Maurice Jackson: Joining us for a conversation is Tim Termuende, the CEO of Taiga Gold Corp. (TGC:CSE; TGGDF:OTCBB).

Glad to have you back on the program, because you have some exciting news—very exciting news by the way—for shareholders on the Fisher Gold Project. Before we begin, Mr.Termuende, please introduce us to Taiga Gold and the opportunity before us.

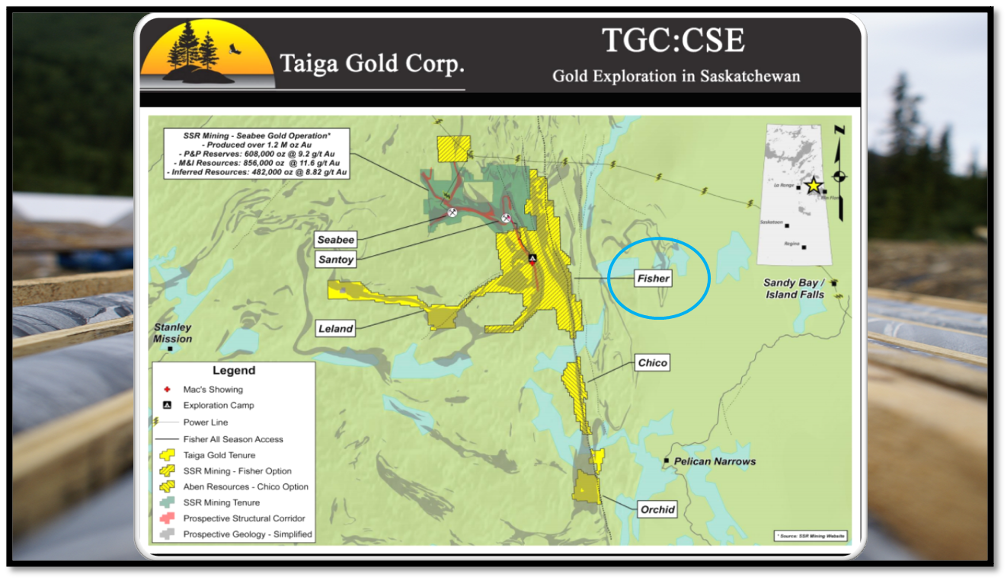

Tim Termunde: Taiga Gold is a relatively new company. We spun out from Eagle Plains Resources Ltd. (EPL:TSX.V), the parent company, in April 2018 on a one-for-two basis—two shares of Eagle Plains got you one share of Taiga. We trade on the CSE under the symbol TGC. Our flagship property is the Fisher Gold Project, and it is contiguous with the Seabee Gold Operation being run by SSR Mining Inc. (SSRM:NASDAQ), who took out Claude Resources to purchase the Seabee gold operation.

We've also got several projects outside of the Fisher Project, but the Fisher Project is certainly the flagship and is significant to us, and likewise to SSR Mining, which had an option on the Fisher property for the last four years now. And they spent a fair amount of money on the Fisher property. We are proud to convey that we just received a notice in the last couple of days that, in tender, they have exercised their earn-in to earn 60% of the Fisher property.

Maurice Jackson: That's exciting! And I'm a shareholder myself, full disclosure. And speaking of that, this is a huge milestone. The entire staff has been working very diligently behind the scenes. And it's a real win for shareholders. Walk us through the earn-in agreement and what it means for shareholders.

