Avivagen Inc. (VIV:TSX.V), a biotech company focused on science-based, natural health products for livestock, companion animals and humans, is making rapid headway with products for livestock in light of government mandates across the world.

Many countries have banned (and are continuing to ban) the use of antibiotics as growth promoters in livestock because of their role in causing antibiotic resistance. The European Union did so in 2006. In 2017, the FDA put in place rules curtailing antibiotic use in livestock in the U.S., but recent studies have found that routine antibiotic use continues.

According to the Centers for Disease Control and Prevention (CDC), "each year in the U.S., at least 2 million people are infected with antibiotic-resistant bacteria, and at least 23,000 people die as a result." Resistant strains also result in 8 million additional hospital days. "The antibiotic resistant bacteria that arises from the use of antibiotics in animal feed are the same 'superbugs' that infect and kill humans," Kym Anthony, Avivagen's chairman, told Streetwise Reports.

An alternative to antibiotics is important to preserve animals' health and combat antibiotic resistance. "Scientific evidence demonstrates that overuse of antibiotics in animals can contribute to the emergence of antibiotic resistance," says Dr. Kazuaki Miyagishima, director of the Department of Food Safety and Zoonoses at the World Health Organization (WHO). "The volume of antibiotics used in animals is continuing to increase worldwide, driven by a growing demand for foods of animal origin, often produced through intensive animal husbandry." The WHO estimates that around 80% of antibiotics consumed are used in the animal sector, mostly for growth promotion.

The WHO recommends that farmers and the food industry stop using antibiotics routinely to promote growth and prevent disease in healthy animals. Farmers are looking for alternatives to keep their livestock healthy and promote growth.

This is where Avivagen comes in. Its products are "able to replace antibiotics used for enhancing food production in livestock feeds but also can be beneficial in conditions where antibiotic use is precluded, e.g., in milk-producing dairy cows."

Research initiated at Canada's National Research Council and continued at Avivagen found that carotenoids, the compound that gives vegetables like carrots their bright color, are a "non-antibiotic means of maintaining optimal health and growth." Further research discovered that oxidized beta-carotene provides many times the health benefits of regular beta-carotene. Avivagen has an exclusive global license.

Avivagen's Kym Anthony noted, "The company discovered the existence of beta-carotene-oxygen copolymers as the main product of the spontaneous oxidation of beta-carotene in air." Together with beta-carotene's role as the actual source of non-vitamin A effects has opened up major product opportunities.

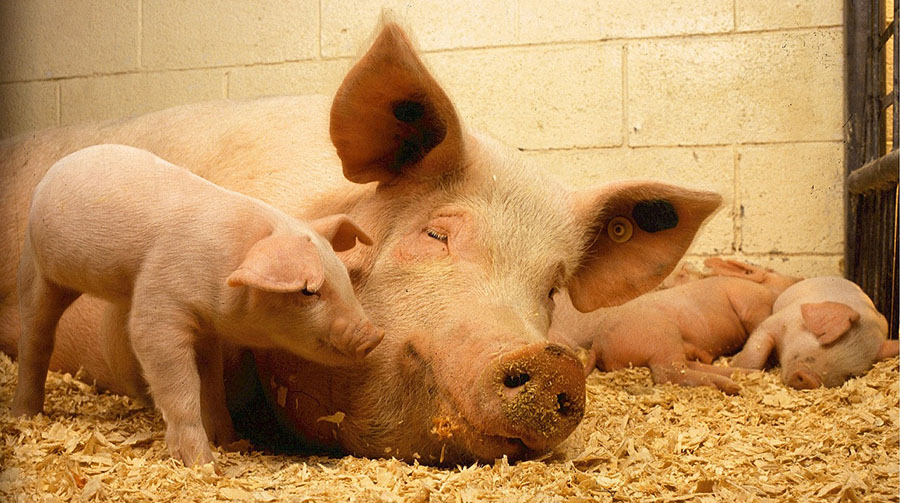

The Avivagen commercial OxBC formulations include OxC-beta™ Livestock premix for livestock feeds and Vivamune™ Health Chews supplements for companion animals. The company has reported that "numerous international livestock trials with poultry and swine using OxC-beta Livestock have proven that the product performs as well as, and, sometimes, in some aspects, better than in-feed antibiotics."

Already, Avivagen has already received approvals and begun sales in Asia, including the Philippines, Taiwan, Thailand and New Zealand.

Avivagen announced on September 20 that its partner in the Philippines, UNAHCO, purchased 2 metric tonnes of OxC-beta™ Livestock, which follows an order of 2 metric tonnes delivered to it in June 2018. UNAHCO is the wholly owned feed and veterinary subsidiary of Unilab Inc., the biggest pharmaceutical company in the Philippines.

OxC-beta Livestock has been in commercial use for over a year in the Philippines, where 17 million metric tonnes of feed is consumed annually, compared to 11.75-million-metric-tonne consumption in 2016, a rapid increase.

The commercial use of OxC-beta Livestock has been ramping up steadily in the Philippines, and Avivagen believes that the scale-up of OxC-beta Livestock use in Thailand will mirror the Philippines.

