Maurice Jackson: Joining us for conversation is Tim Johnson, the president and CEO of Granite Creek Copper Ltd. (GCX:TSX.V). It's a pleasure to have you back to provide us with some important updates regarding the 100% Stu Copper-Gold-Silver project located in the prolific Minto Copper district. Before we go any further, Mr. Johnson, for first time listeners, please introduce us to Granite Creek Copper and what is the opportunity the company presents to the market?

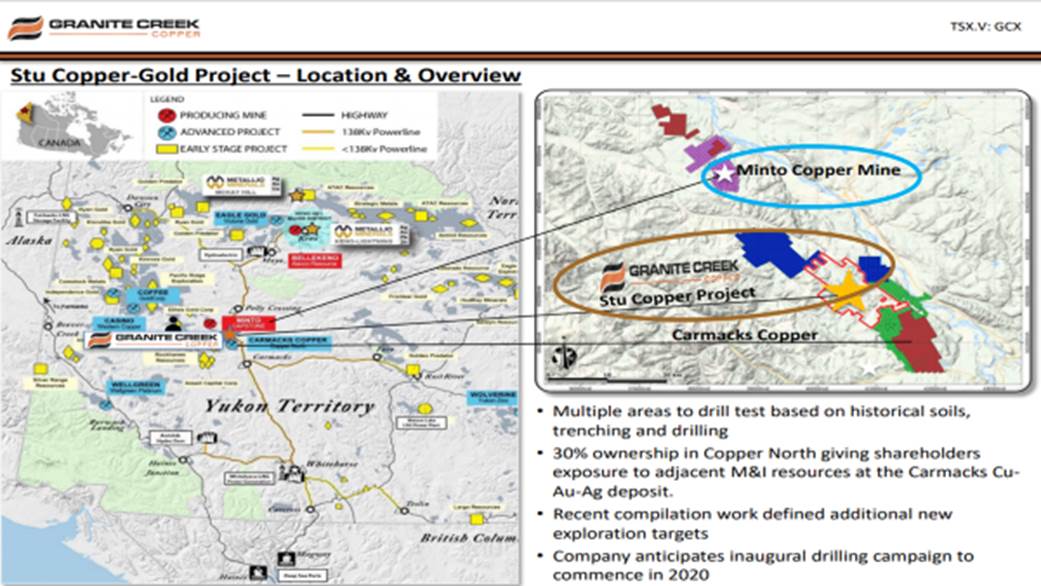

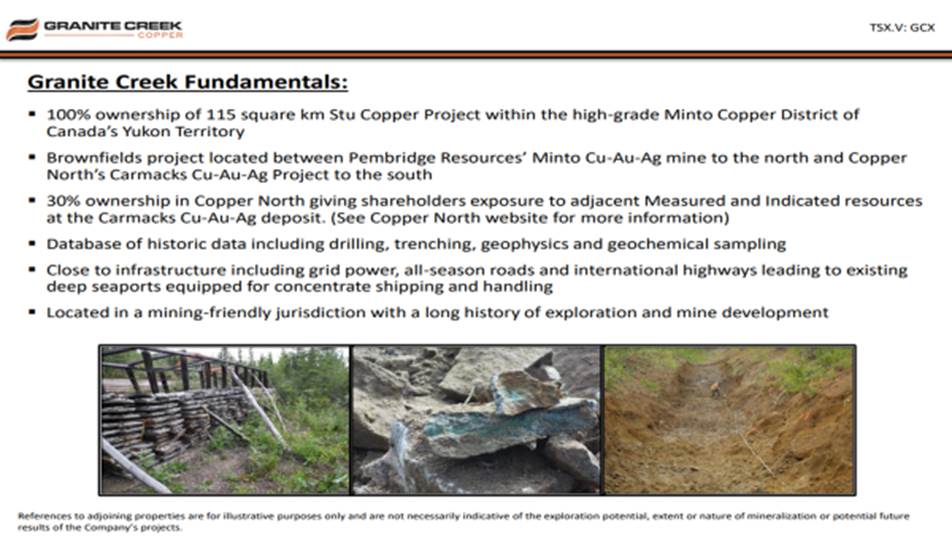

Tim Johnson: Granite Creek is a member of the Metallic Group of Companies, and why that's significant is that all three companies in the group share a common philosophy and a common way of doing business, which is to identify a large, quality land position in what we're calling a brownfields districtóin our case, a brownfields district is something that has already been explored previously, has an operating mine or near to an operating mine in the district, and it gives us multiple exit strategies.