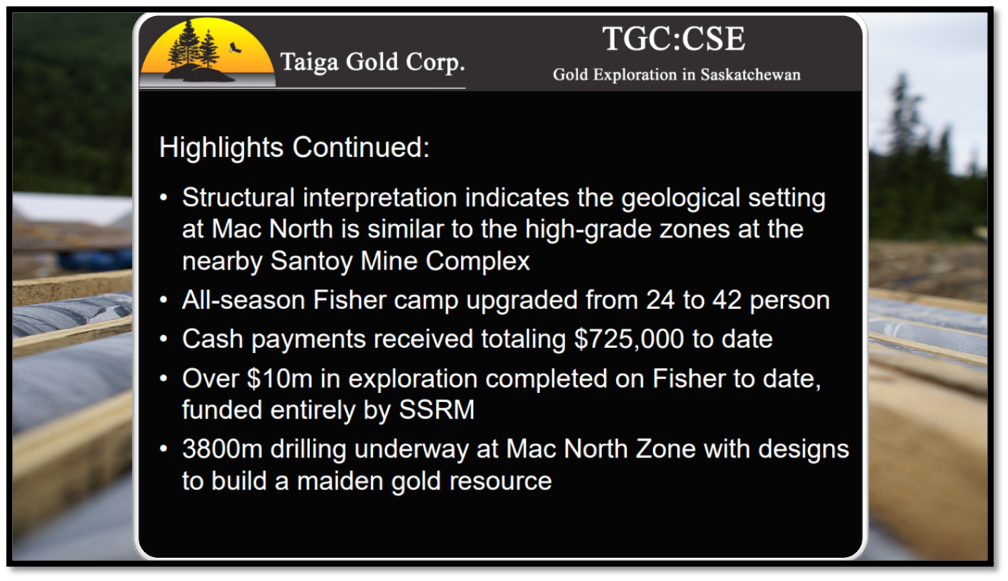

Tim Termunde: It's an interesting agreement. Over the last four years, SSR has been required to spend $4 million on exploration work on the Fisher property. They initially reimbursed Eagle Plains, which was the original owner of Fisher before it got transferred to Taiga. They reimbursed Eagle Plains for $400,000. And over the four years of the option agreement, since it went into Taiga's hands, they've been making annual cash payments of $75,000 to Taiga.

So in essence, for them to earn 60%, they had to spend $4 million and make $800,000 in cash payments to Taiga. Very interestingly though, they've already spent over $11 million on the property. So they've almost tripled their requirements at their costs, to do more work on the Fisher property. They're very encouraged by what they're seeing. I'm often asked, "Why would they overspend by that much?"

It's an interesting agreement, that once they earn 60%, which they have just done, they have a relatively short period to decide whether to go to 80%. So they've got one year, now, to decide whether to go to 80%. If they choose to go to 80%, we will form an 80-20% joint venture. They will pay us $3 million in cash on the formation of the joint venture, and they are required to pay us $100,000 a year in advanced royalty payments. So it's a very big win for Taiga Gold. Plus then we'd become partners with SSR Mining in exploring the property further.

Maurice Jackson: In addition to that, you also have an NSR (net smelter returns) royalty. Is that correct?

Tim Termunde: We have a 2.5% NSR on the entire property. That NSR has reduced in a couple of areas of the property because we've got underlying agreements with other prospectors and former property owners. We put together the property five or six years ago. We consolidated the land in the area. We had the lion's share of the area covered by the claims now, but we did have to do a couple of small deals with underlying owners to get them into the project boundaries. So, some small NSRs come with those.

Maurice Jackson: I see the success in the acumen from Eagle Plains here, in Taiga Gold as a prospect generator basically, in the model in this transaction, because you're using the joint venture and you're maximizing leverage.

And the big question I think everyone wants to know now is, when can we expect drilling to commence? And the all-important question is, when should we expect results?

Tim Termunde: Drilling is underway right now, still on the property. It has been since mid-September. This year, SSR has done, I believe, over 12,000 meters of drilling on the property. So, they're going great guns. There's a drill turning as we speak right now. We get reports quarterly from SSR.