On the heels of the latest order in the Philippines, Avivagen also received its first OxC-beta Livestock order in Thailand, for sow feed. Management believes Thailand represents a significant new market for Avivagen's OxC-beta Livestock product. In Thailand, 18 million metric tonnes of feed is consumed annually.

Most recently, Avivagen signed a distribution agreement for OxC-beta Livestock in Malaysia with TLC Veterinary Services, a principal supplier to farms that supply KFC, which has more than 600 restaurants in Malaysia. The country consumes 4.4 million metric tonnes of animal feed, most of it for chickens. As part of the agreement, TLC will undertake the registration process in Malaysia.

"The Malaysian government's goal is to have all chickens antibiotic free by 2020, so we believe our product is well-placed," said Anthony.

In China, Avivagen is currently selling its companion animal products.

Avivagen is currently awaiting sale approval of OxC-beta Livestock in the United States, Mexico and Brazil for livestock feed. But it already has approval to sell Vivamune Health Chews in the United States and Canada for companion animals, such as dogs, and just entered into a distribution agreement in Vietnam for that product.

And the company has begun discussions with nutraceutical companies to develop products for human consumption.

Institutional investors include Bloom Burton & Co, Pathfinder Asset Management and AlphaNorth Asset Management.

Jolyon Burton, cofounder, president and head of investment banking at Toronto-based Bloom Burton & Co., Canada's only dedicated healthcare specialized investment bank, told Streetwise Reports, "The core discovery that Avivagen owns—and is intellectual property protected—is rolling out in a significant way in livestock currently, in companion animals over the next year and in human market opportunities over the next two to five years; this provides built-in, organic growth. The company needs to do no acquisitions to drive very significant growth if everything plays out.

"Knowing that we're in the early innings of return yet, with a market cap at these levels of approximately $20 million and sales ramping quite quickly now into large markets is why we're pretty excited," Burton stated.

Steve Palmer, founding partner and chief investment officer of Toronto-based AlphaNorth Asset Management, told Streetwise Reports, "We've owned Avivagen shares for quite a while. It's taken some time to get going, as it's had to do a lot of animal trials for its product, which it has shown to be very effective. It's had initial orders, and now it's getting repeat orders. So it's an exciting time as things start ramping up with the revenue."

Vancouver-based Pathfinder Asset Management owns just over 10% of Avivagen. Portfolio Manager Rob Ballard told Streetwise Reports that the firm was attracted to Avivagen because "it is a small start-up that has developed a novel technology that could potentially address a large global problem, replacing antibiotics as growth promoters in animal feed. Right now the company has some initial orders in Asia, but a key driver in the company will be it scaling those up and increasing its market penetration and sales volume from its customers."

Avivagen also has caught the attention of industry analysts. Beacon Securities initiated coverage on Avivagen in August 2017. Analyst Doug Cooper commented, "Avivagen's OxC-beta product was originally conceived at Canada's National Research Council (NRC), for which the company has received an exclusive global license. The technology is protected by a robust IP portfolio that includes 31 patents." The report noted that "through 16 animal trials, the product has proven efficacy on par, or better, than antibiotics in terms of animal weight gain, lowering feed conversion ratio and protection against disease."

Beacon has a Buy recommendation and CA$3 target price on Avivagen, whose shares are trading at around CA$0.55.

Avivagen currently has about 33 million shares issued and outstanding, with about 5% held by insiders and more than 20% by institutions.

Read what other experts are saying about:

Disclosure:

1) Nikia Wade compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Avivagen. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Avivagen. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Avivagen, a company mentioned in this article.

Additional disclosures

Bloom Burton and Co., Pathfinder Investment Management and AlphaNorth Asset Management hold shares of Avivagen. In addition, Jolyon Burton personally holds shares of Avivagen.

Disclosures from Beacon Securities, Avivagen, Initiating Coverage, August 15, 2017

Does Beacon, or its affiliates or analysts collectively, beneficially own 1% or more of any class of the issuer's equity securities? No

Does the analyst who prepared this research report have a position, either long or short, in any of the issuer’s securities? No

Does Beacon Securities beneficially own more than 1% of equity securities of the issuer? No

Has any director, partner, or officer of Beacon Securities, or the analyst involved in the preparation of the research report, received remuneration for any services provided to the securities issuer during the preceding 12 months? No

Has Beacon Securities performed investment banking services in the past 12 months and received compensation for investment banking services for this issuer in the past 12 months? No

Was the analyst who prepared this research report compensated from revenues generated solely by the Beacon Securities Investment Banking Department? No

Does any director, officer, or employee of Beacon Securities serve as a director, officer, or in any advisory capacity to the issuer? No

Are there any material conflicts of interest with Beacon Securities or the analyst who prepared the report and the issuer? No

Is Beacon Securities a market maker in the equity of the issuer? No

Has the analyst visited the head office of the issuer and viewed its operations in a limited context? No

Did the issuer pay for or reimburse the analyst for the travel expenses? No

Beacon analysts are not permitted to own the securities they cover, but are permitted to have a position, either long or short, in securities covered by other members of the research team, subject to blackout conditions.

Analyst Certification: The Beacon Securities Analyst named on the report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the company and securities that are the subject of the report; or any other companies mentioned in the report that are also covered by the named analyst. In addition, no part of the research analyst's compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.