about 200 kilometers west-northwest of Bogota.

Mining in the district dates back to at least 1585 when Spanish settlers mined high-grade silver veins at or near the surface. Reports in the Spanish Royal Archives said there were 14 mines in the area producing an average of 4,000 g/t Ag over an average of 1.4-meters width — with some operations reaching as high as 17,000 g/t Ag.

The company has roughly 132 million shares outstanding. Outcrop trades in a 52-week range of CA$0.355 and CA$0.12.

Sign up for our FREE newsletter

Disclosures

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Outcrop Silver & Gold Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Outcrop Silver & Gold Corp., a company mentioned in this article.