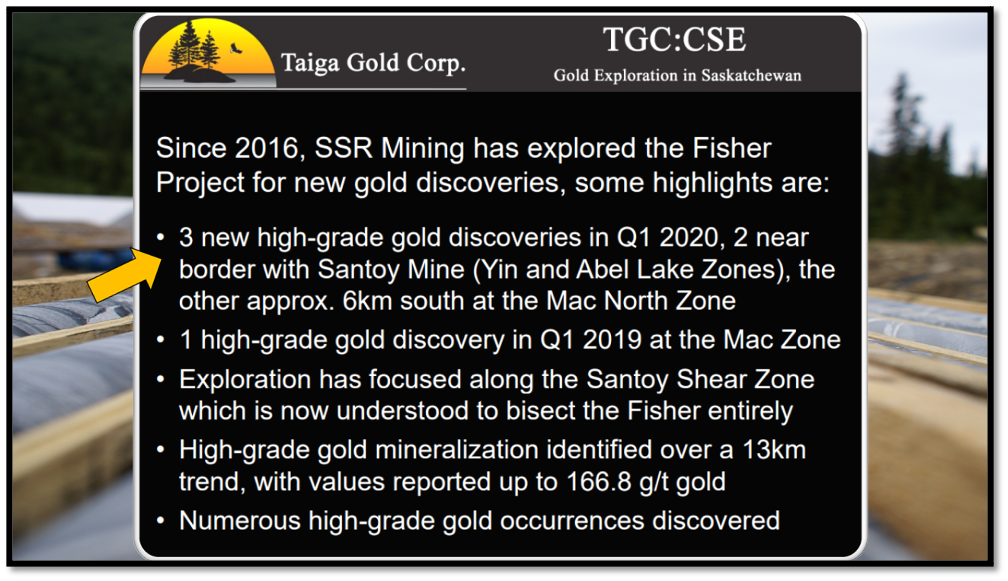

So the drilling they're doing right now, we won't see results from that until early 2021, in January. And that's just been the way it's going and all the way along. The last significant results we received were from the winter drilling they did, in January, February, March of this year. And while they were doing that work, they made discoveries in three different areas of the property. They were targeting specific areas along the Santoy Shear. These areas were two or three kilometers apart, but they had soil anomalies that they were testing and, remarkably, of the four target areas that they were testing.

They discovered gold in three of those four areas. That's created a lot of excitement for us, and clearly for them. They're putting their money where their mouth is right now, by exercising the earning—by seriously looking at whether to go to 80% or not.

So, the watershed event here happened earlier this year, in January, February, March. That program was stopped early because of COVID. You'll recall, in early March this year, a lot of uncertainty came with the recognition of COVID all over the place. And so, to err on the side of caution, they shut the program down. They are now going back, they're now drilling again. They're even processing some of the core that they didn't get to in that March program because it was stopped suddenly.

We're expecting a lot of results to come. We're quite hopeful.

For the past few years, they've been testing the Santoy Shear along its length. But now that they've made these four discoveries, they are now focused on these four areas. And they targeted exploration now. Their goal is to drill an Inferred resource, and we would love to see that happen. It would make it a lot easier for people to value Taiga. Right now, it's nebulous. We have a 20-kilometer target structure that has been barely tested so far, but the big question is how much gold is there and where do we find it?