We don't need to go all the way to a Measured and Indicated resource. We can find something that might be interesting to our neighbor and, in our case, we can bring the amount of contained copper in the district up to a point where we start to attract bigger attention to the belt for our benefit and to the other players in the belt as well.

Maurice Jackson: From a macro perspective, can you share the supply and demand fundamentals for copper?

Tim Johnson: We see a potential deficit in copper moving forward and some analysts say that we're in deficit already. We see probably first or second quarter of 2020 being in a real deficit that's going to start to come out on the books of the main major analysts. There's a lot of reasons for that. People point to the electrification of transportation, but we see it as sort of an electrification of a bunch of other things. China is creating a middle class and when you do that, you need an awful lot of copper in vehicles and houses and industry. There's a lot of different metrics driving it, whether it's China or globally, including the move from internal combustion engines to electric vehicles.

One of the important points that we see in the copper market is when you do that transition, whether it's houses or vehicles, you actually take a large amount of copper out of the market and you put it in things that might last longer than you would expect. It's not electronics that are getting turned over every year. We're hearing that some of these electric cars could have 15- to 20-year life. When you take an awful lot of copper and you sock it away in these things and it's off the market, the supply has to come up to maintain the global economy.

Maurice Jackson: One of the reasons we have you on the program here is that we believe that copper may very well become one of the most valuable metals on the planet. More copper is going to be consumed in the next 25 years than all of combined history, and please correct me if I'm wrong, but there's less than two weeks supply of copper on hand in the world today and germane to this point is that a number of copper mines are running out of materials in which we're witnessing right now among your peers that are in production in the Minto Copper Belt, is that correct?

Tim Johnson: Yes. In the Minto copper belt itself, the Minto mine, owned by Pembridge, just recently went back into production and they went into production, I believe, with somewhere around a 3.5- to 4-year mine life. So that's not a lot. Because this is a new company that has recently acquired this asset, we expect them to be aggressively exploring on their own ground, which is very close to us, to add resources. But we also expect them to have at least half an eye, if not a full eye, toward us and our progress as we build out our resources, as well. And you're right on the global picture. Even some of the mines that still have resources, in Chile for instance, they've gotten down through the easily extracted materials.

They've gone through the oxide and they're now looking at a sulfide resource that is a lot more expensive to extract. It's entirely different economics. For instance, with an oxide resource, these big mines in Chile are producing copper at mine site. With a sulfide resource, you're producing a concentrate at mine site that has to be then shipped to a smelter. We're seeing this transition in a lot of the really large mines that have been producing for upwards of 50 years. This transition is going to be significant to our industry,

Maurice Jackson: Sir, for the person listening, how does Granite Creek Copper fit into the narrative?

Tim Johnson: We're a brownfields project. We've got historical drilling on our ground and, after we acquired the project in January, we also acquired a large, historical database. We've been able to fast track drill targets and hope to be able to do what we're calling discovery-focused drilling next season, where we're taking those targets and drilling off a bunch of them and seeing in which area we are most likely to be able to quickly build a resource.

We see ourselves as an explorer and developer of resources. We don't see ourselves as miners, but every year you evaluate where you are and see where you're going to go. I think what we want to do is tie into something and rapidly grow a resource as the copper market turns and as a price starts to push north of $3 to $3.50 a pound, which is going to make production decisions in anything that we discover much easier.

Maurice Jackson: Granite Creek Copper has successfully expanded its footprint in the prolific Minto Copper District by completing a strategic acquisition of 30% in Copper North mining (Press Release). Can you share the details with us?

Tim Johnson: That was a good acquisition for us. It gives our shareholders just under 30% exposure to an already drilled off and identified resource within the Minto Copper Belt itself. We think the synergies are really good with whatever we discover on our ground. There's a potential to combine resources at some point and look at what we do with that 30%. We're open to either further acquisition or even developing jointly with Copper North. There are many different possibilities we can do with that interest.

Maurice Jackson: Take us behind the scenes and walk us through on why this was the right acquisition for shareholders and why now?

Tim Johnson: The copper market has been depressed; prices have been down around $2.50 to $2.60 over the past few months. The resource that Copper North had isn't economic at these prices. I think there was a frustration amongst shareholders that maybe they got in too early. And they were looking for an exit and they were looking for a block exit. They didn't want to trickle their shares out, and there was really no market for their shares.

The share exchange that we did, we, in a way, offered them an exit strategy. We have a little bit longer term view; we see the price of copper starting to turn and we see a very strong copper price moving into 2020 and beyond. For our shareholders, I think it was a very good acquisition and I think you'll see that reflected as copper price increases, which it should do very well for our share price.

Maurice Jackson: Does this transaction change the thesis on your genetic model and or your exploration model?