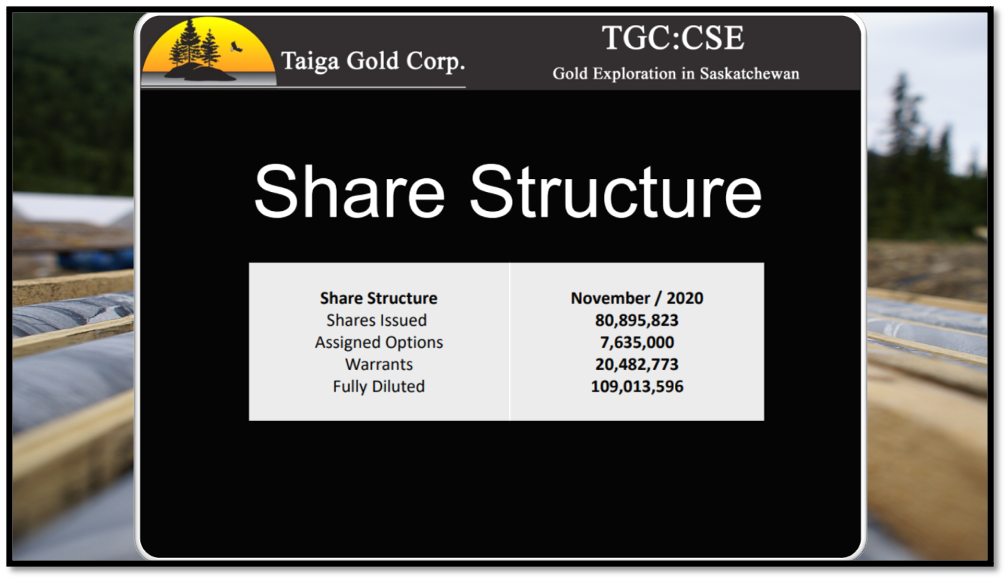

Maurice Jackson: All right. Let's get into some numbers. Mr. Termunde, please provide us with an update on the current capital structure for Taiga Gold.

Tim Termunde: We have roughly 80 million shares outstanding. The predecessor company, Eagle Plains, holds 12 million shares. So that's very strategic for us too, it gives us a very solid control of our share structure. Our directors and insiders and friends of the company own millions more. Probably 25–30% of the stock is in very safe hands. And again, because it was a spinout from Eagle Plains, a lot of the Taiga shareholders are Eagle Plains shareholders, Eagle Plains has been around for 25 years. We've got a very loyal shareholder base. So, we're very comfortable to share structure right now.

Maurice Jackson: Let's take a look at the treasury. How does it look right now? And what do you plan to do with this new capital coming into the treasury?

Tim Termunde: At the end of our Q3, which was Sept. 30, we had over $800,000 in the treasury. Should SSR go to 80%, we will have another $3 million in our treasury. And we will use that money to further exploration on the Fisher property, because once the joint venture starts, we will be on the hook for 20% of the exploration expenditures.

But we're very confident that we will be participating in every step of the way; we love the project. We like the potential that SSR sees too. So we want to stay in the game and plan to do that all the way along.

Maurice Jackson: It sounds like a win-win proposition for both parties involved. In closing, multilayered question. What is the next unanswered question for Taiga Gold? When can we expect a response, and what determines success?

Tim Termunde: I touched on it earlier. The big question right now is, how much gold is on the Fisher property and our other properties. We do have several five other projects there that SSR is not involved in. And we've got other partners on those.

But the value of the company is a direct result of our exploration success. We're a very experienced exploration crew. We've got geologists under our roof that have worked with us for 20 years. And so, we're quite confident in our abilities.

And as far as future success, it will come at the end of a drill bit.

Again, I mentioned that reporting from SSR happens every 90 days. So those will be coming steadily. We also control these other projects. So we have the Leland property, which is a joint venture optioned off to SKRR Exploration Inc. (SKRR:TSX.V). They're talking right now about doing a drill program on that over the winter.

We also have our Orchid project, which is 100% Taiga. It has several very high-grade gold occurrences that have not been tested by drilling. So we're looking at drilling that ourselves as a 100%-owned entity there. And so we'll control news flow on that. As far as that goes, I think there'll be a lot of news flow, over the coming months, over the winter months.

The beauty of working in Saskatchewan, too, is it's not a seasonal exploration thing. We can drill in the summer, or we can drill in the winter. It's a lot more efficient in some places to be drilling in the winter in Saskatchewan, because some of these areas are boggy or swampy ground and once they're frozen, you can get on the knees easily and drill.

So, we're looking at steady news flow over the next year or so with the coming months for sure.

Maurice Jackson: Looking forward to it. Sir, what keeps you up at night that we don't know about?

Tim Termunde: Well, I guess you know about COVID; everyone does. That's certainly a concern for me, seeing these rising numbers right now. It did cause an interruption of the last drilling program on the Fisher property. I hope it doesn't do it anymore. The SSR guys have very stringent safety protocols in place. And they're very conscientious about, keeping contact to a minimum. So, yeah, COVID in short.

Also, again like everybody, the uncertainty of the U.S. election I think is on everybody's mind. The economic implications are certainly up in the air. But no matter how the election results pan out in the end, it's bullish for gold. So, in that regard, we've got a bright future with gold anyhow.

Maurice Jackson: Mr. Termuende, last question. What did I forget to ask?

Tim Termunde: I didn't speak too much about it, but we're not just a one-trick pony too. The Fisher property is getting the news, and it's the most exciting right now. And it's had $11 million in exploration on it so far, in the last few years.

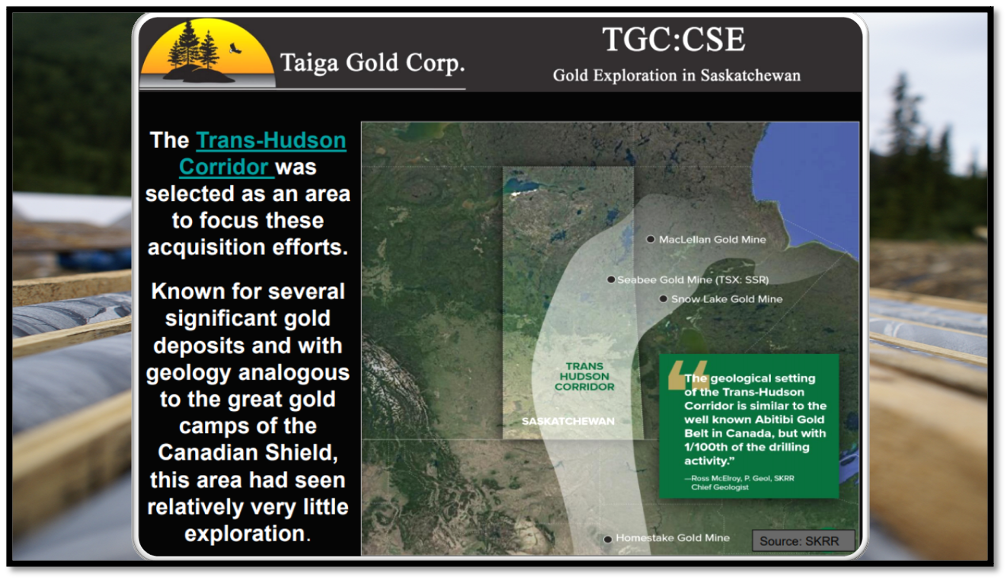

But we do have these other projects. We've got the Chico Project, the Leland, the Mari Lake, and the Orchid projects, which all have great potential. They're all in this same area. We love working in Saskatchewan. We're in this called the Trans-Hudson Corridor, which is an underexplored belt of rocks that trends down into the northern United States, into South Dakota. Part of this corridor includes the Homestake Deposit, which was a $43 million-ounce gold deposit in South Dakota. There are structural connections from a number of our projects to down into South Dakota along the Taverner fault that transcends through a couple of our projects.

We're very excited about our other projects as well. We're happy to see the way Fisher's going. It's right on track. We hope that SSR takes it to an 80–20% joint venture; that would suit us just fine. And again, with the funds we'll get from that, we'll be able to not only participate in the exploration of Fisher further, but we'll be able to use those funds to further our other projects as well, that are either optioned to other companies or we have them 100%.

So we're in a very good position right now for a rising gold bull market. I would encourage all readers to visit our website: www.taigagold.com.

Maurice Jackson: Good to hear, Mr.Termuende, it's been an absolute delight to speak with you today. Wishing you and Taiga Gold the absolute best, sir.

Before you make your next bullion purchase, make sure you contact me. I'm a licensed representative to buy and sell physical precious metals through Miles Franklin Precious Metals Investments, where we offer a number of options to expand your precious metals portfolio from physical delivery of gold, silver, platinum, palladium and rhodium, directly to your home or office, to offshore depositories and precious metal IRAs. Call me directly at (855) 505-1900 or email maurice@milesfranklin.com.

Finally, please subscribe to Proven and Probable, where we provide mining insights and bullion sales. Subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Taiga Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Taiga Gold is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.