Tim Johnson: Not really. Our focus this field season this year had been on looking for resources that are right close to the claim boundary. Readers should note that the two properties, the two projects owned by Copper North and by us, are adjacent and we see potential just across the claim boundary for extensions of mineralization that's been identified on their ground. It doesn't really change anything in that regard. And we will be looking at what further transactions we might make within the belt.

Exploration focus isn't going to change and our development track is to find combined pounds in the ground that will attract significant players to the belt. Whether it's one of the big copper players or a multi-metal player. Once we get to a certain threshold, whether it's Copper North, or us, or combined, we're going to attract the big players. That's been our narrative and that's going to continue to be our narrative.

Maurice Jackson: Speaking of what's next, multilayered question: what is the next unanswered question for Granite Creek Copper, when can we expect a response, and what determines success?

Tim Johnson: Our big thing is whether or not we can identify and drill resources in an initial drill program on the project that should start as soon as winter breakup is completed. That will be around MayĖJune, somewhere in there. We will be seeking a financing in order to raise funds for that in the next few months. Our success is finding something that we can point to and say, yes, we can start to drill off a resource around this and you'll see that second quarter to mid-next year.

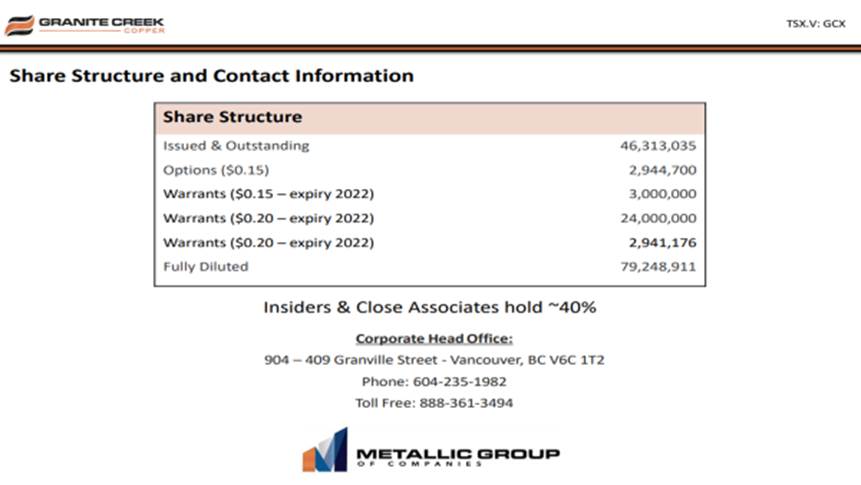

Maurice Jackson: Let's review some numbers. Mr. Johnson, please share the capital structure for Granite Creek Copper.

Tim Johnson: We've got 46 million shares out right now. That was recently bumped up by our acquisition. We issued roughly 10 million shares for the acquisition of the Copper North shares. Currently we've got about 27 million warrants out at 20 cents and another 3 million warrants out at 15 cents. So fully diluted, we're at 79 million shares. Insiders and close associates of insiders hold roughly 40% to 45% of that. And we're all very incentivized to work hard and to increase shareholder value.

Maurice Jackson: In closing, Tim, what keeps you up at night that we don't know about?

Tim Johnson: So, the extension of the low copper prices that we see now, as I said, I think they've just started to turn and hopefully they continue to strengthen throughout the rest of this year and into next year. But, if there was a protracted sub $2.50 copper, it would be very difficult for us and we'd have to revise our strategy. That's the biggest worry for us. Global markets are going to mitigate that. So, there's not a lot we can do about that other than just keep an eye on it.

Maurice Jackson: Mr. Johnson, last question. What did I forget to ask?

Tim Johnson: You've done a really good job. I can't think of a single question you forgot to ask.

Maurice Jackson: For more information about Granite Creek Copper, please visit www.gcxcopper.com. For direct inquires call 604-235-1982 or you may email: info@gcxcopper.com. Granite Creek Copper trades on the TSX.V symbol: GCX.

Before you make your next bullion purchase, make sure you call me. I'm a licensed representative from Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, off-shore depositories, precious metal IRAs, and private blockchain distributed ledger technology. Call me directly at 855.505.1900, or you may email maurice@milesfranklin.com.

Finally, please subscribe to www.ProvenandProbable.com for Mining Insights and Bullion Sales.

Tim Johnson of Granite Creek Copper, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Granite Creek Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Granite Creek Copper is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Metallic Group of Companies and Granite Creek Copper. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Metallic Group of Companies and Granite Creek Copper. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Granite Creek Copper, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.